How to do Futures Trading on MEXC

What are Perpetual Futures Contracts?

A futures contract is a legally binding agreement between two parties to buy or sell an asset at a predetermined price and date in the future. These assets can vary from commodities like gold or oil to financial instruments such as cryptocurrencies or stocks. This type of contract serves as a versatile tool for both hedging against potential losses and securing profits.

Perpetual futures contracts, a subtype of derivatives, enable traders to speculate on the future price of an underlying asset without actually owning it. Unlike regular futures contracts with set expiration dates, perpetual futures contracts do not expire. Traders can maintain their positions for as long as they desire, allowing them to capitalize on long-term market trends and potentially earn substantial profits. Additionally, perpetual futures contracts often feature unique elements like funding rates, which help align their price with the underlying asset.

One distinctive aspect of perpetual futures is the absence of settlement periods. Traders can keep a position open for as long as they have sufficient margin, without being bound by any contract expiry time. For instance, if you purchase a BTC/USDT perpetual contract at $30,000, there is no obligation to close the trade by a specific date. You have the flexibility to secure your profit or cut losses at your discretion. It’s worth noting that trading perpetual futures is not allowed in the U.S., although it constitutes a substantial portion of global cryptocurrency trading.

While perpetual futures contracts offer a valuable tool for gaining exposure to cryptocurrency markets, it’s essential to acknowledge the associated risks and exercise caution when engaging in such trading activities.

Explanation of Terminology on the Futures Trading Page on MEXC

For beginners, futures trading can be more complex than spot trading, as it involves a greater number of professional terms. To help new users understand and master futures trading effectively, this article aims to explain the meanings of these terms as they appear on the MEXC futures trading page.We will introduce these terms in order of appearance, starting from left to right.

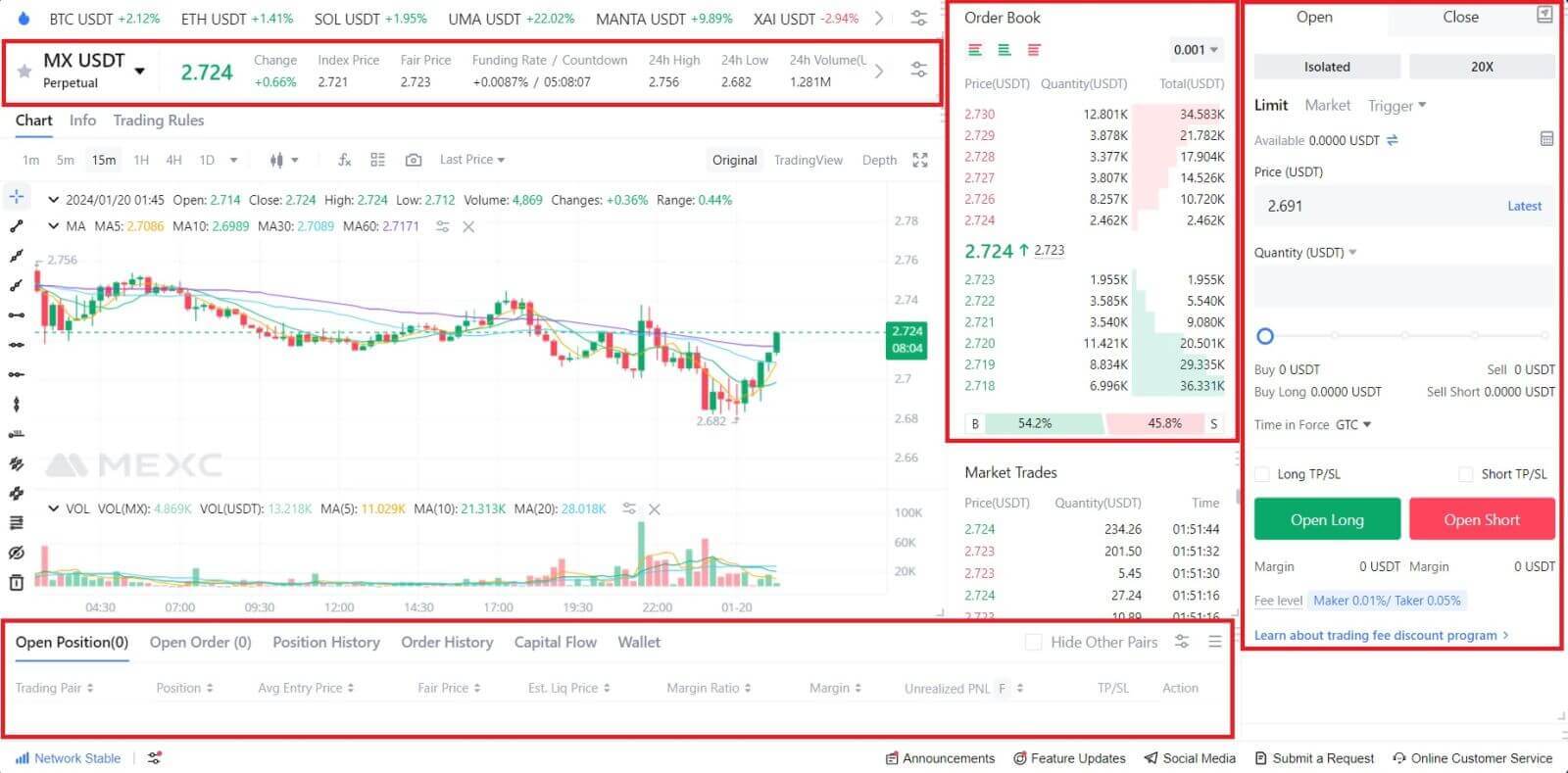

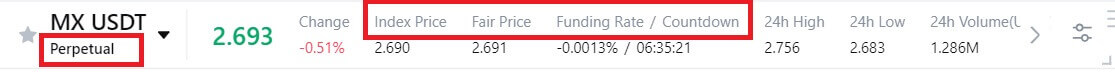

Terms above the K-line chart

Perpetual: "Perpetual" denotes continuity. The commonly seen "perpetual futures" (also known as perpetual futures contracts) evolved from traditional financial futures contracts, with the key difference being that perpetual futures have no settlement date. This means that as long as the position is not closed due to forced liquidation, it will remain open indefinitely.Index Price: The comprehensive price index obtained by referencing the prices of major mainstream exchanges and calculating the weighted average of their prices. The index price displayed on the current page is the MX index price.

Fair Price: The real-time fair price of the futures, calculated based on the index price and market price. It is used to calculate the floating PNL of positions and determine position liquidation. It may deviate from the last price of the futures to avoid price manipulation.

Funding Rate / Countdown: The funding rate in the current stage. If the rate is positive, long position holders pay the funding fee to short position holders. If the rate is negative, short position holders pay the funding fee to long position holders.

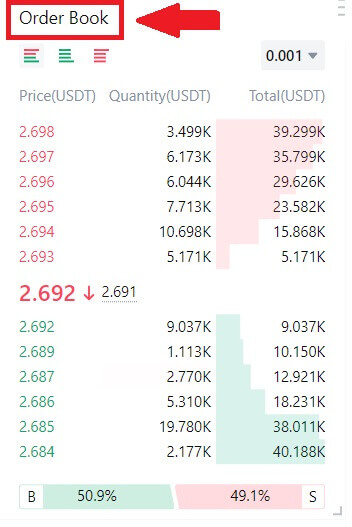

Terms in the order book area

Order Book: A window to observe market trends during the trading process. In the order book area, you can observe each trade, the proportion of buyers and sellers, and more.

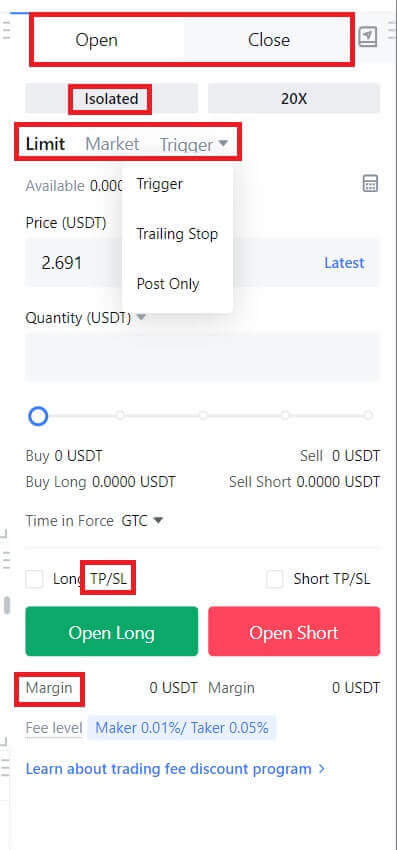

Terms in the trading area

Open and Close: After entering the price and quantity based on your judgment of the market direction, you can choose to open a long or short position. If you predict an increase in price, you open a long position; if you predict a decrease, you open a short position. When you sell the contract you bought, you close the position. When you open a position by purchasing a contract and hold it without settling, it is called a holding position. You can view your holding positions by clicking on [Open Position] at the bottom of the page.Open Long: When you predict that the token price will rise in the future and open a position based on this trend, it is known as opening a long position.

Open Short: When you predict that the token price will fall in the future and open a position based on this trend, it is known as opening a short position.

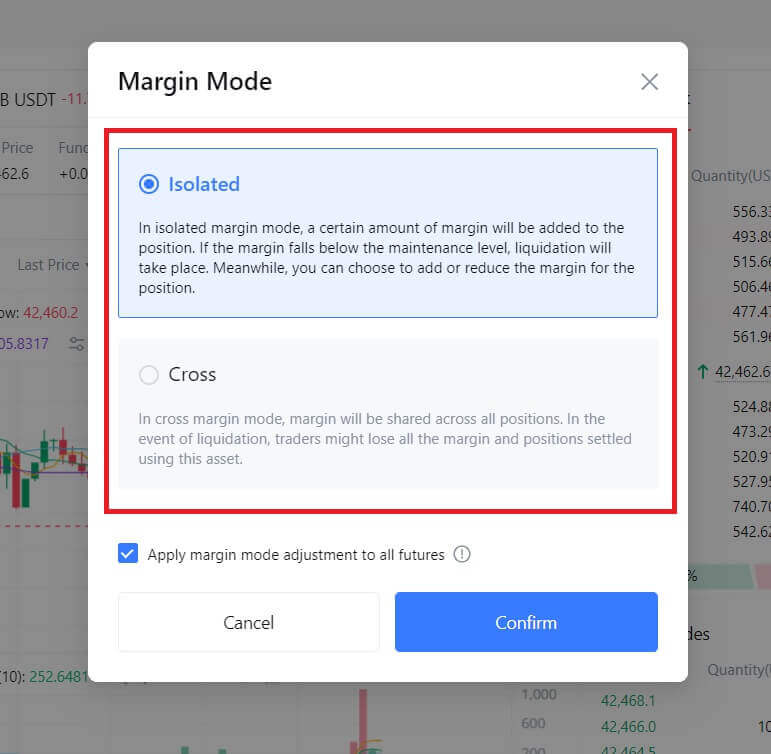

Margin and Margin Mode: Users can engage in futures trading after depositing a certain percentage of funds as financial collateral. This fund is known as margin. The margin mode is divided into isolated margin or cross margin.

Isolated: In isolated margin mode, a certain amount of margin is allocated to a position. If the margin for a position decreases to a level below the maintenance margin, the position will be liquidated. You can also choose to add or reduce margin to this position.

Cross: In cross margin mode, all positions share the cross margin of the asset. In the event of liquidation, the trader may lose all the margin and all positions under the cross margin of that asset.

Order Types: The order types are divided into limit order, market order, trigger order, trailing stop order, and post-only order.

Limit: A limit order is an order placed to buy or sell at a specific price or better. However, a limit order’s execution isn’t guaranteed.

Market: A market order is an order placed to buy or sell quickly at the best available price in the market.

Trigger: For trigger orders, users can set a trigger price, order price, and quantity in advance. When the market price reaches the trigger price, the system will automatically place an order at the order price. Before the trigger order is triggered successfully, the position or margin will not be frozen.

Trailing Stop: A trailing stop order is submitted to the market based on the user’s settings as a strategic order when the market is in a retracement. Actual Trigger Price = Market’s Highest (Lowest) Price ± Trail Variance (Price Distance), or Market’s Highest (Lowest) Price * (1 ± Trail Variance). At the same time, users can set the price at which the order is activated before the trigger price is calculated.

Post Only: A post-only order will not be immediately executed in the market, ensuring that the user will always be the maker. If the order were to be matched with an existing order immediately, it would be canceled.

TP/SL: A TP/SL order is an order with preset trigger conditions (take profit price or stop-loss price). When the last price / fair price / index price reaches the preset trigger price, the system will close the position at the best market price, based on the preset trigger price and quantity. This is done to achieve the goal of taking profit or stopping losses, allowing users to automatically settle the desired profit or avoid unnecessary losses.

Stop Limit Order: A stop limit order is a preset order where users can set the stop-loss price, limit price, and buy/sell amount in advance. When the last price reaches the stop-loss price, the system will automatically place an order at the limit price.

COIN-M: Coin-margined futures provided by MEXC are a reverse contract that uses cryptocurrency as collateral, meaning that cryptocurrency serves as the base currency. For example, in the case of BTC coin-margined futures, Bitcoin is used as the initial margin and for PNL calculations.

USDT-M: USDT-margined futures provided by MEXC is a linear contract, which is a linear derivative product quoted and settled in USDT, a stablecoin pegged to the value of the US dollar.

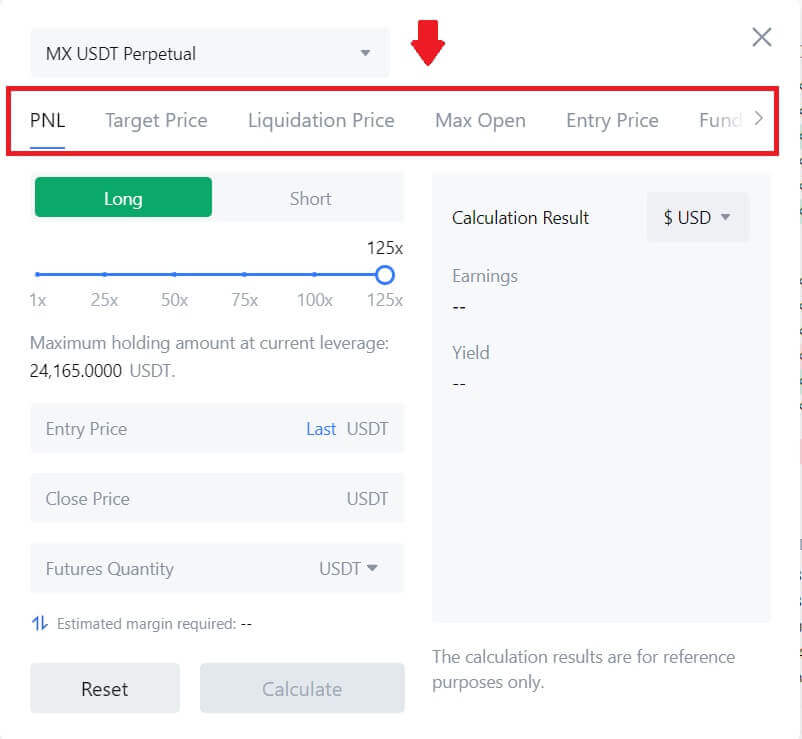

Terms in the Futures Calculator Area

PNL: Enter your entry price, the quantity of futures you hold, and the leverage multiplier. Then, set your expected close price to calculate the final earnings and yield.Target Price: Enter your entry price, the quantity of futures you hold, and the leverage multiplier. Then, set your desired yield to calculate the final earnings and yield.

Liquidation Price: Enter your entry price, the quantity of futures you hold, and the leverage multiplier. Then, select the margin mode (cross or isolated) to calculate your liquidation price.

Max Open: Enter your entry price, leverage multiplier, and your available margin amount to calculate the maximum number of contracts you can open for a long/short position.

Entry Price: When you have multiple futures positions for the same trading pair, enter the respective entry prices and the corresponding futures quantities. You can calculate the average entry price for contracts of the same trading pair.

Funding Fee: Enter the fair price, position quantity, and the funding rate (0.01%) to calculate the amount of funding fee you need to pay or receive.

Note: The results calculated using the futures calculator are for reference purposes only, and the actual results in live trading will prevail.

For beginners, before engaging in futures trading for the first time, you can practice on the MEXC Futures Demo Trading interface to familiarize yourself with various features before entering the live trading platform for trading.

Terms in the order area below the K-line chart

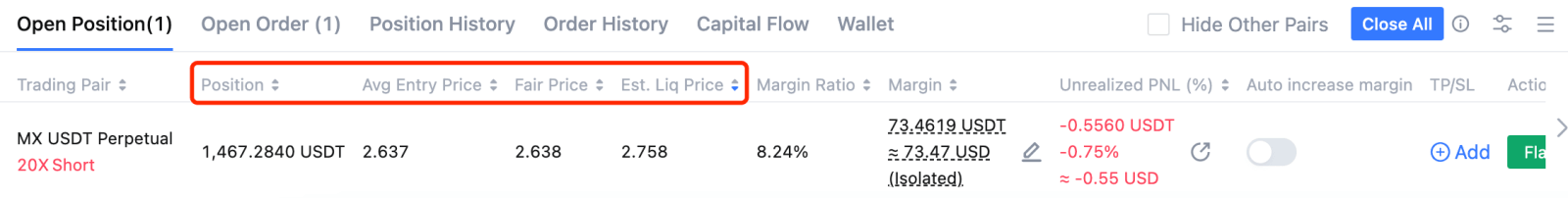

5.1 Open Position

Position: Number of contracts in positions that have not yet been closed.Avg Entry Price: The average cost price when a user opens a position. For instance, if a user opens a long position of 100 cont in MX/USDT perpetual futures at 2 USDT and later opens another position of 100 contracts in the same direction at 2.1 USDT, the user’s average entry price would be calculated as follows: (2 * 100 + 2.1 * 100) / (100 + 100) = 2.05 USDT.

Fair Price: This mechanism was introduced to protect users from losses due to abnormal market fluctuations on a single platform. It is calculated by weighting price data from mainstream exchanges, providing a fair reflection of the real market price. For more information about the fair price, you can refer to the article "Index Price, Fair Price and Last Price."

Est. Liq Price: When the fair price reaches the estimated liquidation price, your position will undergo forced liquidation. For more details on forced liquidation, you can refer to the article "Forced Liquidation."

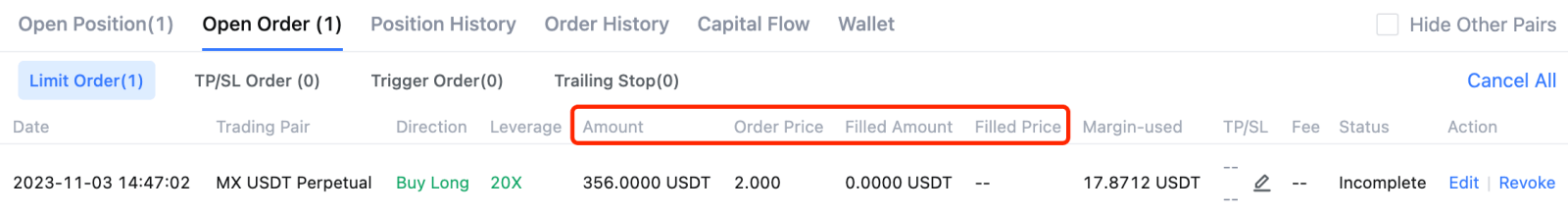

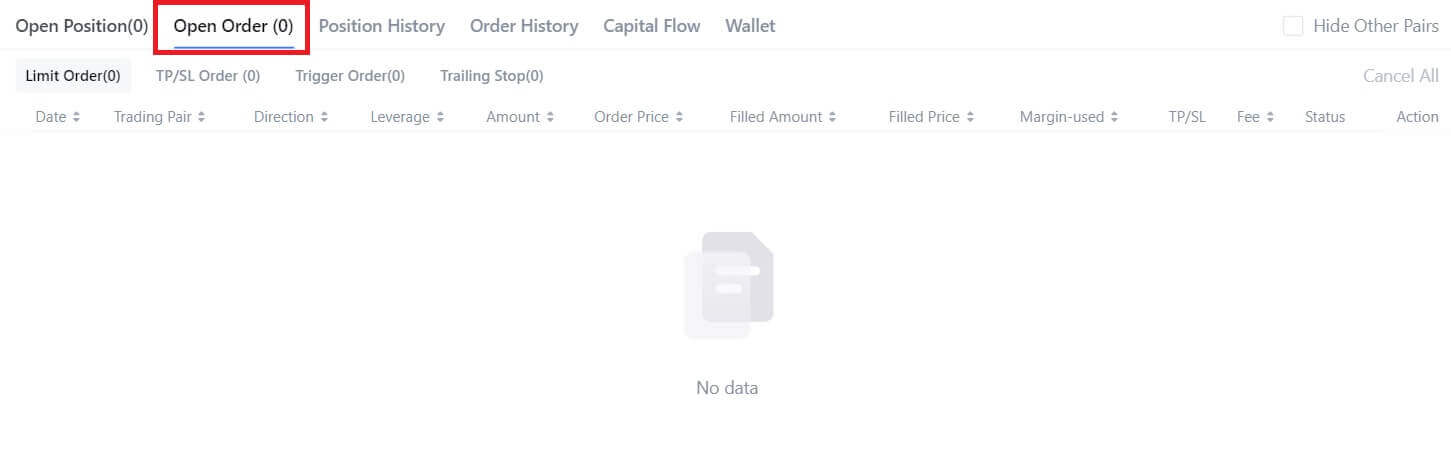

5.2 Open Order

Amount and Filled Amount: "Amount" refers to the desired trading volume set by the user before placing an order. When users place large orders, the order is usually split into multiple smaller orders, which are filled sequentially. "Filled Amount" refers to the actual quantity that has been traded. When the order amount equals the filled amount, it means the order has been completely filled.Order Price and Filled Price: "Order Price" refers to the desired trading price entered by the user when placing an order. If a user chooses a limit order, the order price is the price entered by the user. If the user selects a market order, the order price depends on the actual trading results. When users place large orders, the order is usually split into multiple smaller orders, which are filled sequentially. Due to market fluctuations, the actual filled price of each order may vary. "Filled Price" refers to the average of these actual filled prices.

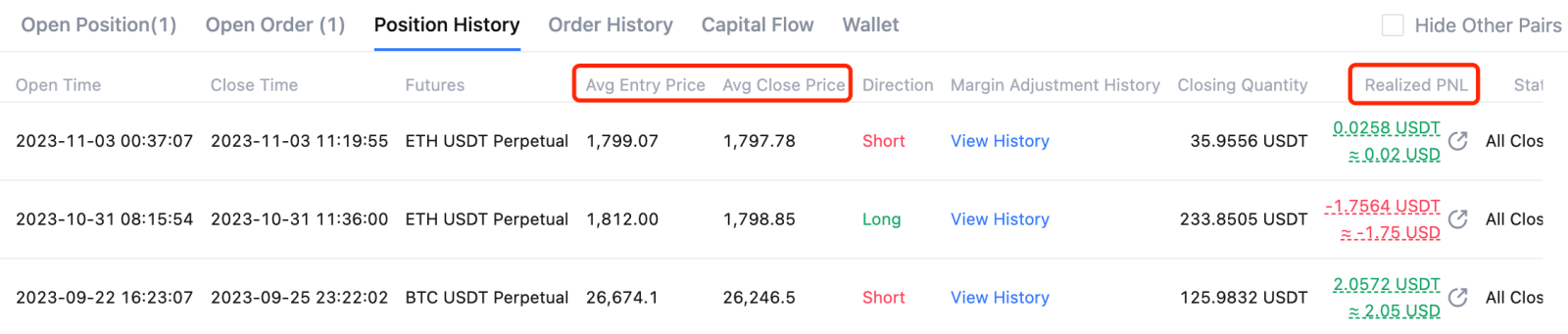

5.3 Position History

Avg Entry Price: The average cost to open a position.Avg Close Price: The average price of all closed positions.

Realized PNL: All realized profits and losses generated by the position, including trading fees, funding costs, and closing PNL. (Excluding portions of trading fees offset using coupons and MX.)

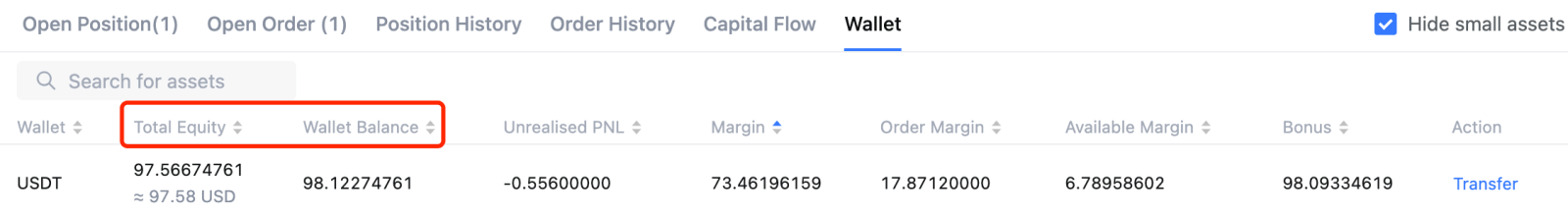

5.4 Wallet

Total Equity: Wallet Balance + Unrealized PNL.Wallet Balance: Total Inbound Transfers – Total Outbound Transfers + Realized PNL.

Understanding the terms related to futures trading is just the first step in learning how to use futures tools. Next, you need to gain practical experience through trading. Before trading futures, you can practice using the futures Demo Trading platform provided by MEXC. Once you are proficient, you can move on to live futures trading.

Disclaimer: Cryptocurrency trading involves risk. This information does not provide advice on investment, taxation, legal, financial, accounting, or any other related services, nor does it constitute advice to purchase, sell, or hold any assets. MEXC Learn provides information for reference purposes only and does not constitute investment advice. Please ensure you fully understand the risks involved and exercise caution when investing. The platform is not responsible for users’ investment decisions.

How to Trade USDT-M Perpetual Futures on MEXC (Website)

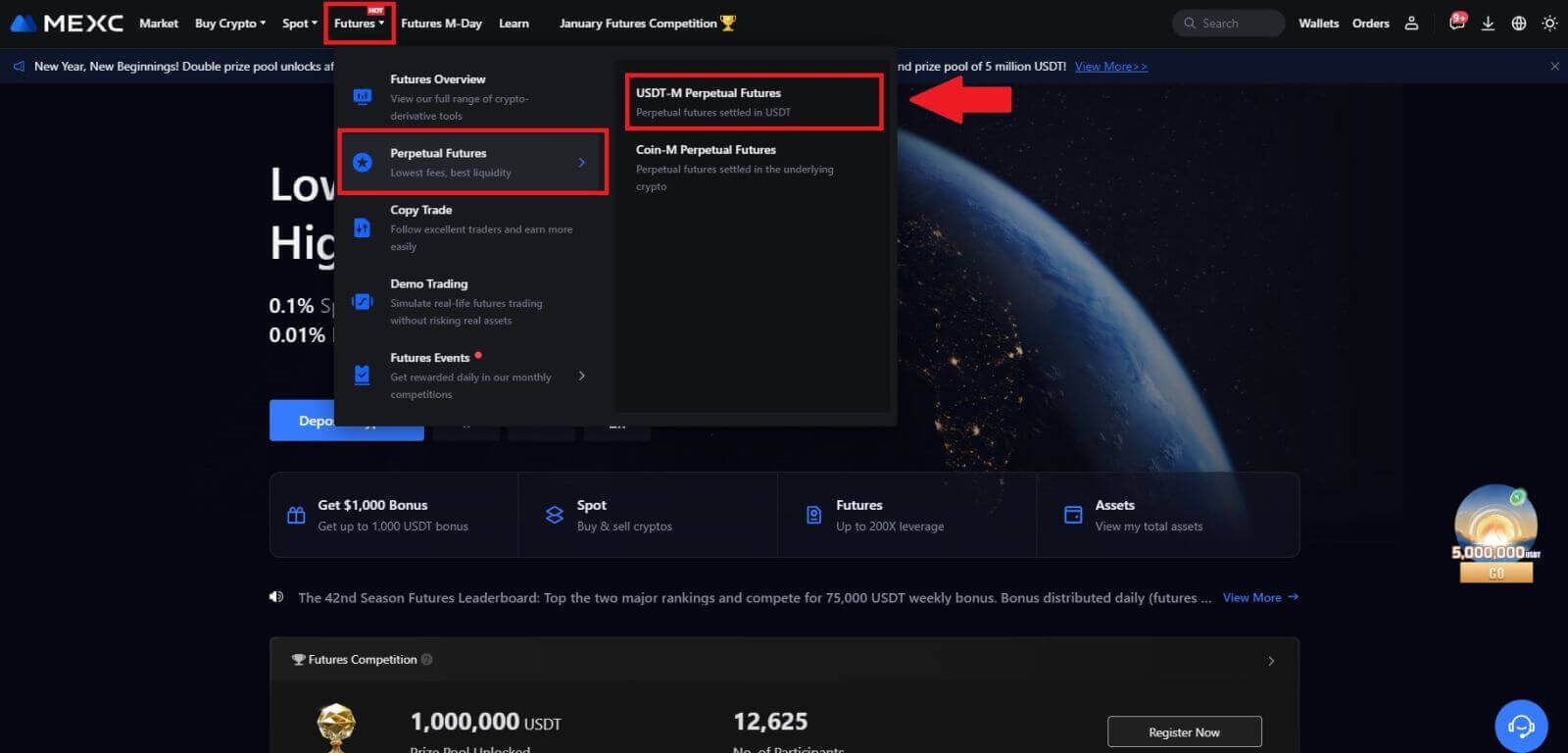

1. Go to MEXC Website, click on [Futures], select [Perpetual Futures], and choose [USDT-M Perpetual Futures].

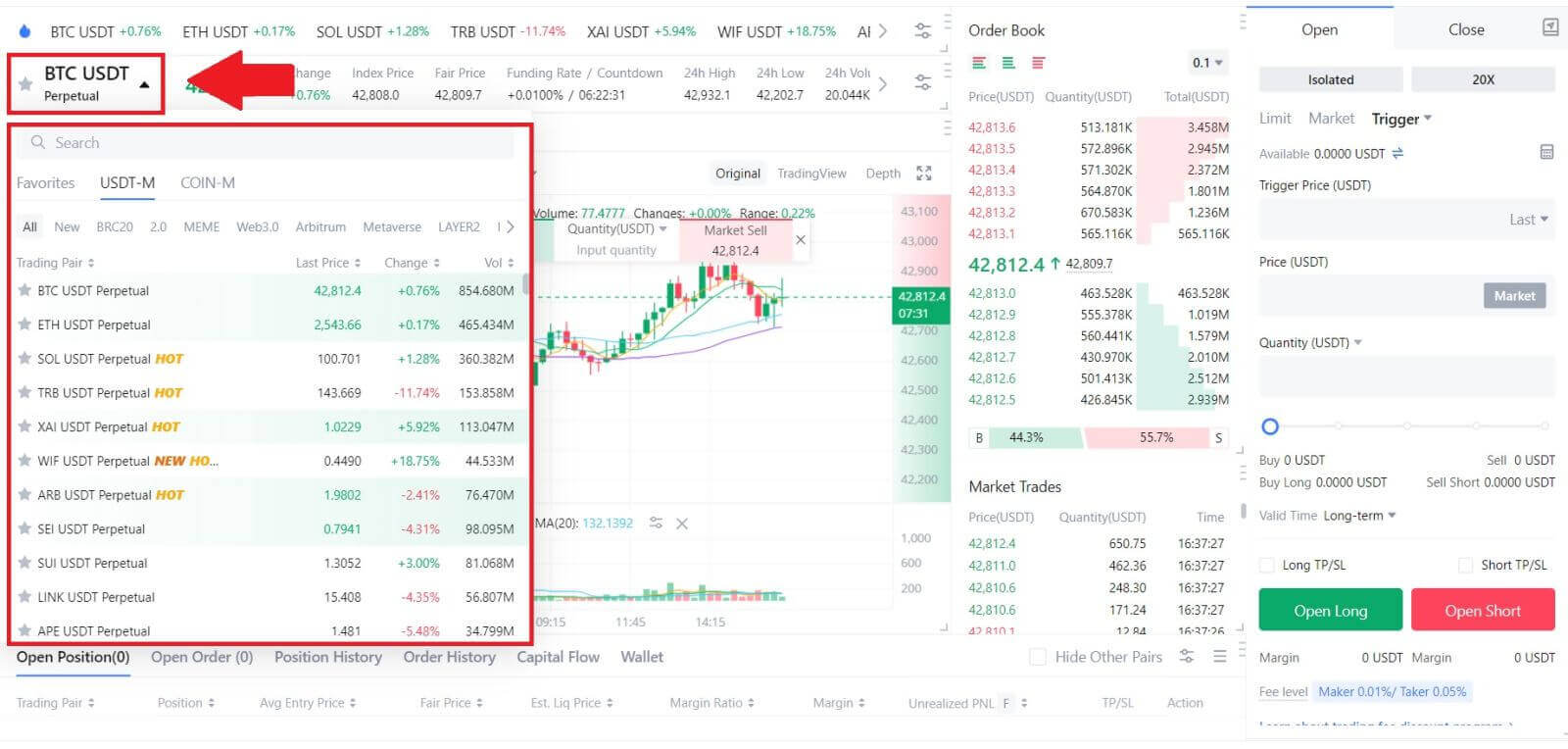

2. On the left-hand side, select BTCUSDT as an example from the list of futures.

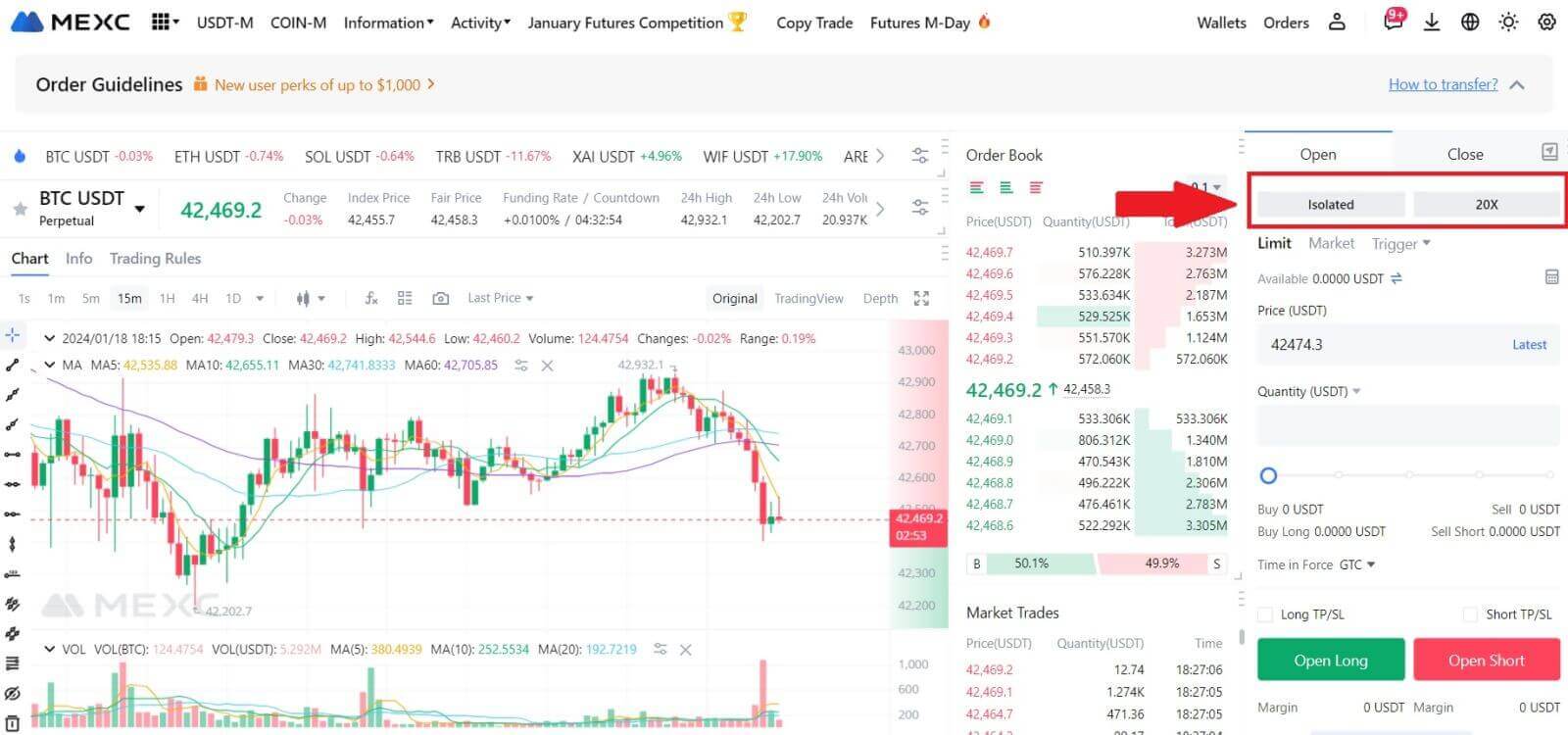

3. Click on Isolated or Cross to choose your [Margin Mode].

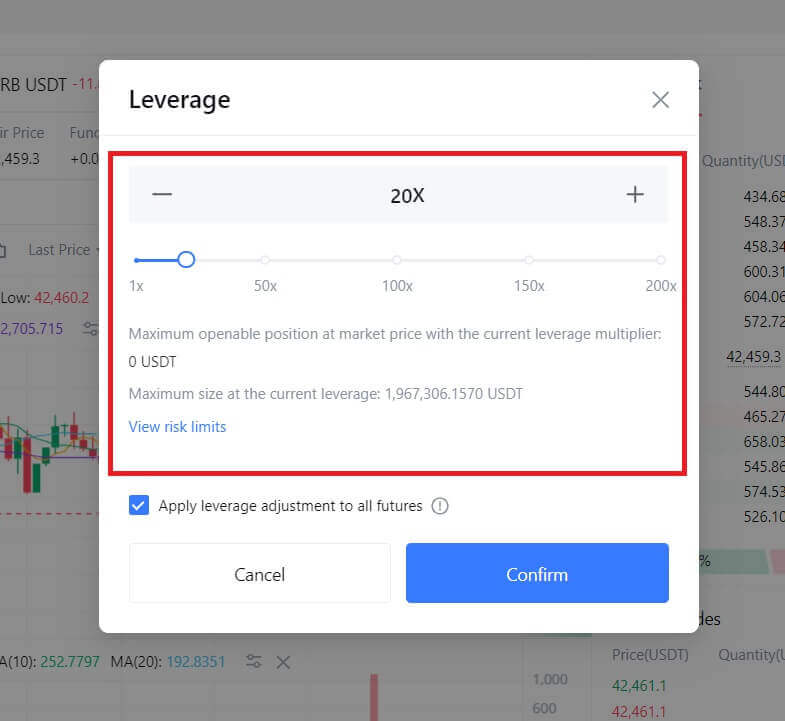

Click on [20X],to adjust the leverage multiplier by clicking on the number.

The platform supports traders with different margin preferences by offering different margin modes.

- The cross-margin mode shares margins with two positions opened against the same cryptocurrency. Any profit or loss from a position can be used to adjust against the balance of the other trade.

- The isolated margin only accepts margin against a position opened. In case of loss, the trade will only lose against the specific position on settlement. This leaves the balance of cryptocurrency untouched. This is the best option for all new traders since it protects the main crypto coin balance.

As a default setting, all traders start trading in isolated margin mode.

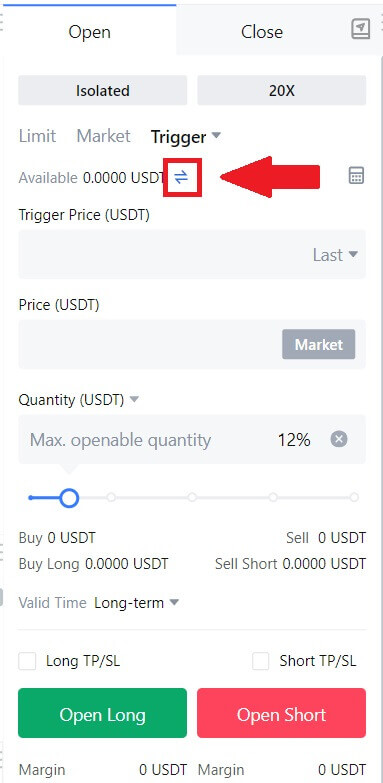

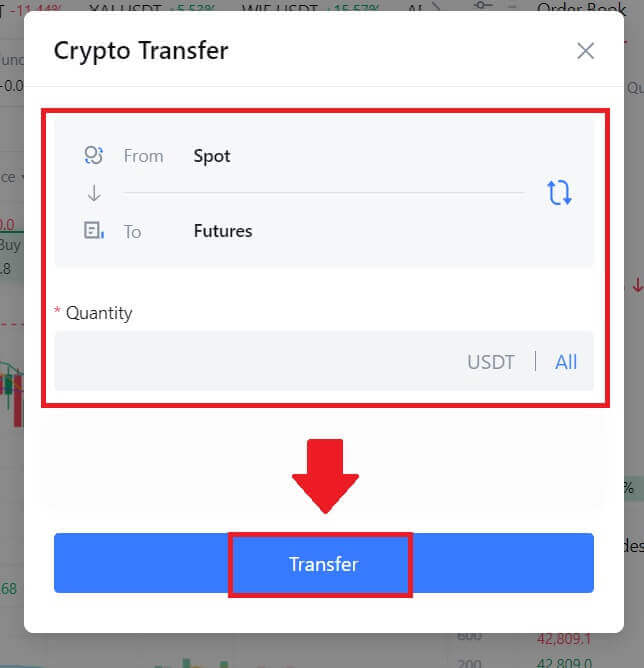

4. To initiate a fund transfer from the spot account to the futures account, click on the small arrow button located on the right to access the transfer menu.

4. To initiate a fund transfer from the spot account to the futures account, click on the small arrow button located on the right to access the transfer menu.Once in the transfer menu, enter the desired amount you wish to transfer, and click on [Transfer].

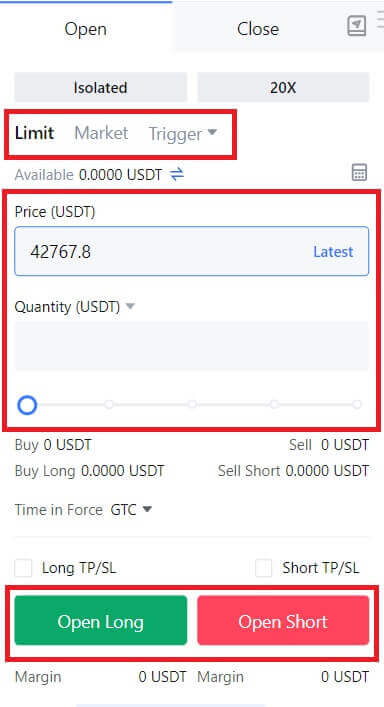

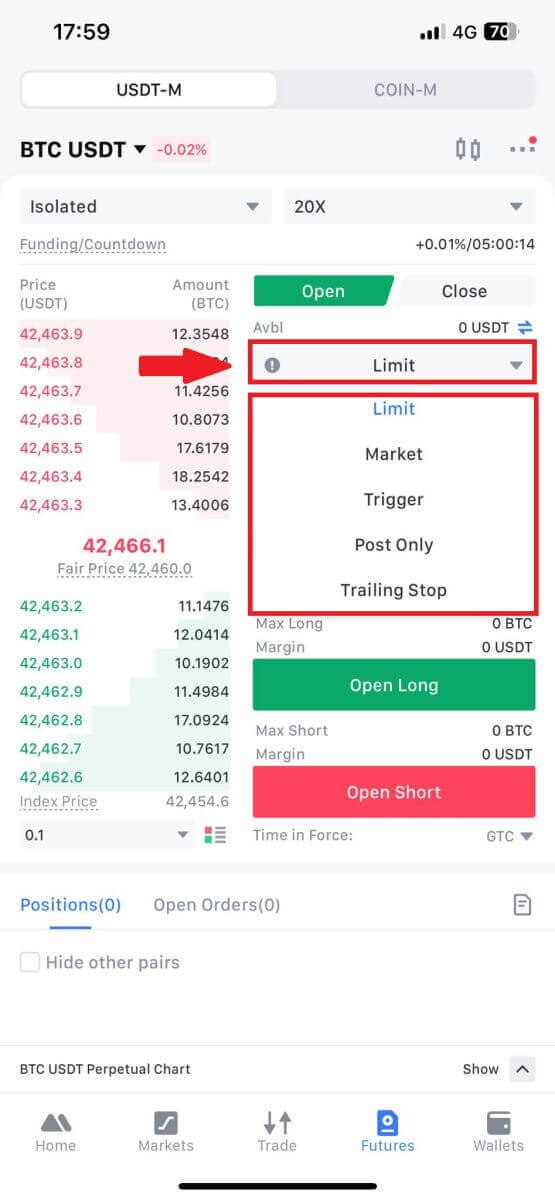

5. To open a position, users have three options: Limit Order, Market Order, and Trigger Order. Follow these steps:

Limit Order:

- Set your preferred buying or selling price.

- The order will only execute when the market price reaches the specified level.

- If the market price doesn’t reach the set price, the limit order remains in the order book, awaiting execution.

- This option involves a transaction without specifying a buying or selling price.

- The system executes the transaction based on the latest market price when the order is placed.

- Users only need to input the desired order amount.

Trigger Order:

- Set a trigger price, order price, and order quantity.

- The order will only be placed as a limit order with the predetermined price and quantity when the latest market price hits the trigger price.

- This type of order provides users with more control over their trades and helps automate the process based on market conditions.

6. After placing your order, view it under [Open Orders] at the bottom of the page. You can cancel orders before they’re filled.

How to Trade USDT-M Perpetual Futures on MEXC (App)

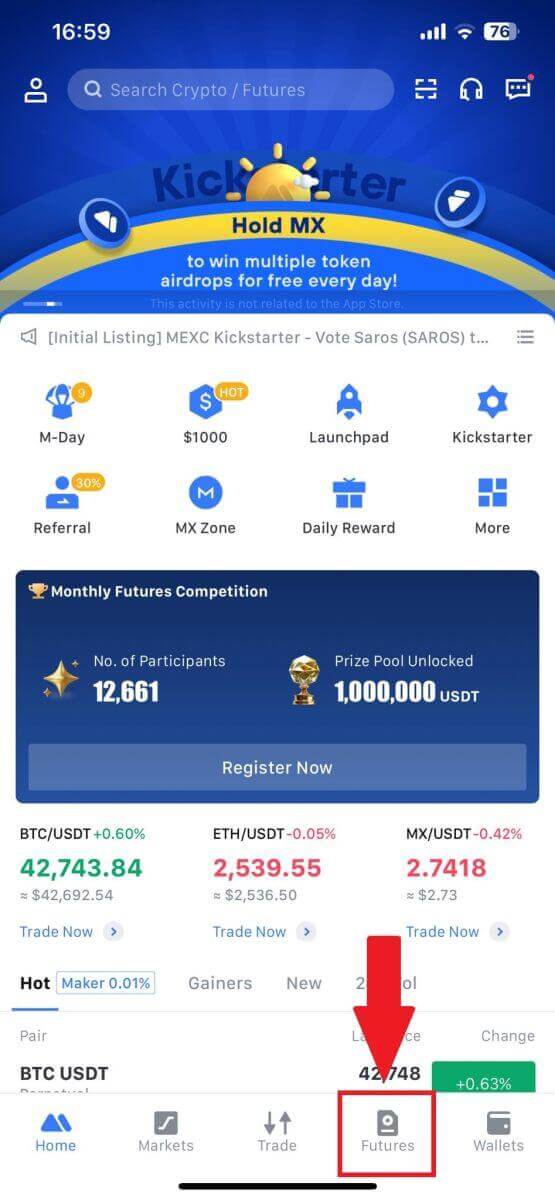

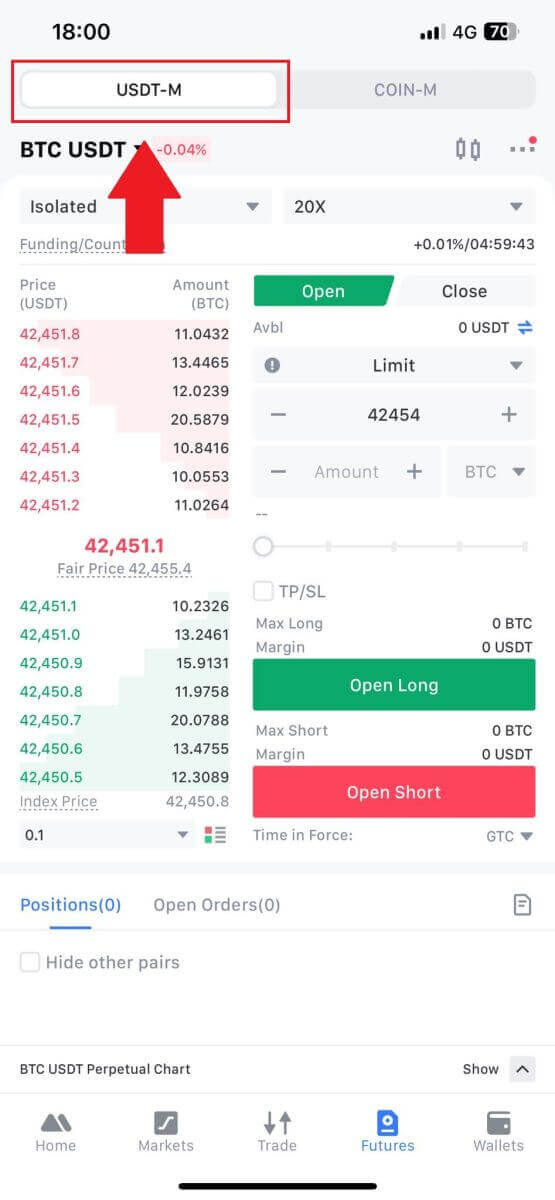

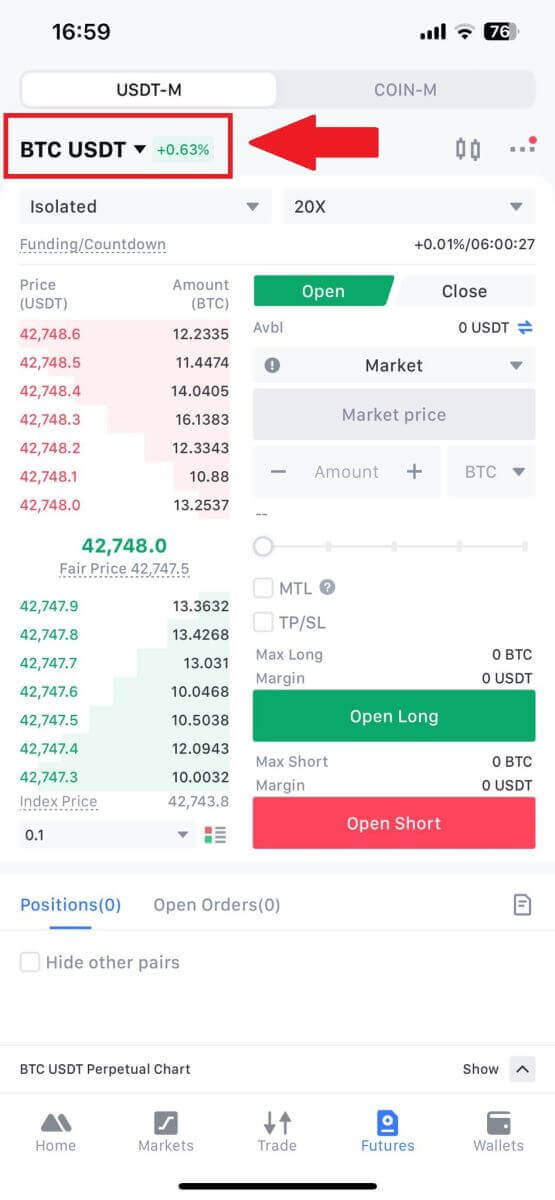

1. Open your MEXC App, on the first page, tap on [Futures] and choose [USDT-M].

2. To switch between different trading pairs, tap on [BTC USDT] located at the top left. You can then utilize the search bar for a specific pair or directly select from the listed options to find the desired futures for trading.

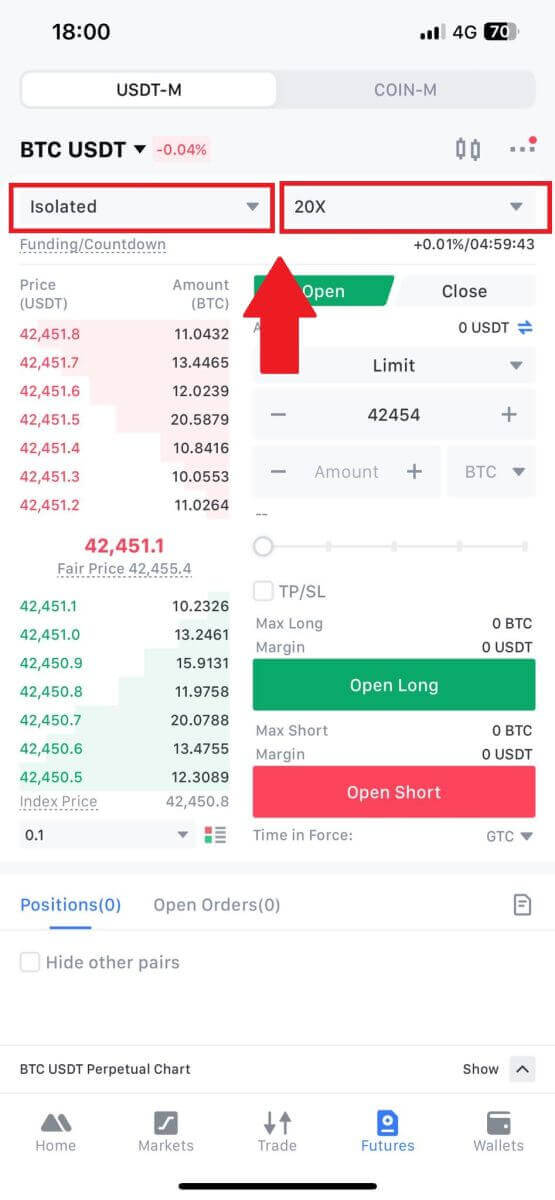

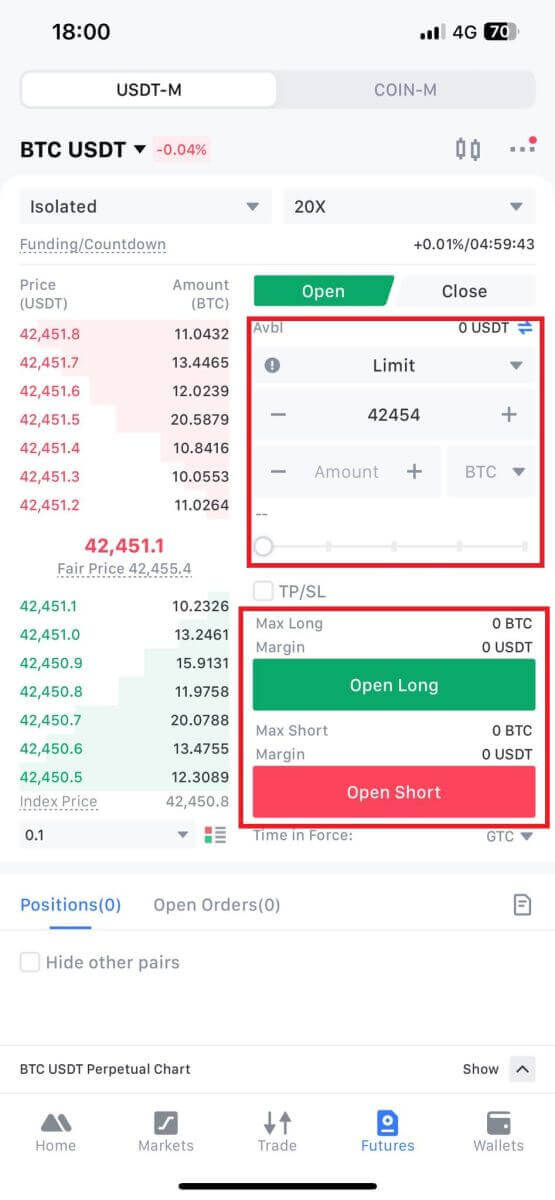

3. Choose the margin mode and adjust the leverage settings according to your preference.

4. On the right side of the screen, place your order. For a limit order, enter the price and amount; for a market order, input only the amount. Tap [Open Long] to initiate a long position, or [Open Short] for a short position.

5. Once the order is placed, if it isn’t filled immediately, it will appear in [Open Orders].

MEXC Future Trading Modes

Position Mode

(1) Hedge Mode

- In Hedge Mode, users are required to explicitly indicate whether they intend to open or close a position when placing an order. This mode allows users to hold positions simultaneously in both long and short directions within the same futures contract. The leverages for the long and short positions are independent of each other.

- All long positions are aggregated, and all short positions are combined within each futures contract. When maintaining positions in both long and short directions, the positions must allocate the corresponding margin based on the specified risk limit level.

For instance, in BTCUSDT futures, users have the flexibility to open a long position with 200x leverage and a short position with 200x leverage concurrently.

(2) One-Way Mode

In One-Way Mode, users are not required to specify whether they are opening or closing a position when placing an order. Instead, they only need to specify whether they are buying or selling. Additionally, users can only maintain positions in a single direction within each futures contract at any given time. If holding a long position, a sell order will automatically close it once filled. Conversely, if the number of filled sell orders surpasses the number of long positions, a short position will be initiated in the opposite direction.

Margin Modes

(1) Isolated Margin Mode

- In Isolated Margin Mode, the potential loss of a position is limited to the initial margin and any additional position margin used specifically for that isolated position. In the event of liquidation, the user will only incur losses equivalent to the margin associated with the isolated position. The available balance of the account remains untouched and is not utilized as additional margin. Isolating the margin used in a position allows users to restrict losses to the initial margin amount, which can be beneficial in cases where a short-term speculative trading strategy doesn’t pan out.

- Users can manually inject additional margin into isolated positions to optimize the liquidation price.

(2) Cross Margin Mode

Cross Margin Mode involves using the entire available balance of the account as margin to secure all cross positions and prevent liquidation. In this margin mode, if the net asset value falls short of meeting the maintenance margin requirement, liquidation will be triggered. If a cross position undergoes liquidation, the user will lose all assets in the account except for the margin associated with other isolated positions.

Modifying Leverage

- Hedge mode allows users to employ different leverage multipliers for positions in the long and short directions.

- Leverage multipliers can be adjusted within the permitted range of the futures leverage multiplier.

- Hedge mode also permits the switching of margin modes, such as transitioning from isolated mode to cross margin mode.

- Note: If a user has a position in cross margin mode, it cannot be switched to isolated margin mode.

Frequently Asked Questions (FAQ)

Types of Order on MEXC Futures

Limit Order

Limit orders allow the trader to set a specific buying or selling price, and the order will be filled at the order price or at a price more favorable than the order price.

When a limit order is submitted, if there is no order of which price is more favorable than or equal to the order price available for matching in the order book, the limit order will enter the order book to be filled, increasing the market depth. After the order is filled, the trader will be charged according to the more favorable maker fee.

When a limit order is submitted, if an order of which price is more favorable than or equal to the order price is already available for matching in the order book, the limit order will be immediately filled at the current best available price. Because of the liquidity consumed during the order execution, a certain trading fee will be charged as the Taker fee expense.

In addition, limit orders can also be used to partially or fully close a take profit limit order. The advantage of a limit order is that it is guaranteed to be filled at the specified price, but there also exists a risk that the order will not be filled.

When using a limit order, the user can also switch the effective time type of the order according to their trading needs, and the default is GTC:

- GTC (Good ‘Til Canceled Order): This type of order will remain valid until it is fully filled or canceled.

- IOC (Immediate or Cancel Order): If this type of order cannot be filled immediately at the specified price, the unfilled part will be canceled.

- FOK (Fill or Kill Order): This type of order will be canceled immediately if all orders cannot be filled.

Market Order

The market order will be filled at the best price available in the order book at the time. The order can be quickly filled without having the trader set the price. The market order guarantees the execution of orders but not the execution price, as it may fluctuate depending on market conditions. Market orders are typically used when a trader needs to make a quick entry to capture a market trend.

Trigger Limit Order

If the trigger price is set, when the benchmark price (market price, index price, fair price) selected by the user reaches the trigger price, it will be triggered, and a limit order will be placed at the order price and quantity set by the user.

Stop Market Order

If the trigger price is set, when the benchmark price (market price, index price, fair price) selected by the user reaches the trigger price, it will be triggered, and a market order will be placed with the quantity set by the user.

Note:

The user’s funds or positions will not be locked when setting the trigger. The trigger may fail due to high market volatility, price restrictions, position limits, insufficient collateral assets, insufficient closeable volume, futures in non-trading status, system issues, etc. A successful trigger limit order is the same as a normal limit order, and it may not be executed. Unexecuted limit orders will be displayed in active orders.

Trailing Stop Order

A trailing stop order is a strategy order for tracking market prices, and its trigger price may change with latest market fluctuations.

Trigger price calculation:

Sell, Actual Trigger Price = Market’s Historically Highest Price - Trail Variance (Price Gap), Or Market’s Historically Highest Price * (1 - Trail Variance %).

Buy, Actual Trigger Price = Market’s Historically Lowest Price + Trail Variance, Or Market’s Historically Lowest Price * (1 + Trail Variance %).

Trailing orders allow users to select an activation price for the order, and the system will start calculating the trigger price only after the order is activated.

Identification for Trailing Stop Order

Trail variance: The trail variance is the main condition for calculating the actual trigger price. The actual trigger price will be calculated based on the highest/lowest price of the specified price type after the order activation and the trail variance.

Quantity: The number of orders placed.

Price type: You can select the last transaction price, fair price or index price as the criteria to activate and trigger trailing orders.

Activation price: Activation price is the activation condition of a trailing order. When the price of the specified price type reaches or exceeds the activation price, the order will be activated. The system will only start calculating the actual trigger price upon activation. If the activation price is not defined, the order will be activated upon placement.

For example:

Case 1 (Sell the rip): The user wants to sell BTC without selecting the activation price (i.e. activate as soon as the order is placed) and the last transaction price is 30,000 USDT.

Then, one may set the parameters as follows.

[Trail Variance - Price Gap] 2,000 USDT

[Quantity] 1 BTC

[Price Type] Last Transaction Price

In the event where the BTC price keeps increasing to the highest point of 40,000 USDT after the order is placed, and then retraces to 38,000 USDT, reaching the retracement condition (40,000 USDT - 2,000 USDT = 38,000 USDT), the system decides for the user to sell at the market price at 38,000 USDT.

Case 2 (Buy the dip): The user wants to buy BTC and the last transaction price is currently 40,000 USDT.

Then one may set the parameters as follows.

[Trail Variance - Ratio] 5%

[Activation Price] 30,000 USDT

[Quantity] 1 BTC

[Price Type] Last Transaction Price

In the event where the BTC price keeps falling to 30,000 USDT after the order is placed, the trailing is activated, it then falls all the way to 20,000 USDT and bounces back to 20,000 USDT * (1 + 5%) = 21,000 USDT, reaching the retracement condition (5%), the system decides for the user to buy at the market price at 21,000 USDT.

Post Only

Post-only orders will not be filled in the market immediately, which ensures that the user is always a maker and enjoys the yield of the trading fee as a liquidity provider; at the same time, if the order is filled with an existing order, then the order will be canceled immediately.

TP/SL

TP/SL refers to the pre-set trigger price (take profit price or stop loss price) and trigger price type. When the last price of the specified trigger price type reaches the pre-set trigger price, the system will place a close market order according to the pre-set quantity in order to take profit or stop loss. Currently, there are two ways to place a stop loss order:

- Set TP/SL when opening a position: This means to set TP/SL in advance for a position that is about to be opened. When the user places an order to open a position, they can click to set a TP/SL order at the same time. When the open position order is filled (partially or fully), the system will immediately place a TP/SL order with the trigger price and trigger price type pre-set by the user. (This can be viewed in open orders under TP/SL.)

- Set TP/SL when holding a position: Users can set a TP/SL order for a specified position when holding a position. After the setting is complete, when the last price of the specified trigger price type meets the trigger condition, the system will place a close market order according to the quantity set in advance.

Differences between Coin-M Perpetual Futures and USDT-M Perpetual Futures

1. Different crypto is used as the valuation unit, collateral asset, and calculation of PNL:- In USDT-M perpetual futures, valuation and pricing are in USDT, with USDT also used as collateral, and PNL calculated in USDT. Users can engage in diverse futures trading by holding USDT.

- For Coin-M perpetual futures, pricing and valuation are in US dollars (USD), utilizing the underlying cryptocurrency as collateral, and calculating PNL with the underlying crypto. Users can participate in specific futures trading by holding the corresponding underlying crypto.

2. Different contract values:

- The value of each contract in USDT-M perpetual futures is derived from the associated underlying cryptocurrency, exemplified by the 0.0001 BTC face value for BTCUSDT.

- In Coin-M perpetual futures, the price of each contract is fixed in US dollars, as seen in the 100 USD face value for BTCUSD.

3. Different risks associated with the devaluation of collateral asset:

- In USDT-M perpetual futures, the collateral asset required is USDT. When the price of the underlying crypto falls, it does not affect the value of the USDT collateral asset.

- In Coin-M perpetual futures, the collateral asset required corresponds to the underlying crypto. When the price of the underlying crypto falls, the collateral assets required for the users’ positions increase, and more of the underlying crypto is needed as collateral.