Frequently Asked Questions (FAQ) in MEXC

Account

Unable To Receive SMS Verification Code on MEXC

If you are unable to receive the SMS verification code on your mobile phone, it may be due to the reasons listed below. Please follow the corresponding instructions and try to obtain the verification code again.Reason 1: SMS services for mobile numbers cannot be provided as MEXC does not offer service in your country or region.

Reason 2: If you have installed security software on your mobile phone, it is possible the software has intercepted and blocked the SMS.

- Solution: Open your mobile security software and temporarily disable blocking, then try to obtain the verification code again.

Reason 3: Problems with your mobile service provider, i.e. SMS gateway congestion or other abnormalities.

- Solution: When your mobile provider’s SMS gateway is congested or experiencing abnormalities, it can cause delays or loss of sent messages. Contact your mobile service provider to verify the situation or try again later to obtain the verification code.

Reason 4: Too many SMS verification codes were requested too quickly.

- Solution: Clicking the button to send the SMS verification code too many times in rapid succession may affect your ability to receive the verification code. Please wait for a while and try again later.

Reason 5: Poor or no signal at your current location.

- Solution: If you are unable to receive SMS or experiencing delays in receiving SMS, it is likely due to poor or no signal. Try again in a location with better signal strength.

Other issues:

Disconnected mobile service due to lack of payment, full phone storage, SMS verification being marked as spam, and other situations can also prevent you from receiving SMS verification codes.

Note:

If you are still unable to receive SMS verification codes after trying the above solutions, it’s possible that your have blacklisted the SMS sender. In this case, contact online customer service for assistance.

What to do if you are not receiving the email from MEXC?

If you have not received the email, please try the following methods:

- Ensure you have entered the correct email address when signing up;

- Check your spam folder or other folders;

- Check if emails are sending and being received properly on the email client’s end;

- Try using an email from a mainstream provider such as Gmail and Outlook;

- Check your inbox again later, as there could be a network delay. The verification code is valid for 15 minutes;

- If you are still not receiving the email, it might have been blocked. You will be required to manually whitelist the MEXC email domain before trying to receive the email again.

Please whitelist the following senders (email domain whitelist):

Whitelist for domain name:

- mexc.link

- mexc.sg

- mexc.com

Whitelist for email address:

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

How To Enhance MEXC Account Security

1. Password Settings: Please set a complex and unique password. For security purposes, make sure to use a password with at least 10 characters, including at least one uppercase and lowercase letter, one number, and one special symbol. Avoid using obvious patterns or information that is easily accessible to others (e.g. your name, email address, birthday, mobile number, etc.).

- Password formats we do not recommend: lihua, 123456, 123456abc, test123, abc123

- Recommended password formats: Q@ng3532!, iehig4g@#1, QQWwfe@242!

2. Changing Passwords: We recommend that you change your password regularly to enhance the security of your account. It is best to change your password every three months and use a completely different password each time. For more secure and convenient password management, we recommend you to use a password manager such as "1Password" or "LastPass".

- In addition, please keep your passwords strictly confidential and do not disclose them to others. MEXC staff will never ask for your password under any circumstances.

3. Two-Factor Authentication (2FA)

Linking Google Authenticator: Google Authenticator is a dynamic password tool launched by Google. You are required to use your mobile phone to scan the barcode provided by MEXC or enter the key. Once added, a valid 6-digit authentication code will be generated on the authenticator every 30 seconds. Upon successful linking, you need to enter or paste the 6-digit authentication code displayed on Google Authenticator every time you log in to MEXC.

Linking MEXC Authenticator: You can download and use MEXC Authenticator on App Store or Google Play to enhance the security of your account.

4. Beware of Phishing

Please be vigilant of phishing emails pretending to be from MEXC, and always ensure that the link is the official MEXC website link before logging into your MEXC account. MEXC staff will never ask you for your password, SMS or email verification codes, or Google Authenticator codes.

What is Two-Factor Authentication?

Two-Factor Authentication (2FA) is an additional security layer to email verification and your account password. With 2FA enabled, you will have to provide the 2FA code when performing certain actions on the MEXC platform.

How does TOTP work?

MEXC uses a Time-based One-time Password (TOTP) for Two-Factor Authentication, it involves generating a temporary, unique one-time 6-digit code* that is only valid for 30 seconds. You will need to enter this code to perform actions that affect your assets or personal information on the platform.

*Please keep in mind that the code should consist of numbers only.

How To Set Up Google Authenticator

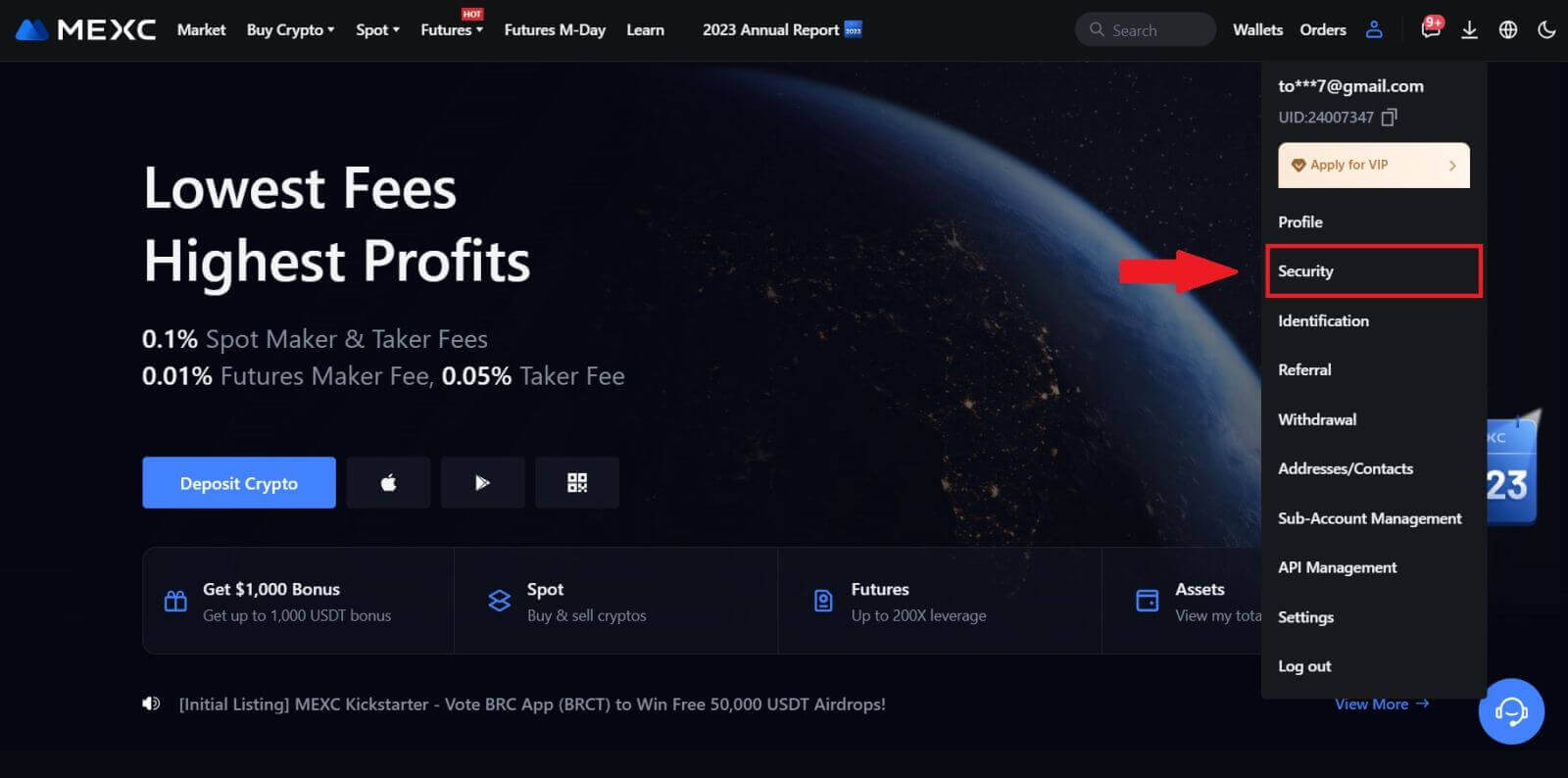

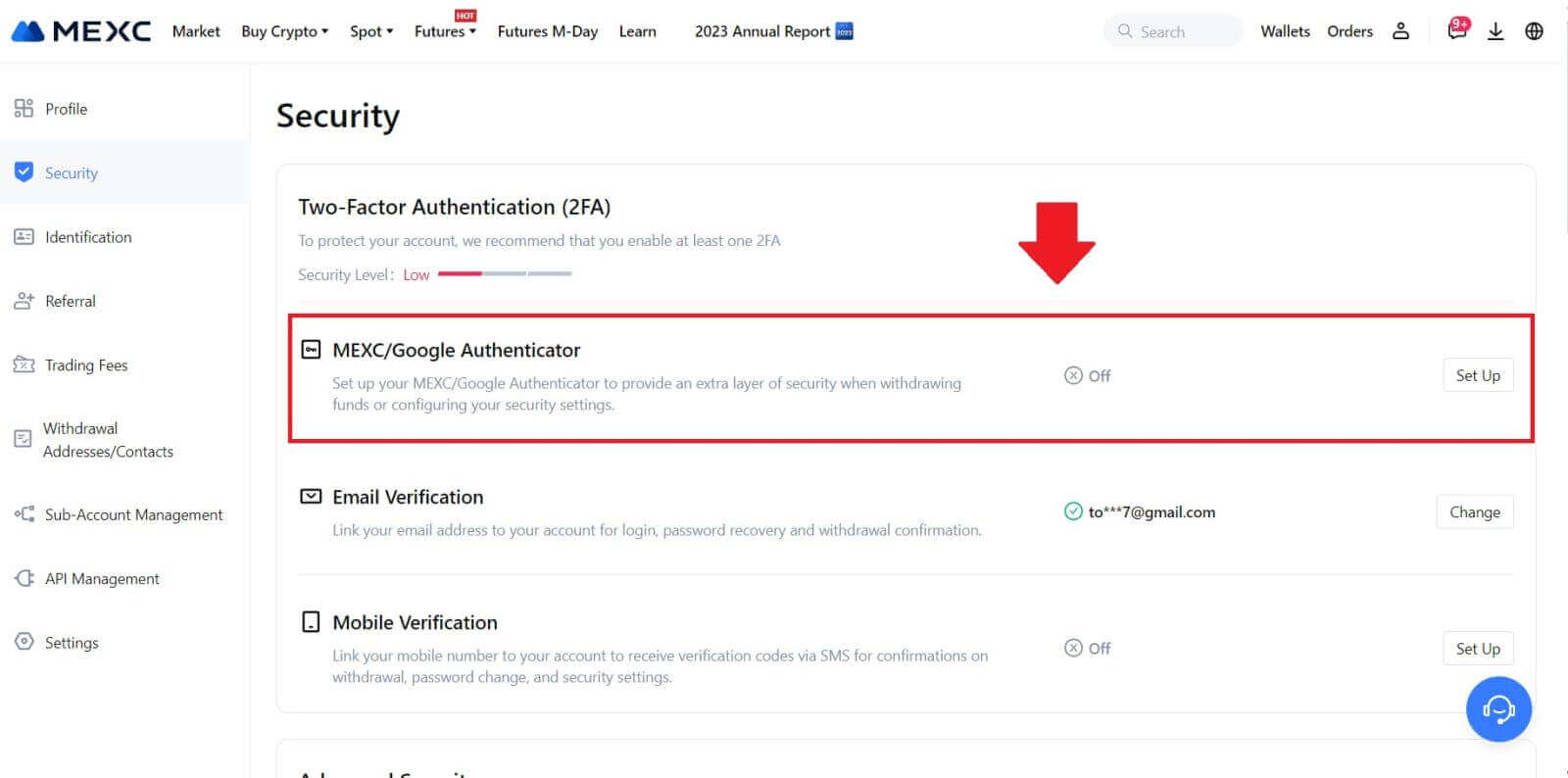

1. Log in to the official MEXC website, click on the [Profile] icon, and select [Security].

2. Select MEXC/Google Authenticator for setup.

3. Install the authenticator app.

If you’re using an iOS device, access the App Store and locate "Google Authenticator" or "MEXC Authenticator" for download.

For Android users, visit Google Play and find "Google Authenticator" or "MEXC Authenticator" to install.

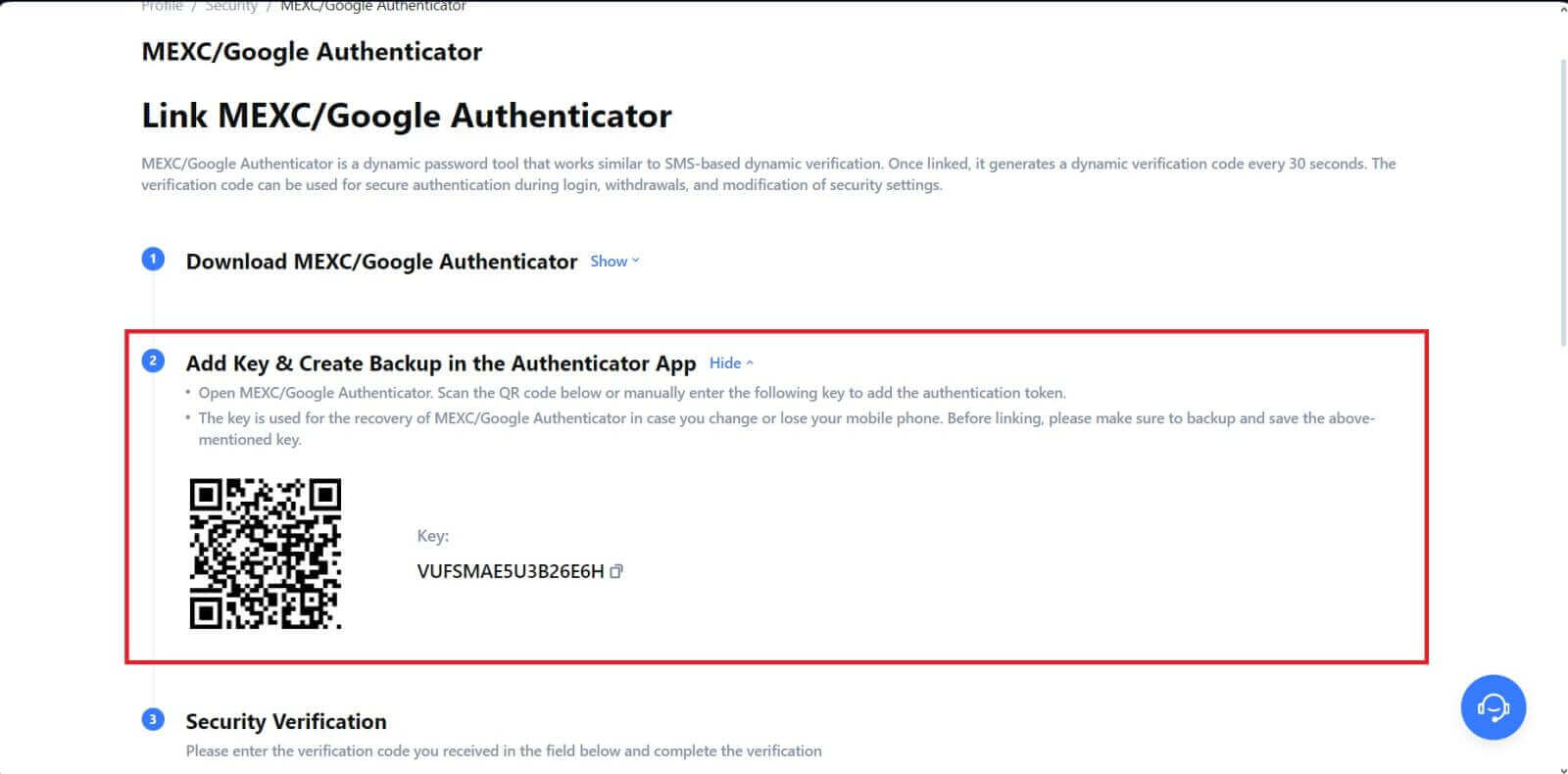

4. Launch the downloaded authenticator app and either scan the QR code displayed on the page or manually copy the key and paste it into the app to generate verification codes.

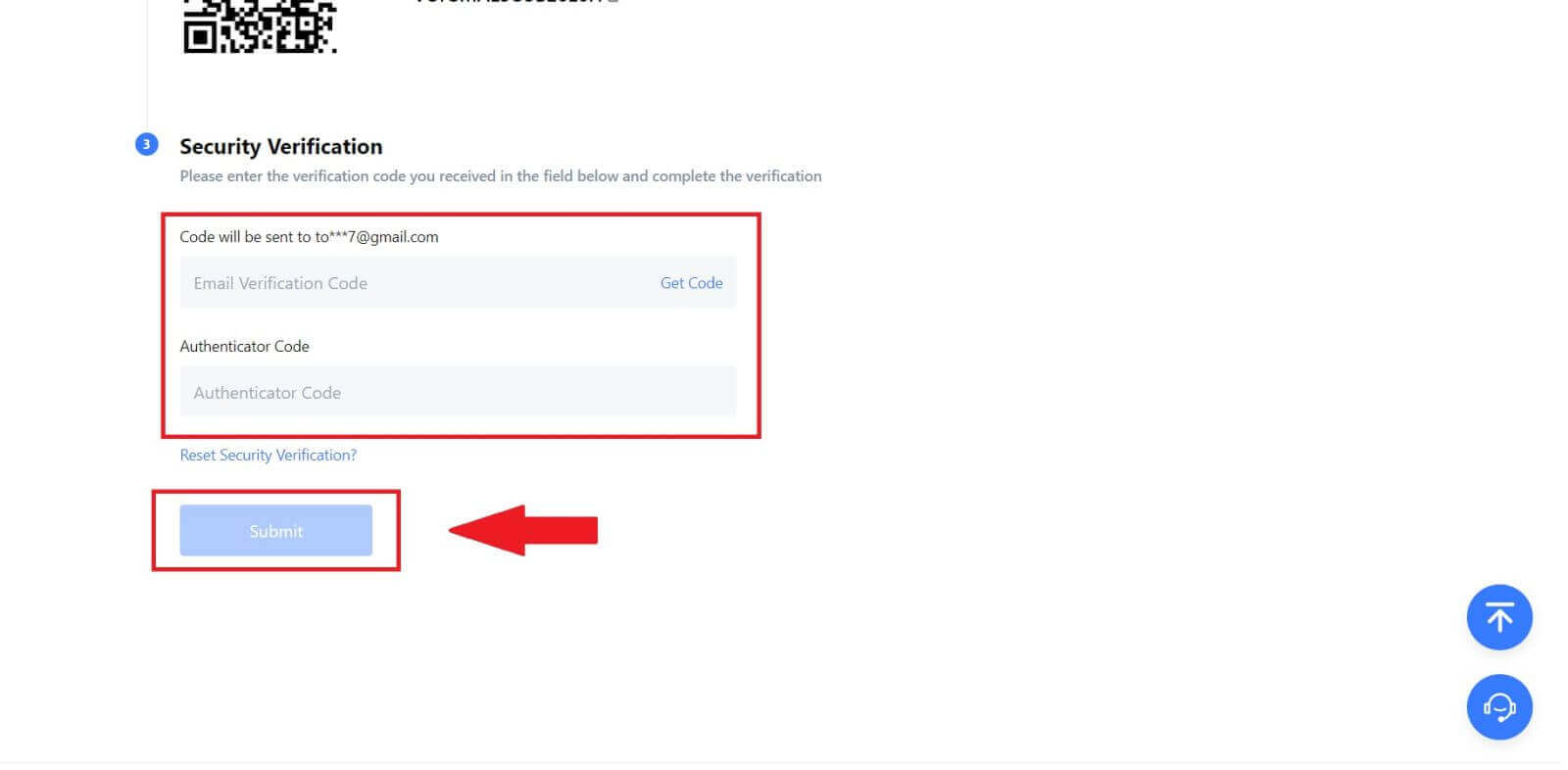

5. Click on [Get Code] and enter the 6-digit code that was sent to your email and the Authenticator code. Click [Submit] to complete the process.

5. Click on [Get Code] and enter the 6-digit code that was sent to your email and the Authenticator code. Click [Submit] to complete the process.

Verification

How to complete Identity Verification? A step-by-step guide

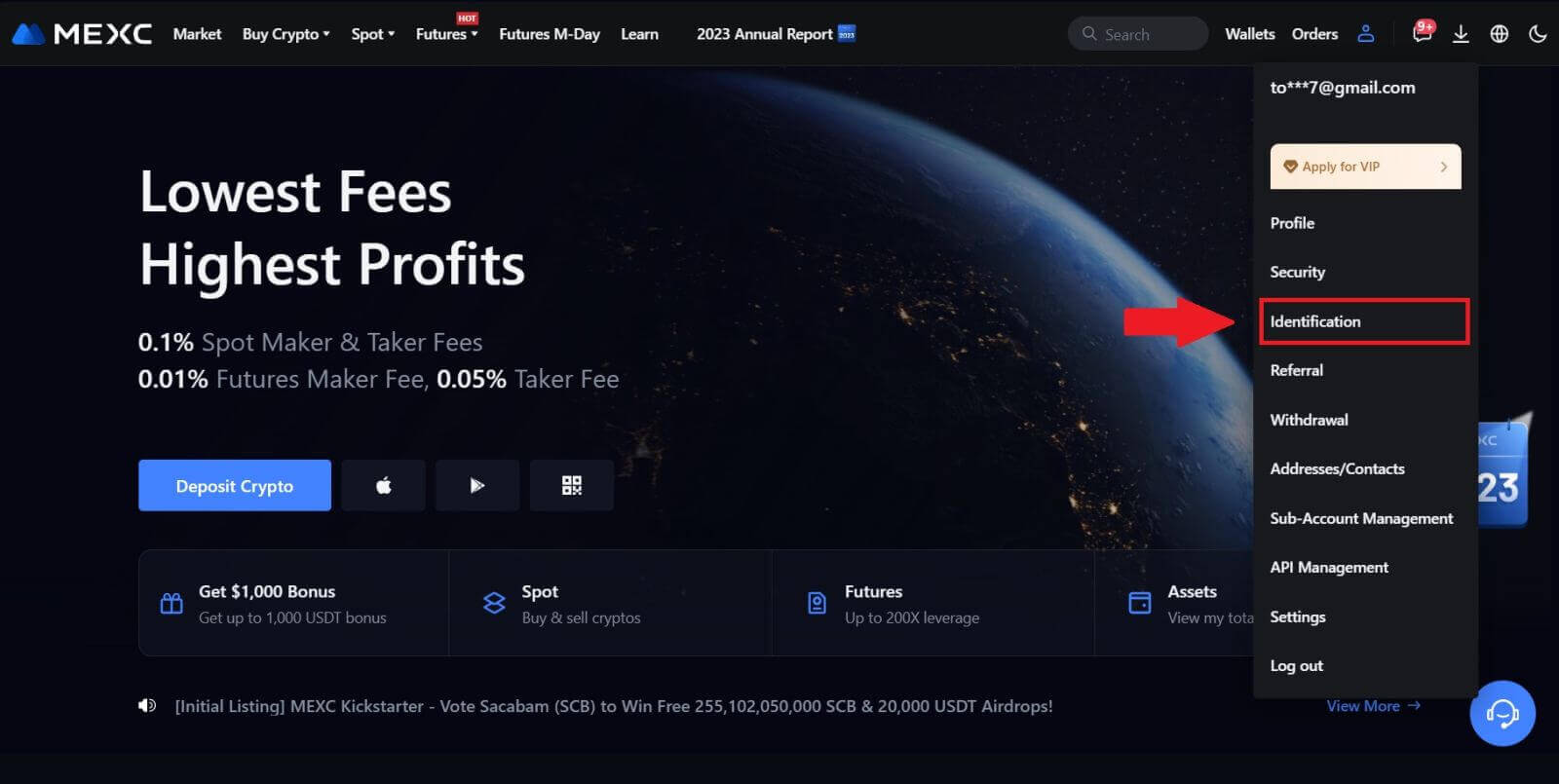

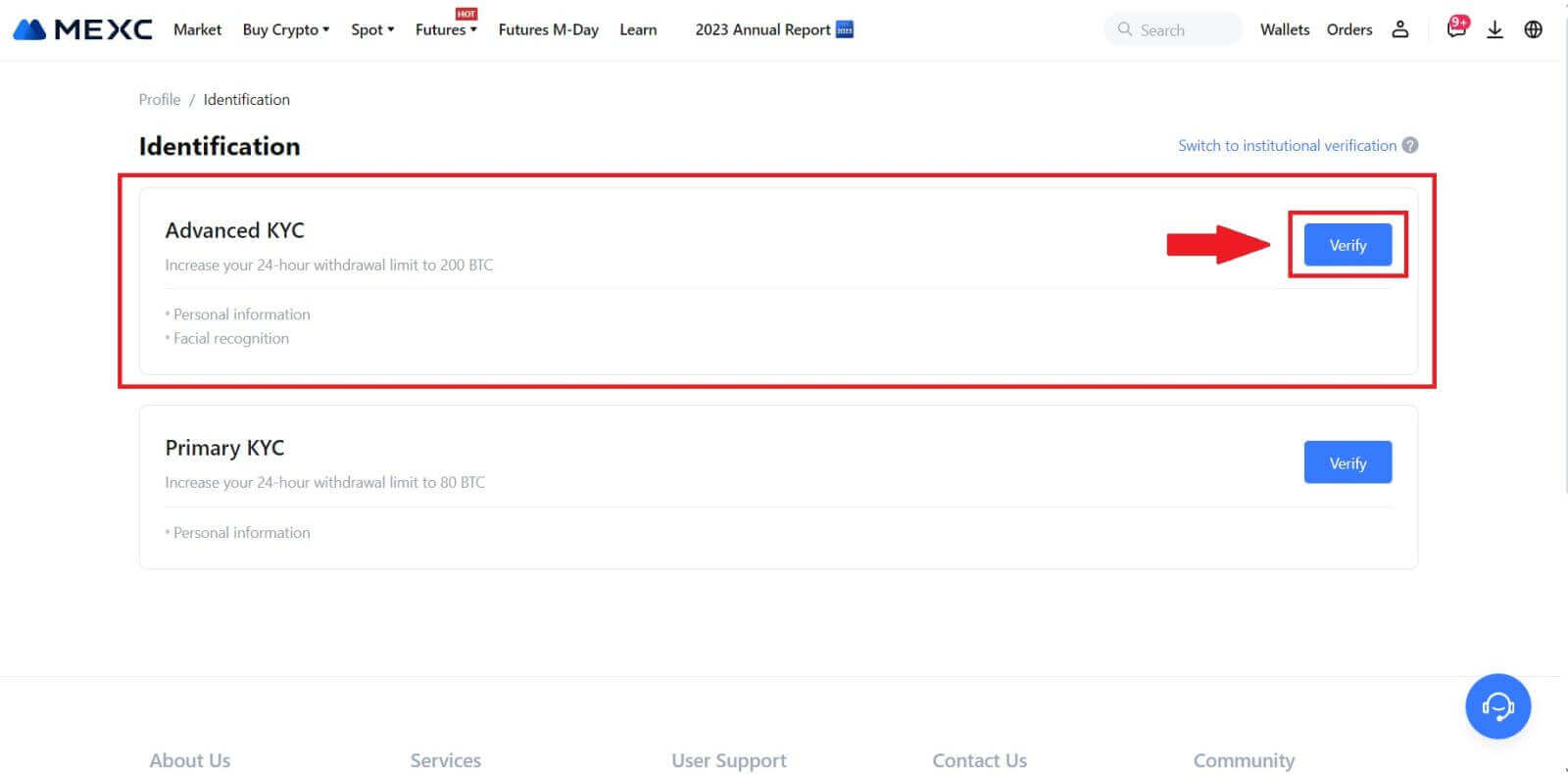

Primary KYC on MEXC (Website)

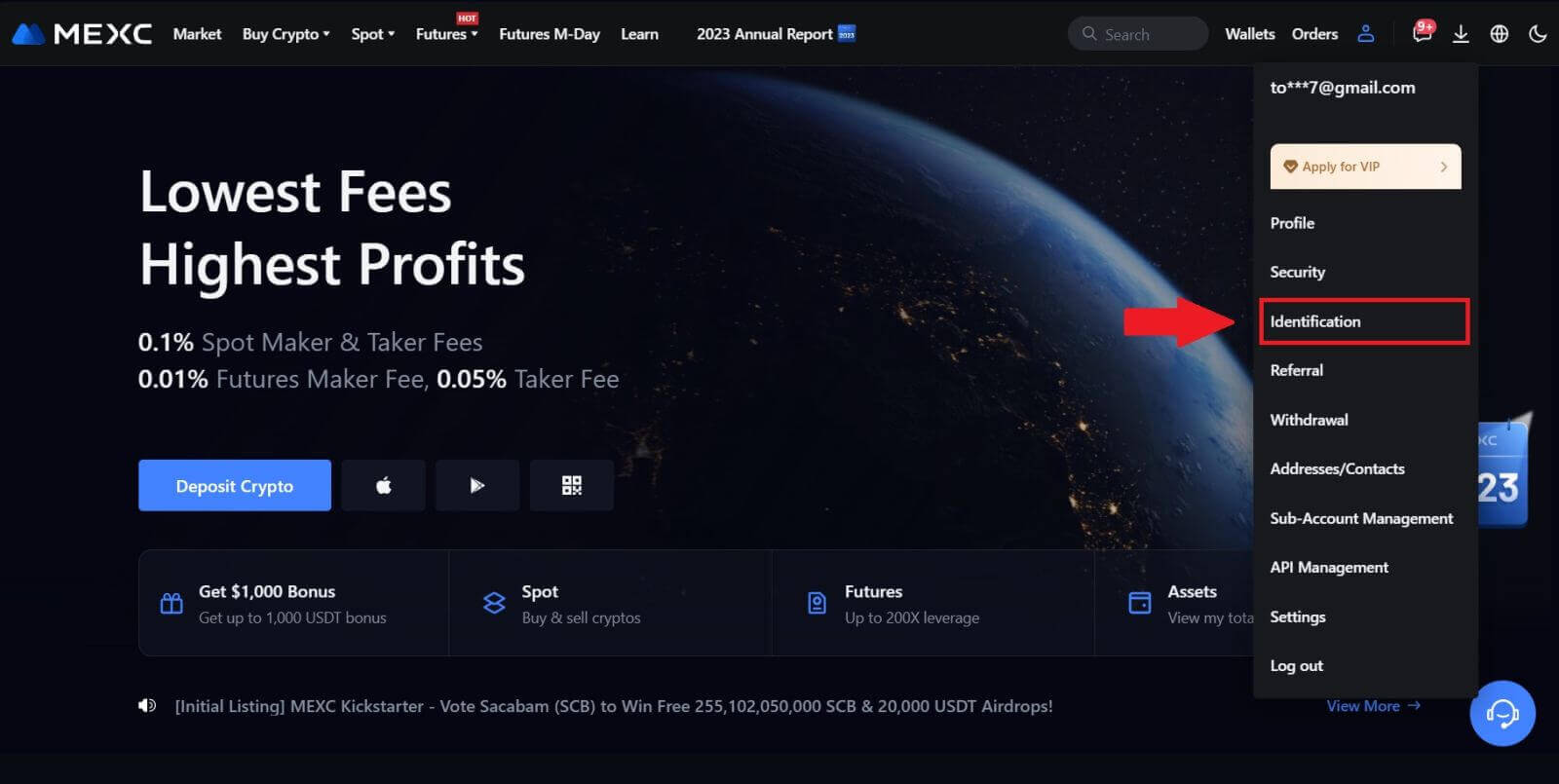

1. Log in to your MEXC account. Place your cursor on the top-right profile icon and click on [Identification].

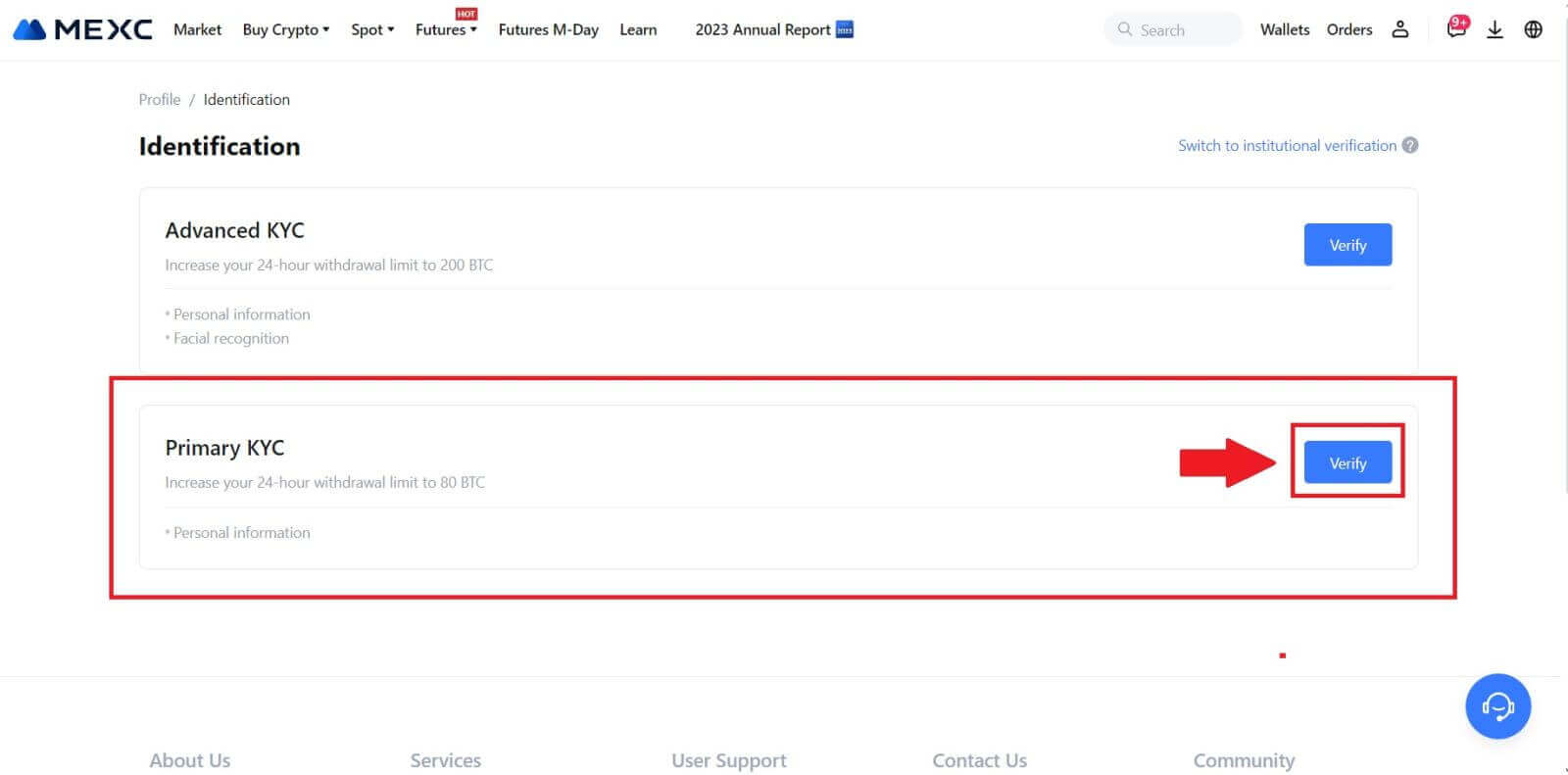

2. Start with Primary KYC and click [Verify].

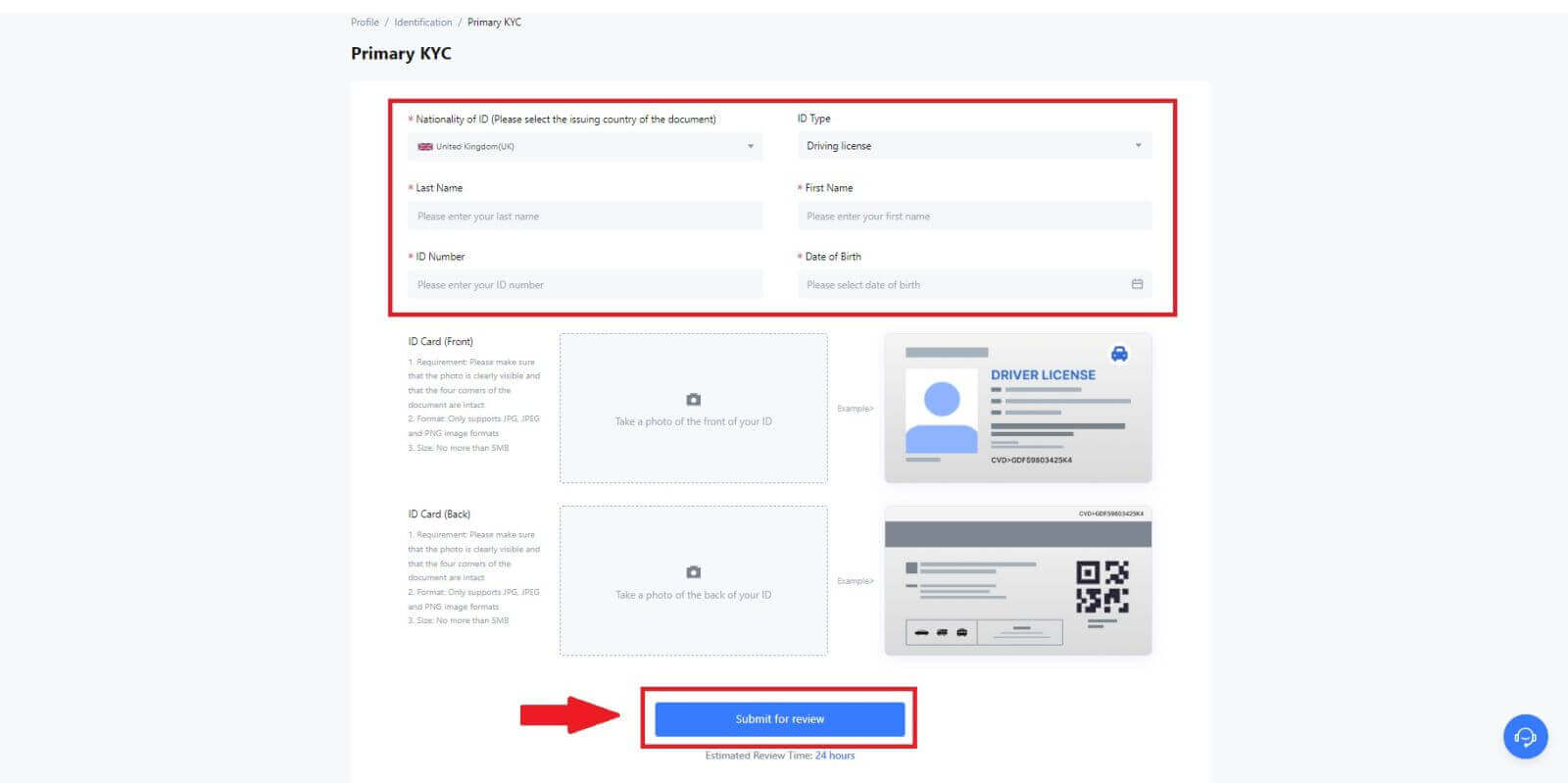

3. Select your country, input your full legal name, choose your ID Type, Date of birth, upload photos of your ID Type, and click on [Submit for review].

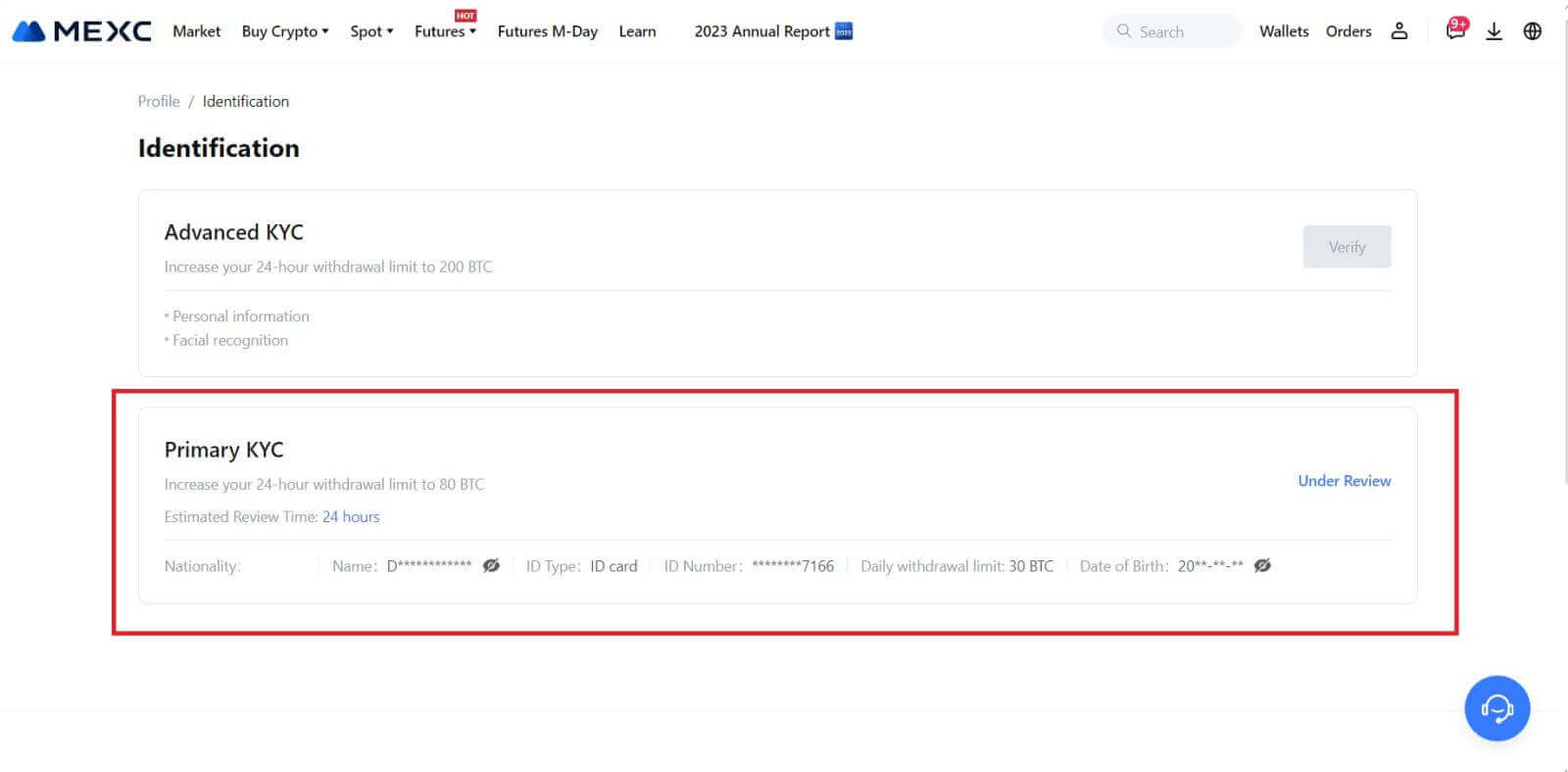

4. After verification, you will see your verification is under review, wait for the confirmation email or access your profile to check the KYC status.

Note

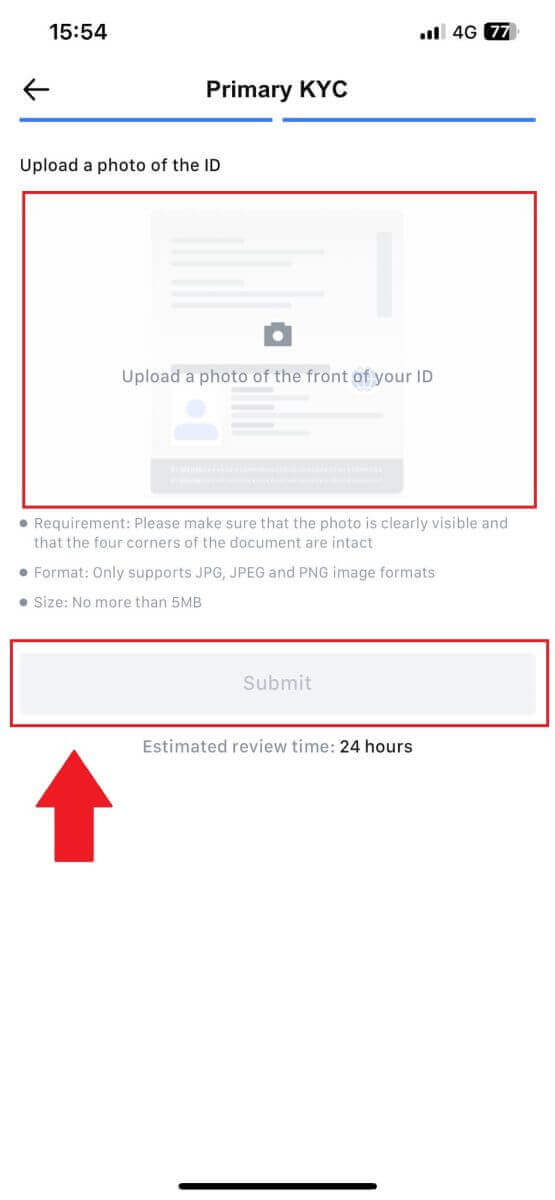

The image file format must be JPG, JPEG or PNG, file size cannot exceed 5 MB. Face should be clearly visible! Note should be clearly readable! Passport should be clearly readable.

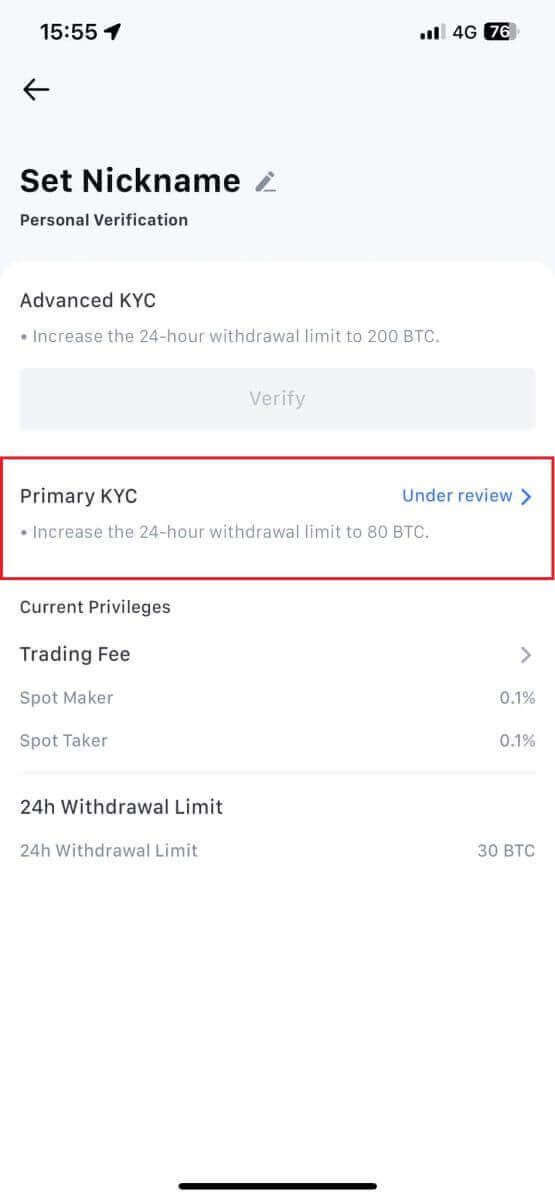

Primary KYC on MEXC (App)

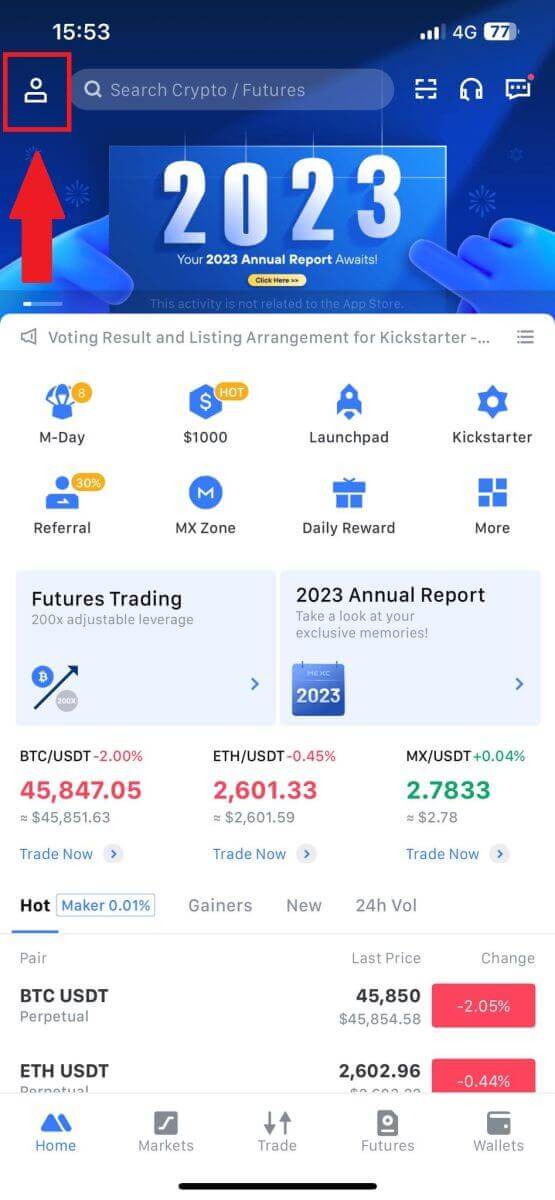

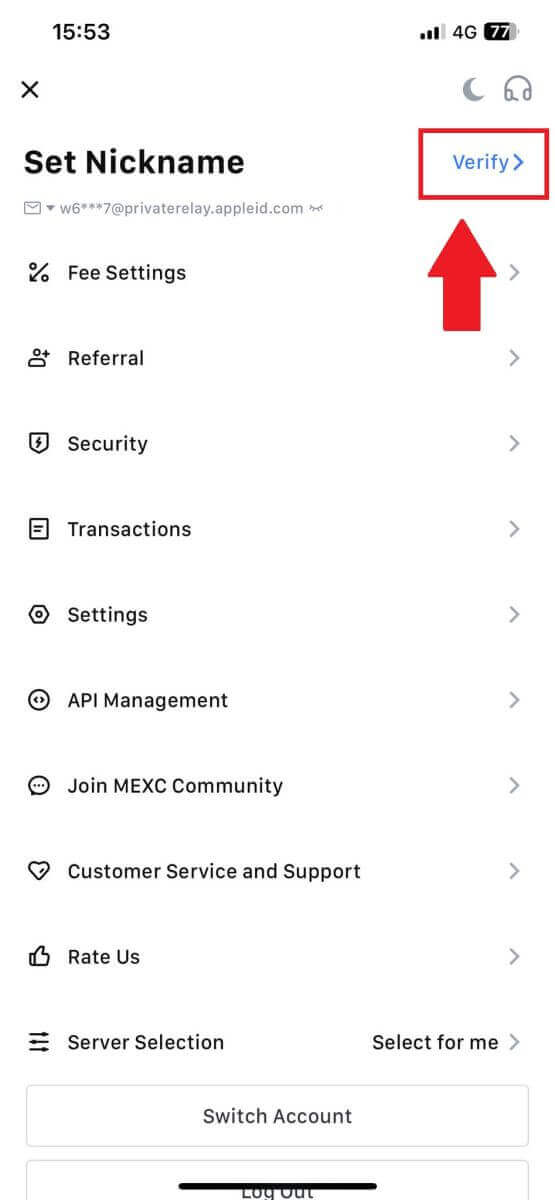

1. Open your MEXC app, tap on the [Profile] icon, and select [Verify].

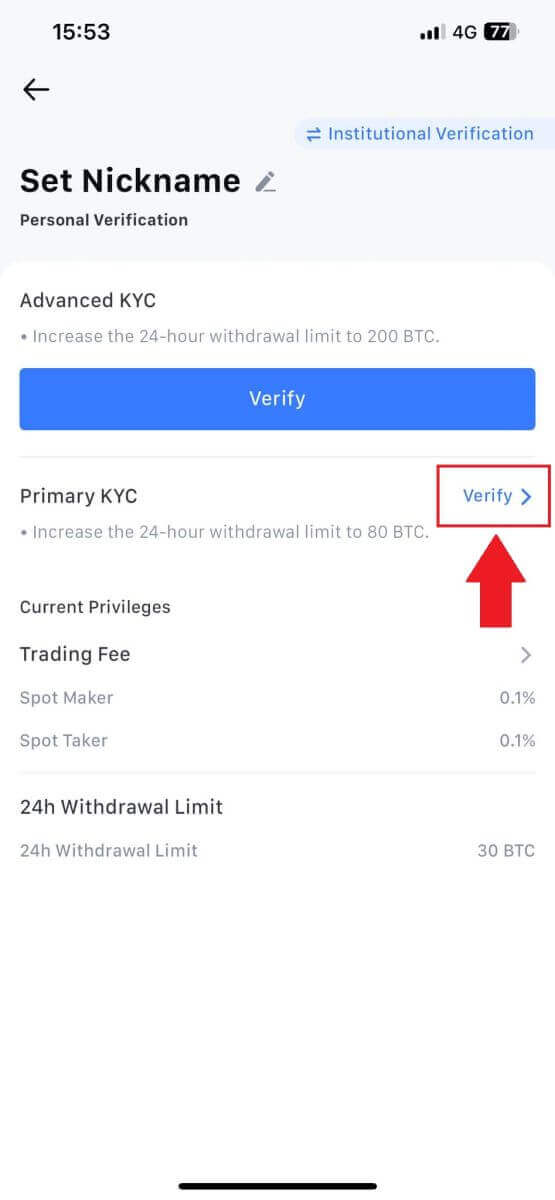

2. Select [Primary KYC] and tap [Verify].

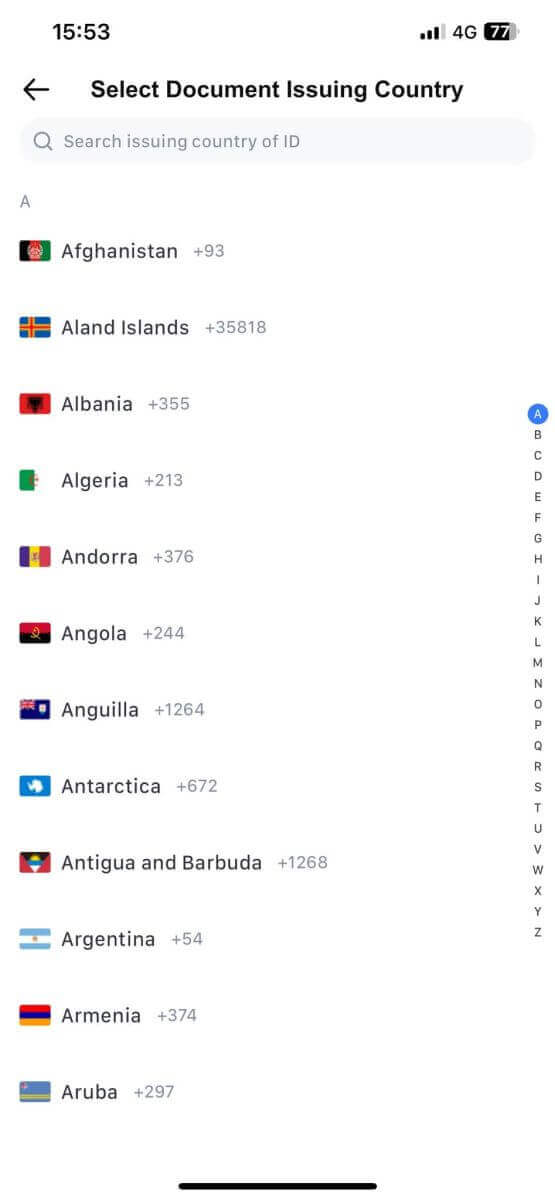

3. Choose your document-issuing country

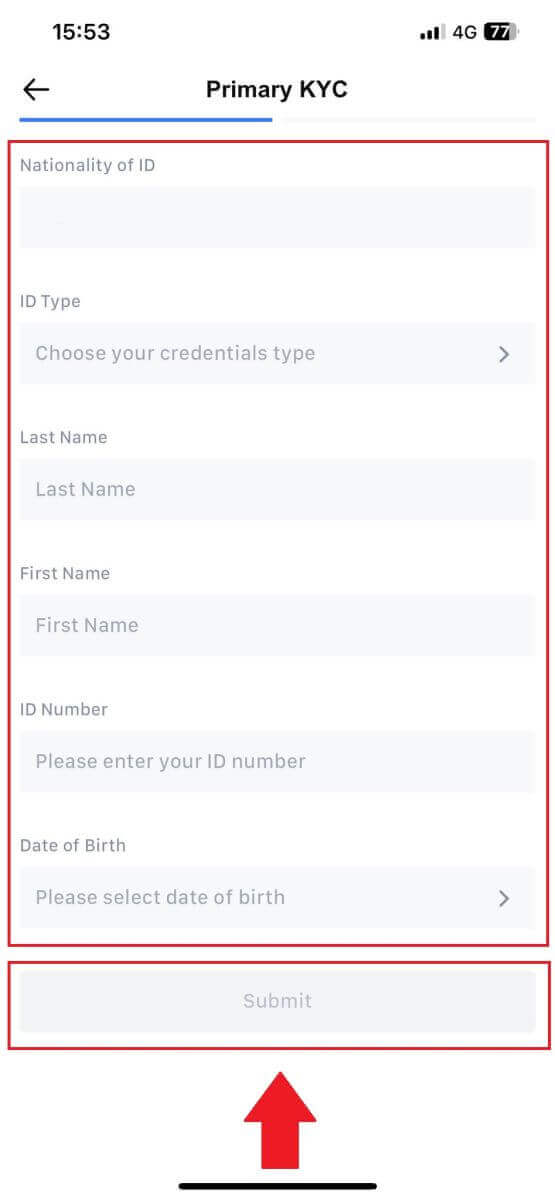

4. Fill out all the information below and tap [Submit].

5. Upload a photo of your chosen document and tap [Submit].

6.After verification, you will see your verification is under review, wait for the confirmation email or access your profile to check the KYC status

Advanced KYC on MEXC (Website)

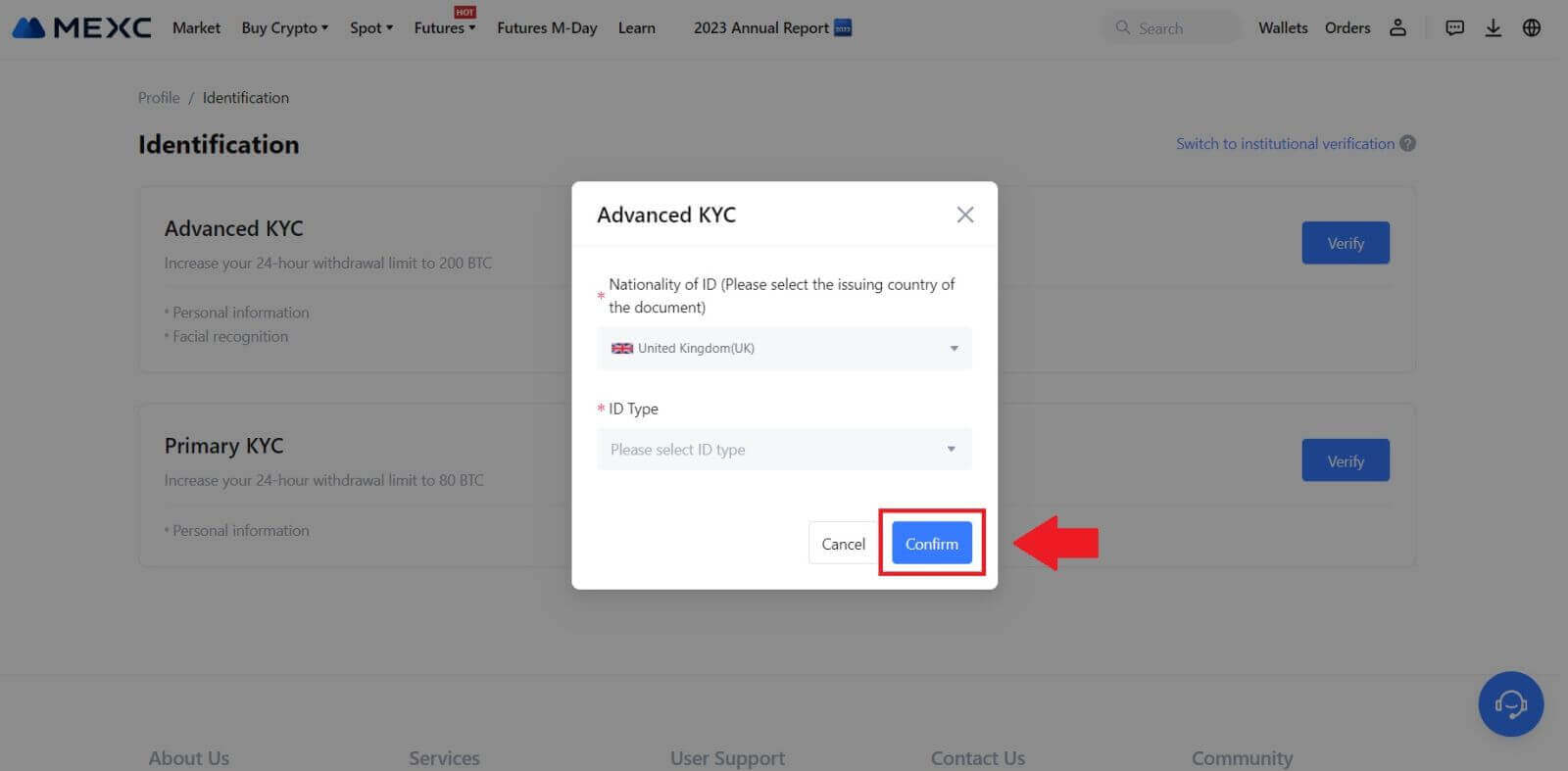

1. Log in to your MEXC account. Place your cursor on the top-right profile icon and click on [Identification]. 2. Select [Advanced KYC], click on [Verify].

2. Select [Advanced KYC], click on [Verify].

3. Choose the issuing country of your document and ID type, then click [Confirm].

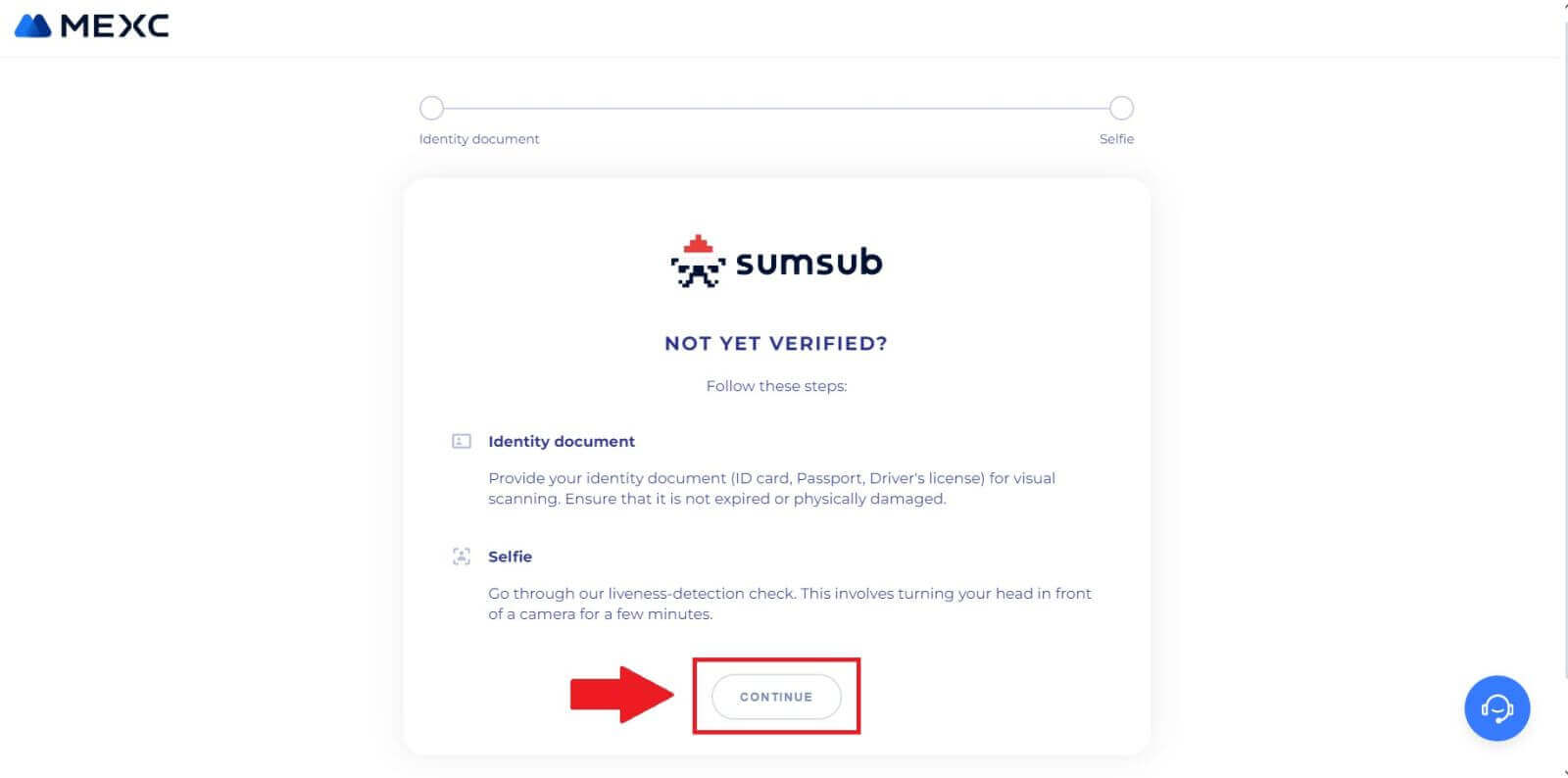

4. Follow the verification steps and click [CONTINUE].

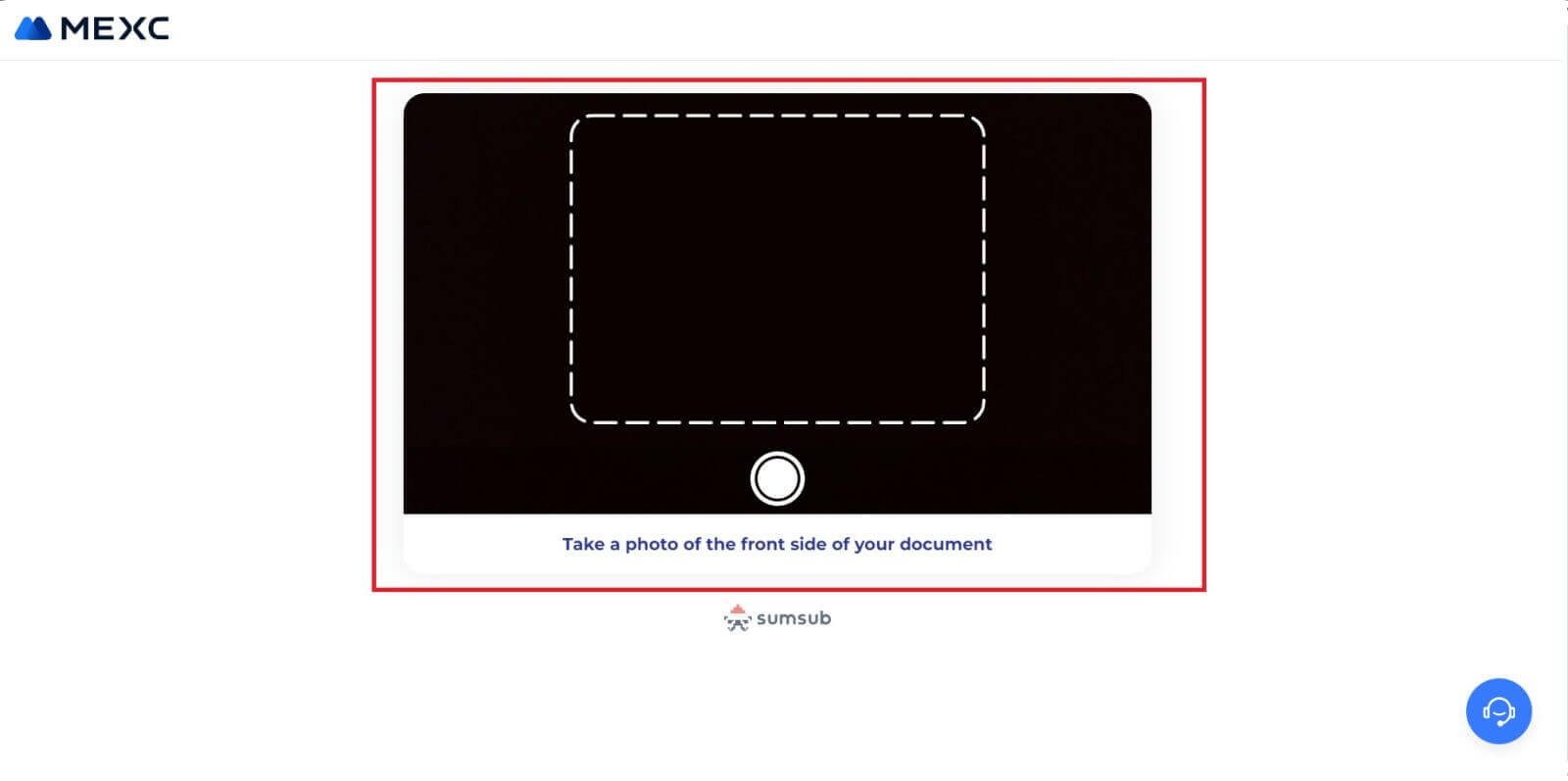

5. Next, place and take your ID-type photo on the frame to continue.

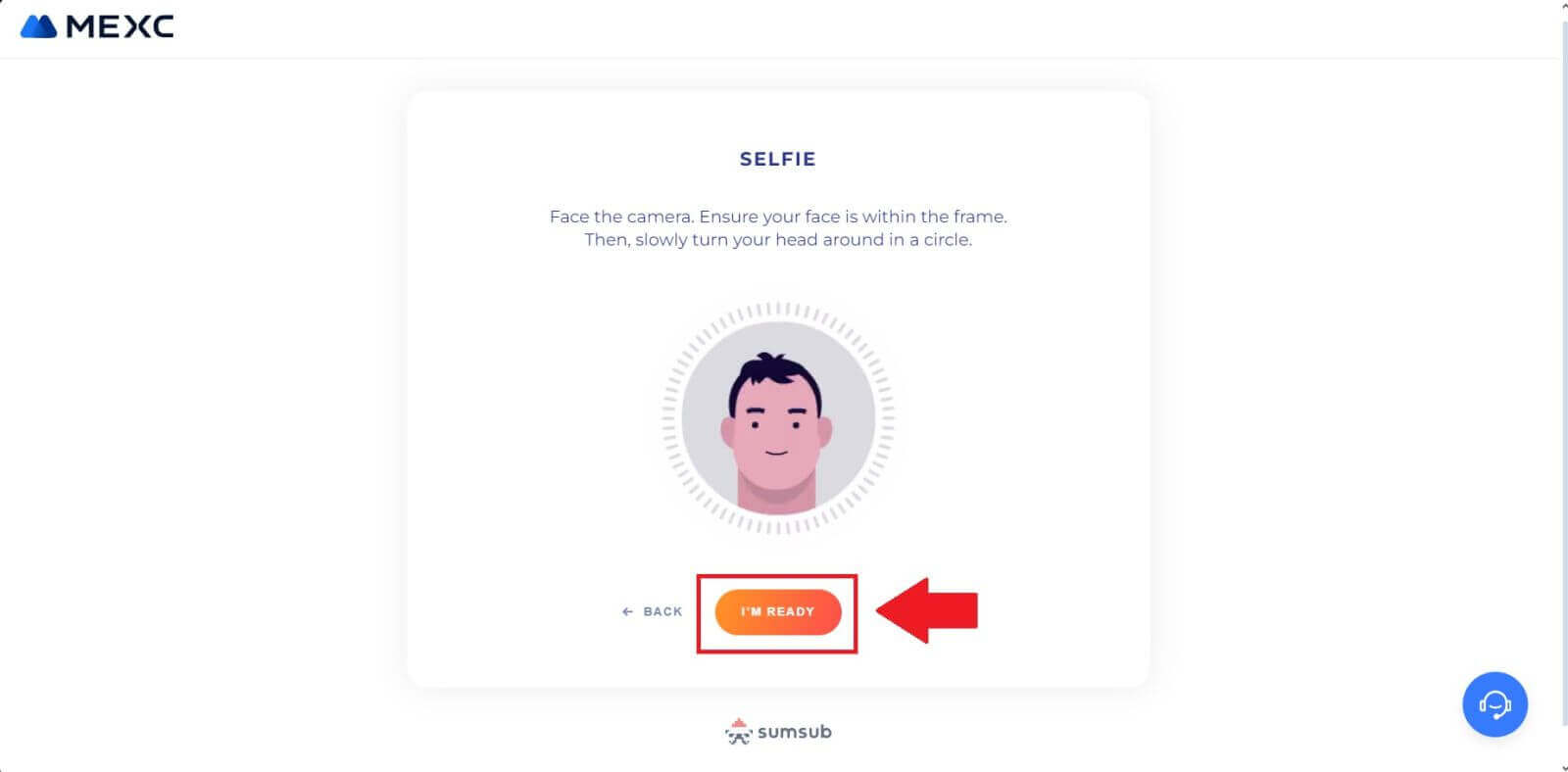

6. Next, start taking your selfie by clicking on [I’M READY].

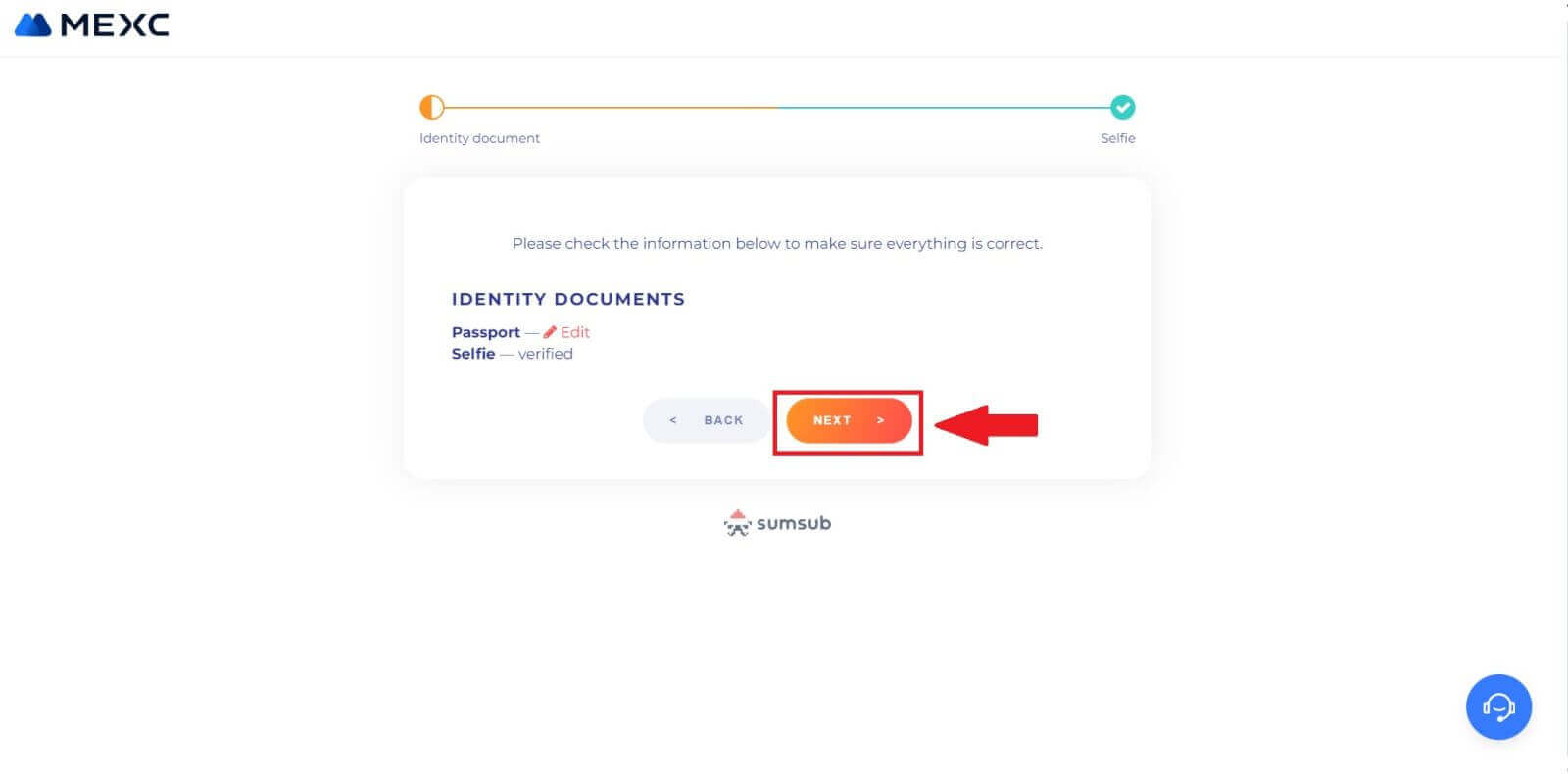

7. Lastly, check out your document information, then click [NEXT].

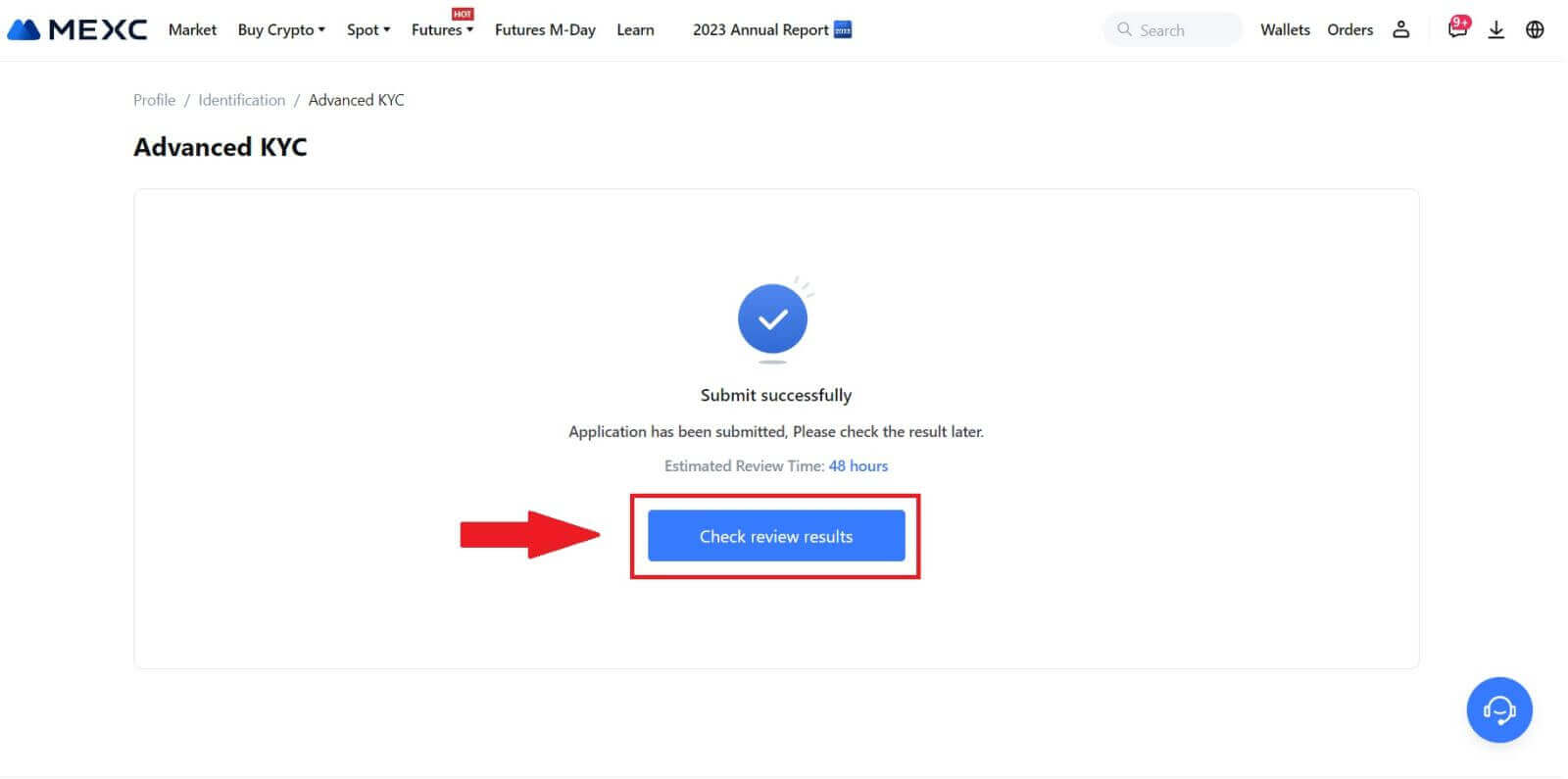

8. After that, your application has been submitted.

You can check your status by clicking on [Check review results].

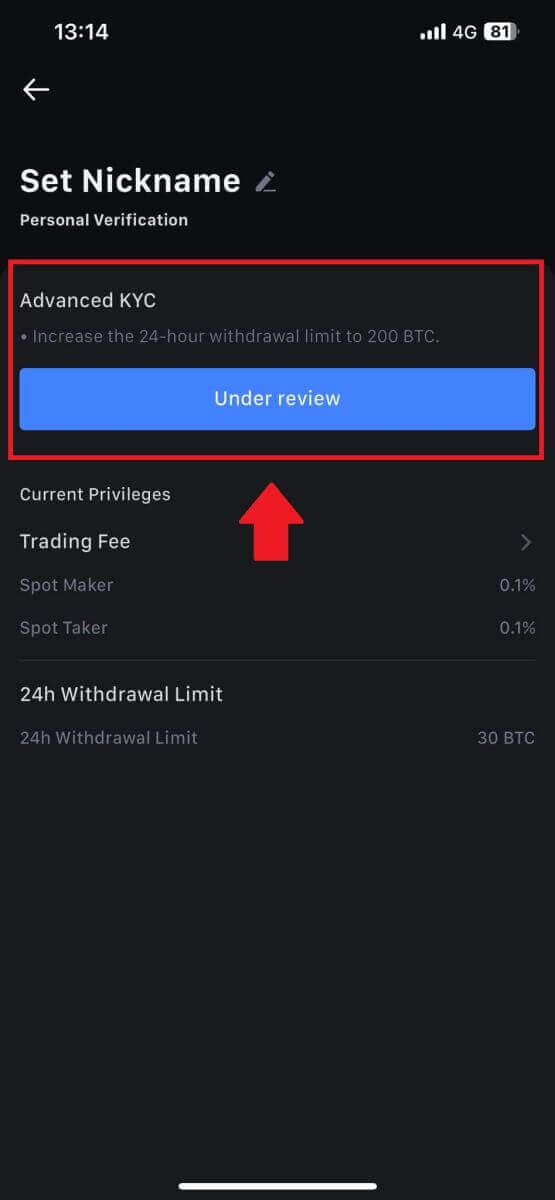

Advanced KYC on MEXC (App)

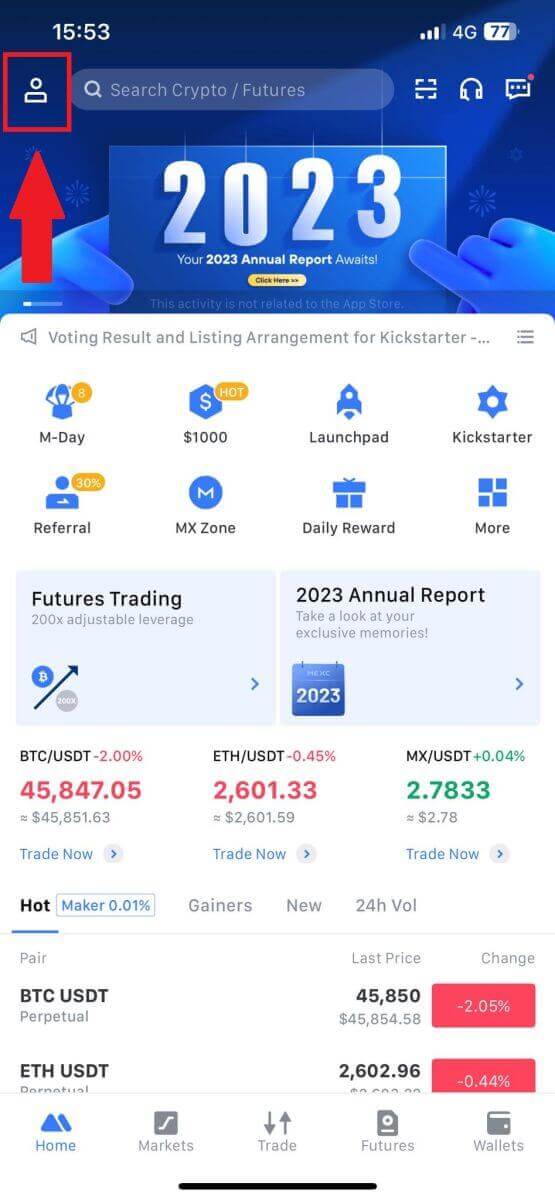

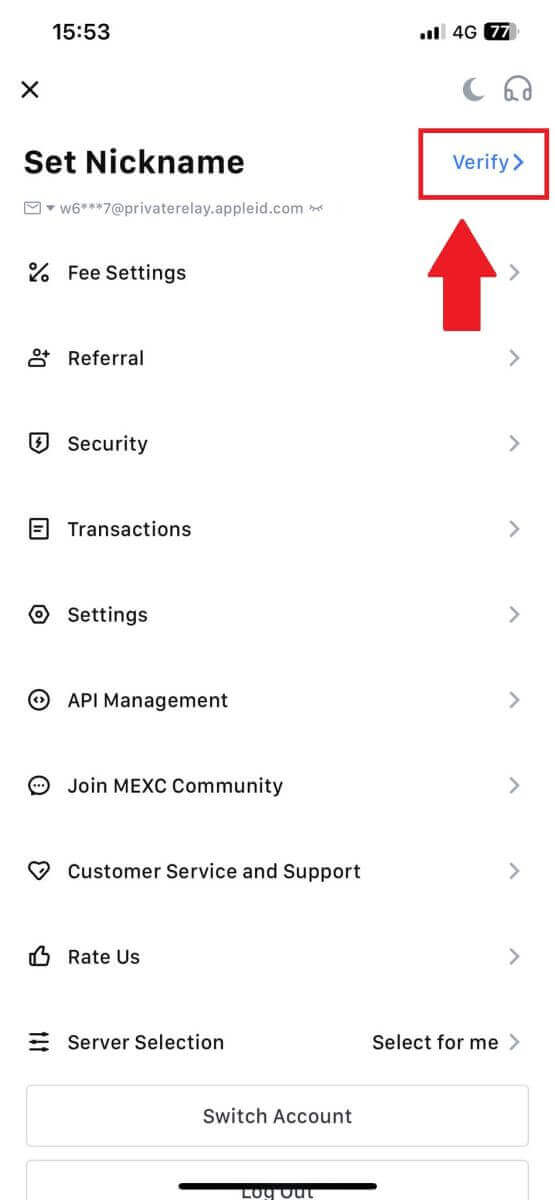

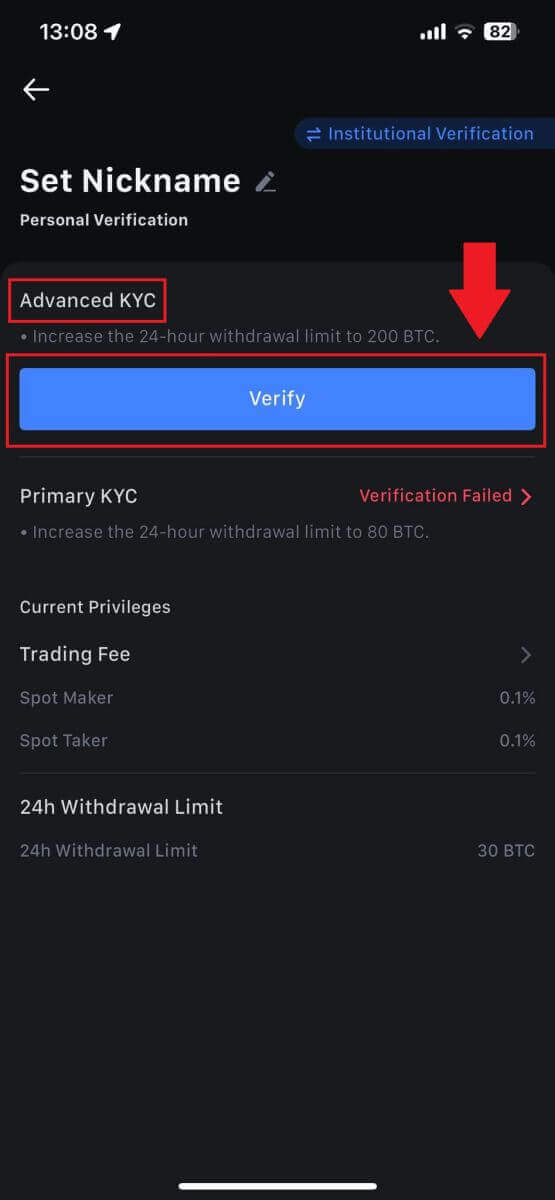

1. Open your MEXC app, tap on the [Profile] icon, and select [Verify].

2. Select [Advanced KYC] and tap [Verify].

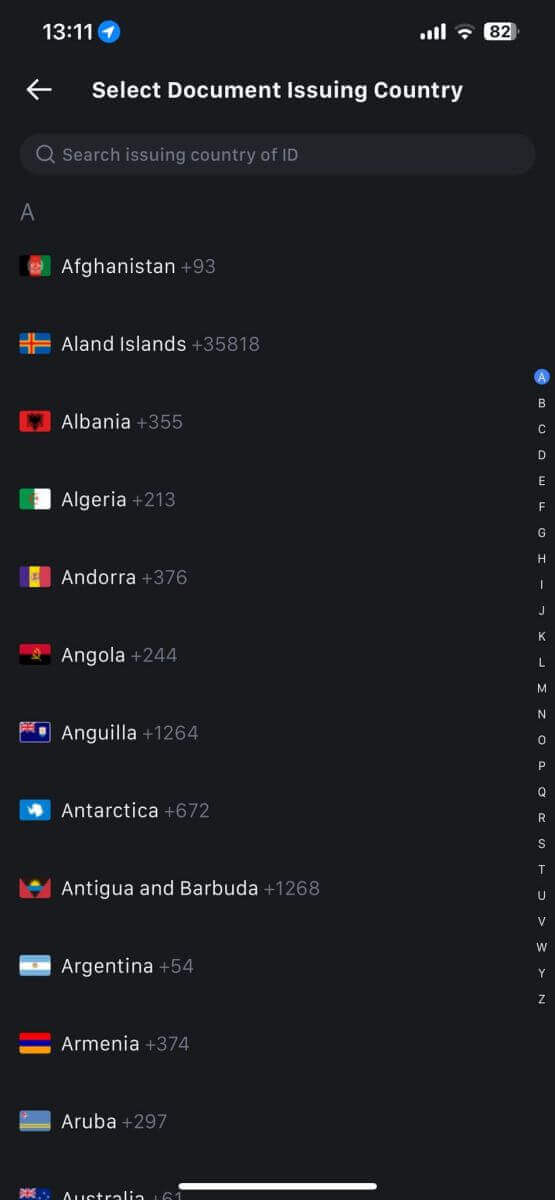

3. Choose your document-issuing country

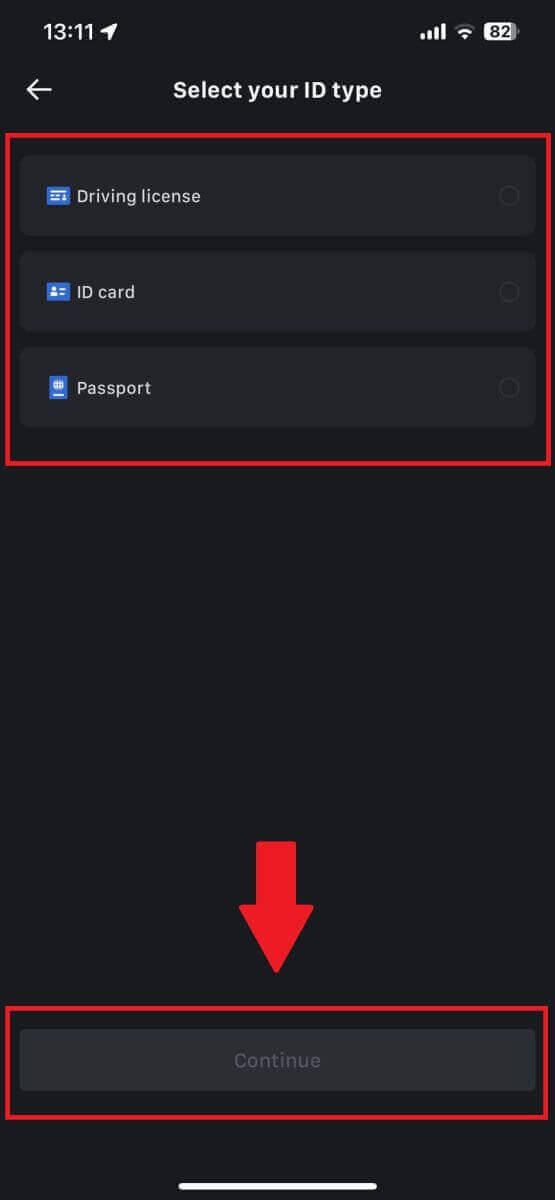

4. Select your ID type and tap [Continue].

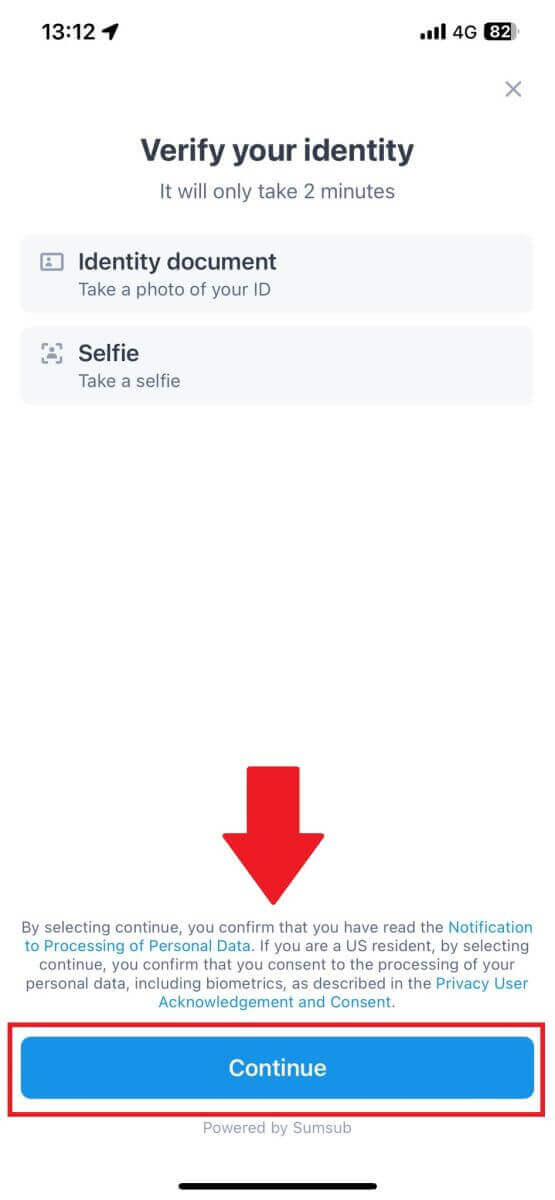

5. Continue your process by tapping [Continue].

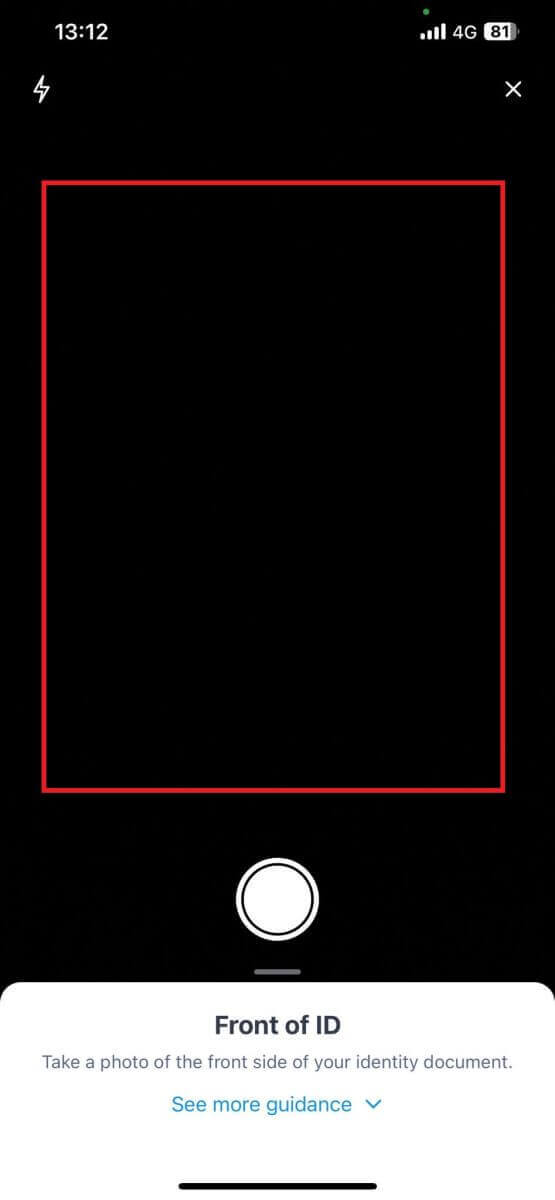

6. Take your photo of your ID to continue.

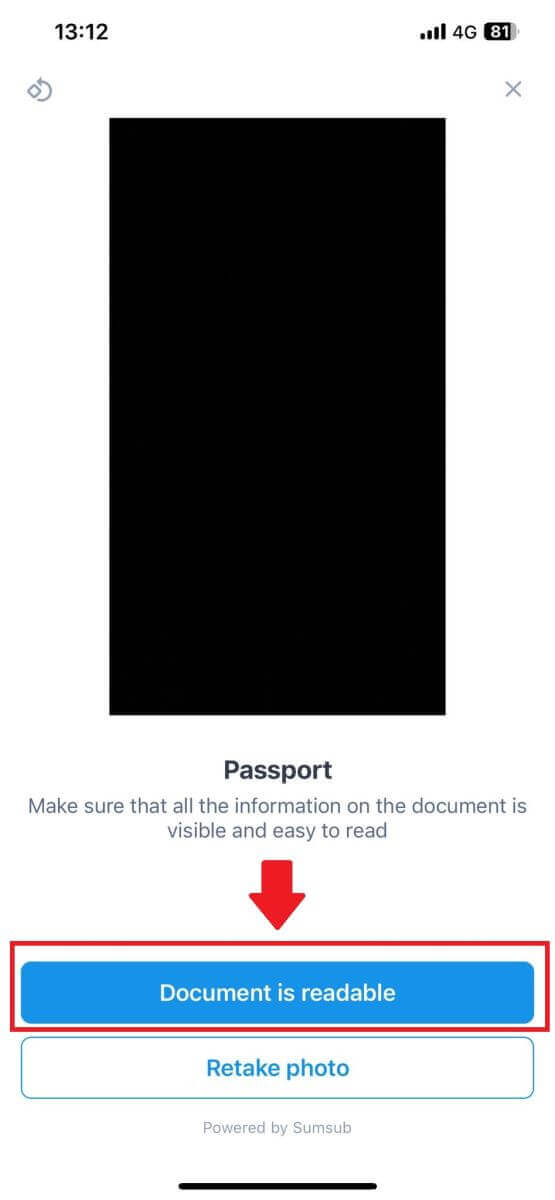

7. Make sure all the information in your photo is visible and tap [Document is readable].

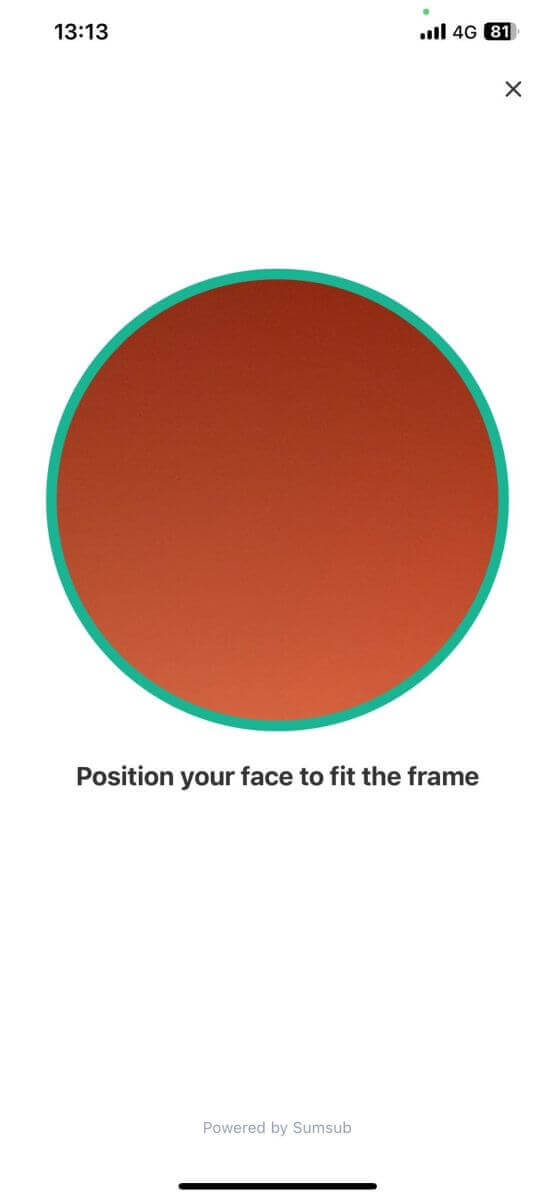

8. Next, take a selfie by putting your face into the frame to complete the process.

9. After that, your verification is under review. Wait for the confirmation email or access your profile to check the KYC status.

Unable to upload photo during KYC Verification

If you encounter difficulties uploading photos or receive an error message during your KYC process, please consider the following verification points:- Ensure the image format is either JPG, JPEG, or PNG.

- Confirm that the image size is below 5 MB.

- Use a valid and original ID, such as a personal ID, driver’s license, or passport.

- Your valid ID must belong to a citizen of a country that allows unrestricted trading, as outlined in "II. Know-Your-Customer and Anti-Money-Laundering Policy" - "Trade Supervision" in the MEXC User Agreement.

- If your submission meets all the above criteria but KYC verification remains incomplete, it might be due to a temporary network issue. Please follow these steps for resolution:

- Wait for some time before resubmitting the application.

- Clear the cache in your browser and terminal.

- Submit the application through the website or app.

- Try using different browsers for the submission.

- Ensure your app is updated to the latest version.

Common Errors During the Advanced KYC Process

- Taking unclear, blurry, or incomplete photos may result in unsuccessful Advanced KYC verification. When performing face recognition, please remove your hat (if applicable) and face the camera directly.

- Advanced KYC is connected to a third-party public security database, and the system conducts automatic verification, which cannot be manually overridden. If you have special circumstances, such as changes in residency or identity documents, that prevent authentication, please contact online customer service for advice.

- Each account can only perform Advanced KYC up to three times per day. Please ensure the completeness and accuracy of the uploaded information.

- If camera permissions are not granted for the app, you will be unable to take photos of your identity document or perform facial recognition.

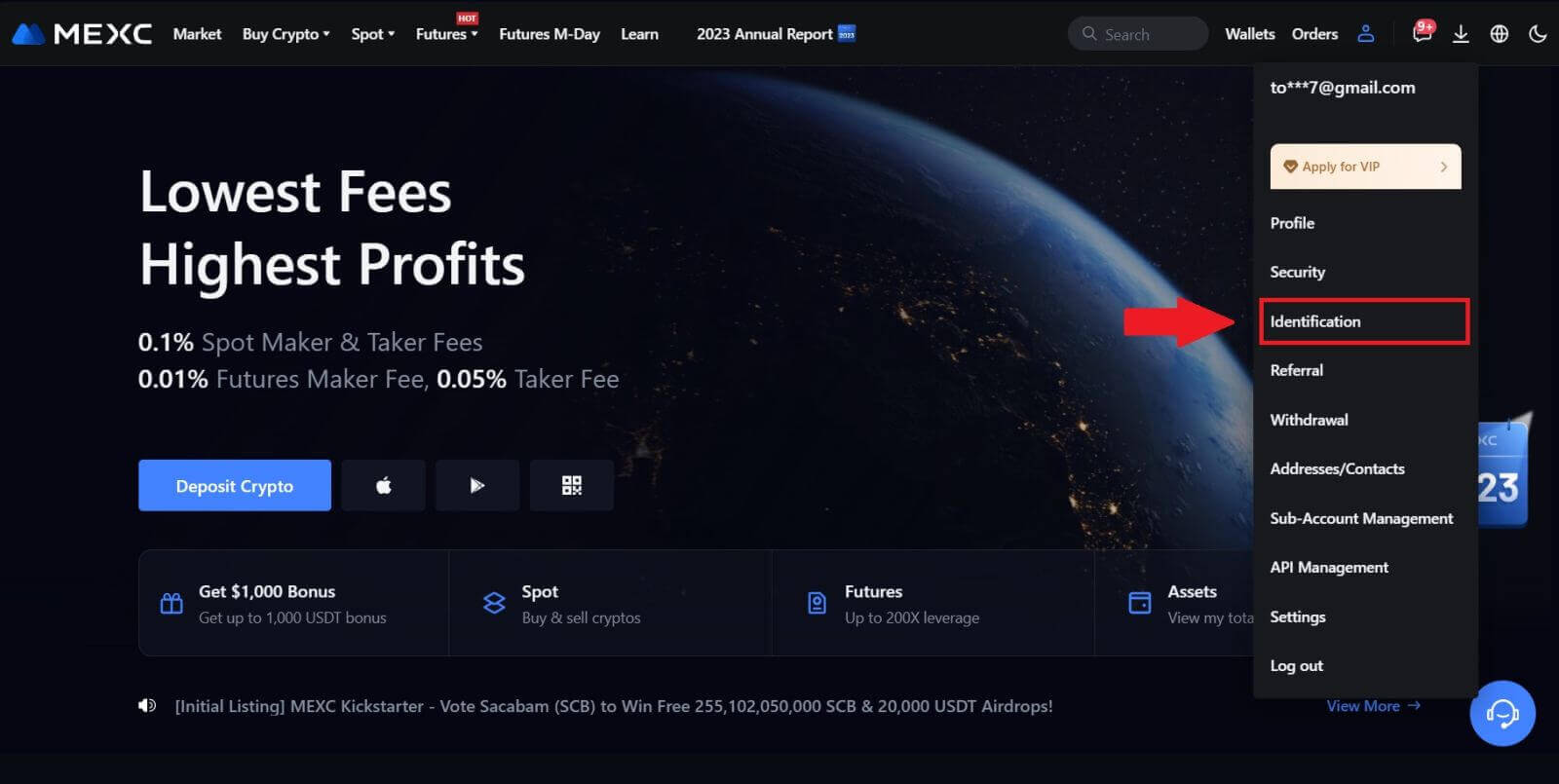

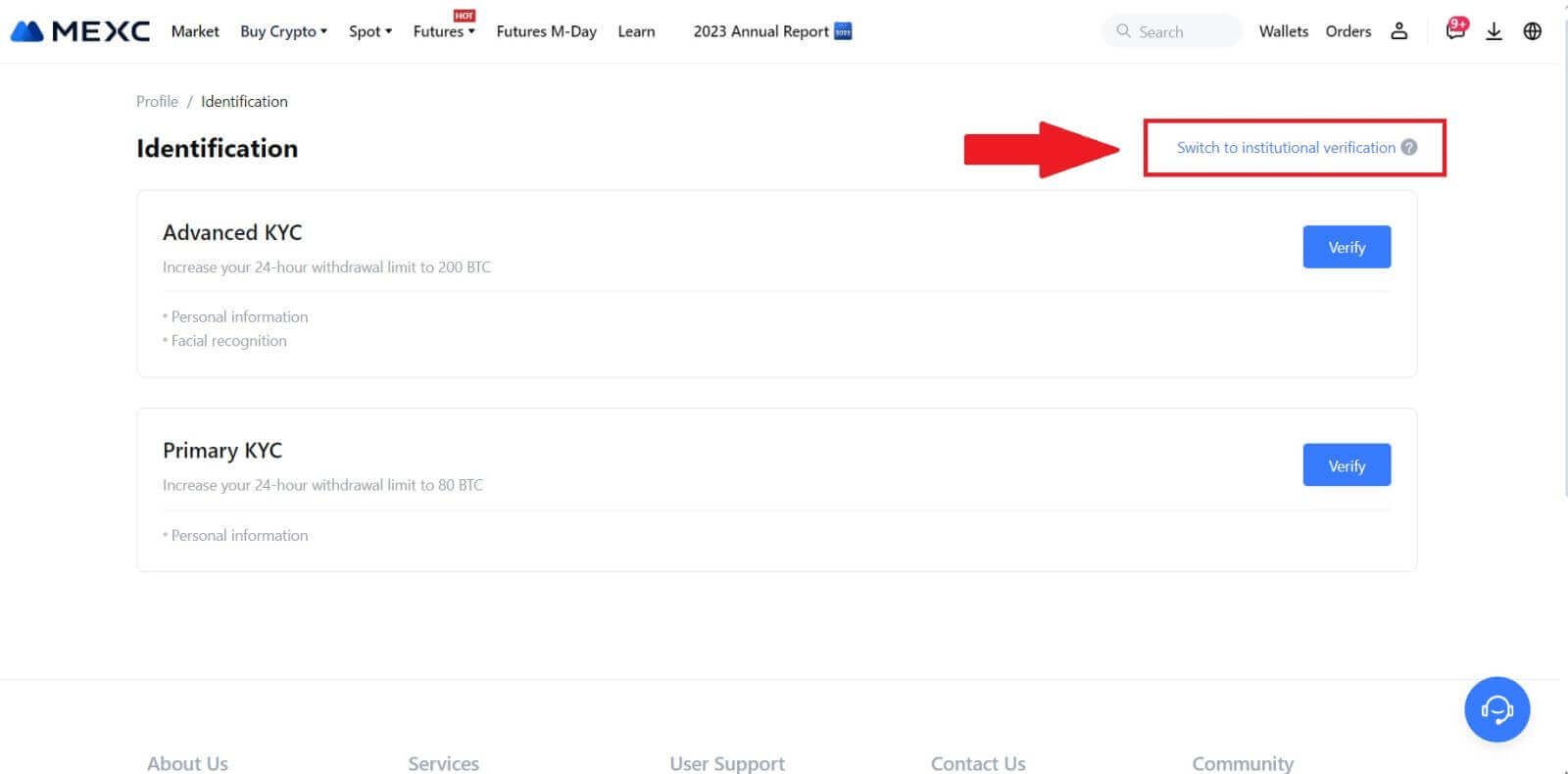

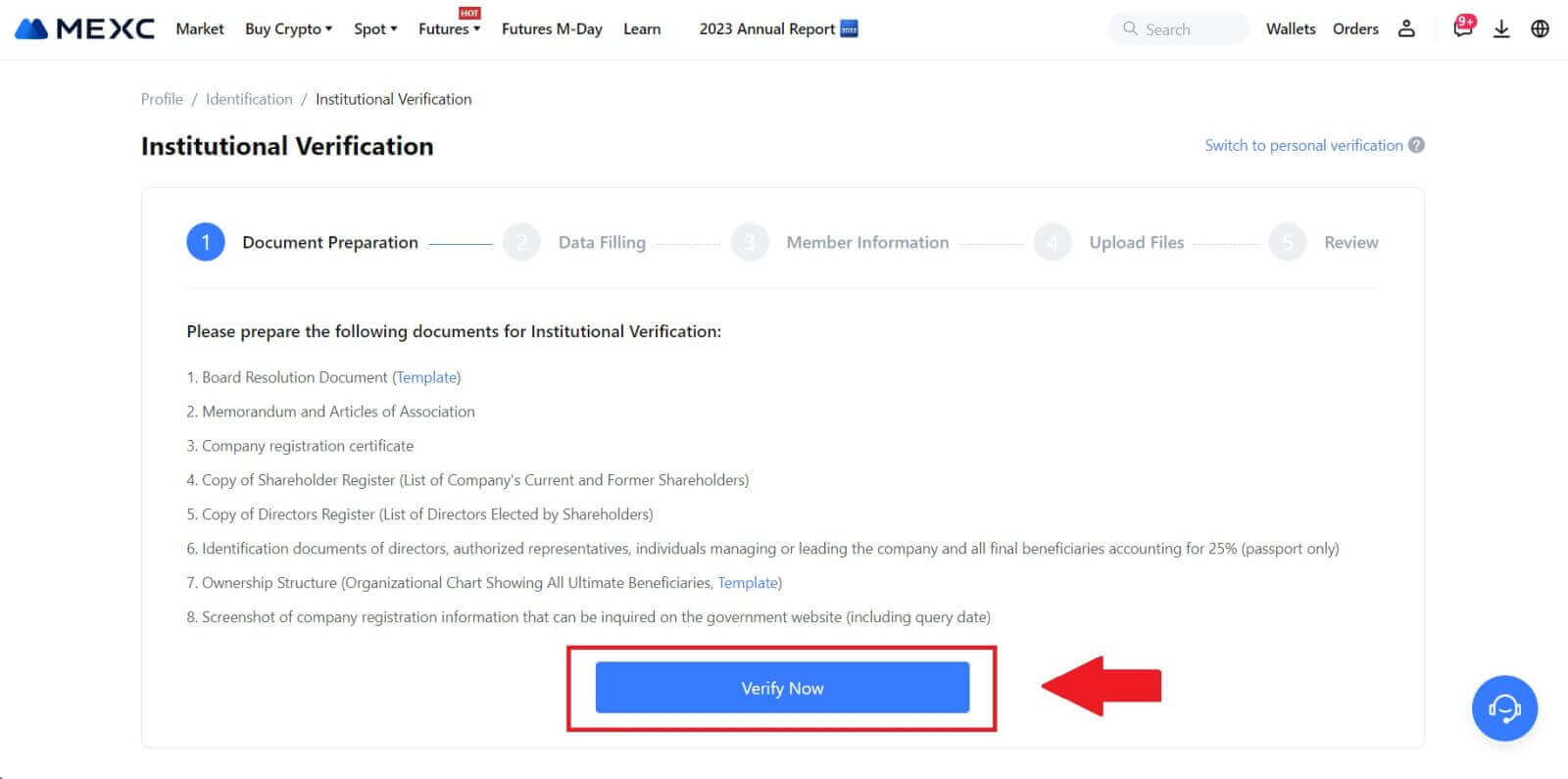

How to Apply and Verify for Institution Account

To apply for an Institution account, please follow the step-by-step guide below:

1. Log in to your MEXC account and go to [Profile] - [Identification].

Click on [Switch to institutional verification].

2. Prepare the following documents that have been listed below and click on [Verify Now].

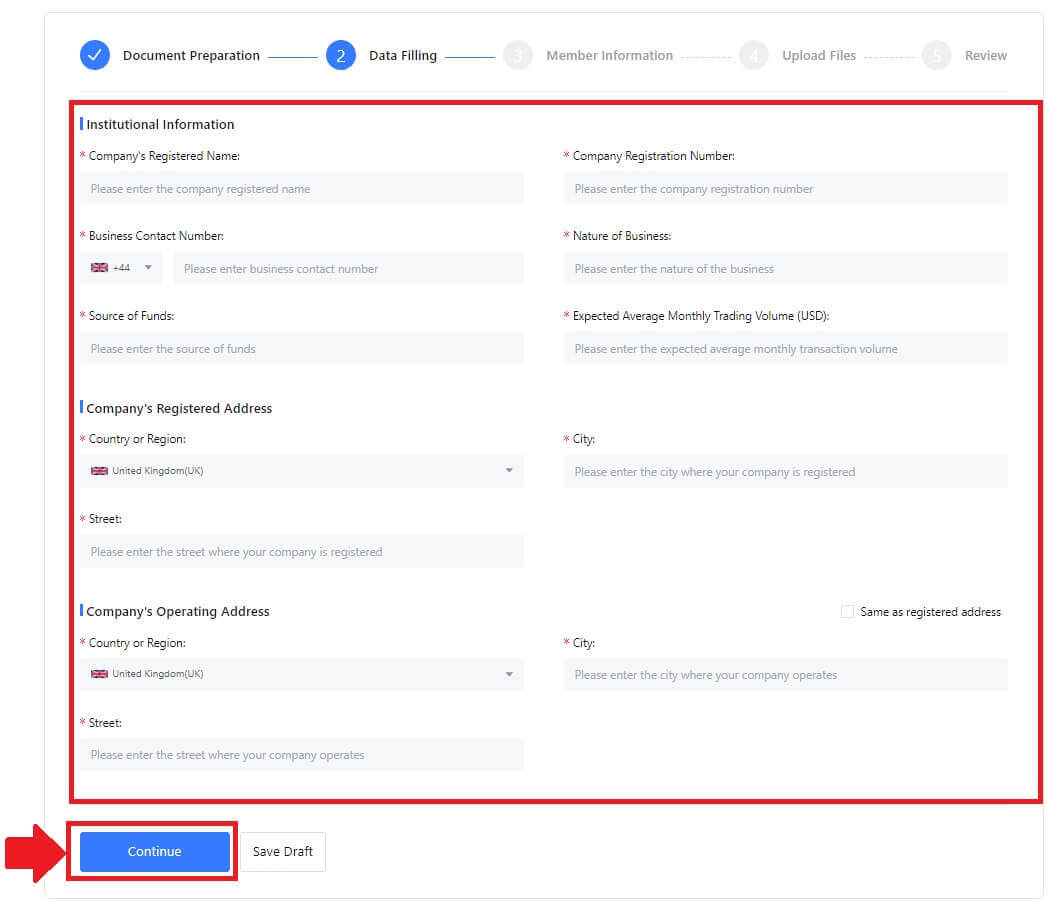

3. Complete the "Data Filling" page by providing comprehensive details, including institutional information, the registered address of your company, and its operating address. Once the information is filled in, proceed by clicking on [Continue] to move to the member information section.

3. Complete the "Data Filling" page by providing comprehensive details, including institutional information, the registered address of your company, and its operating address. Once the information is filled in, proceed by clicking on [Continue] to move to the member information section.

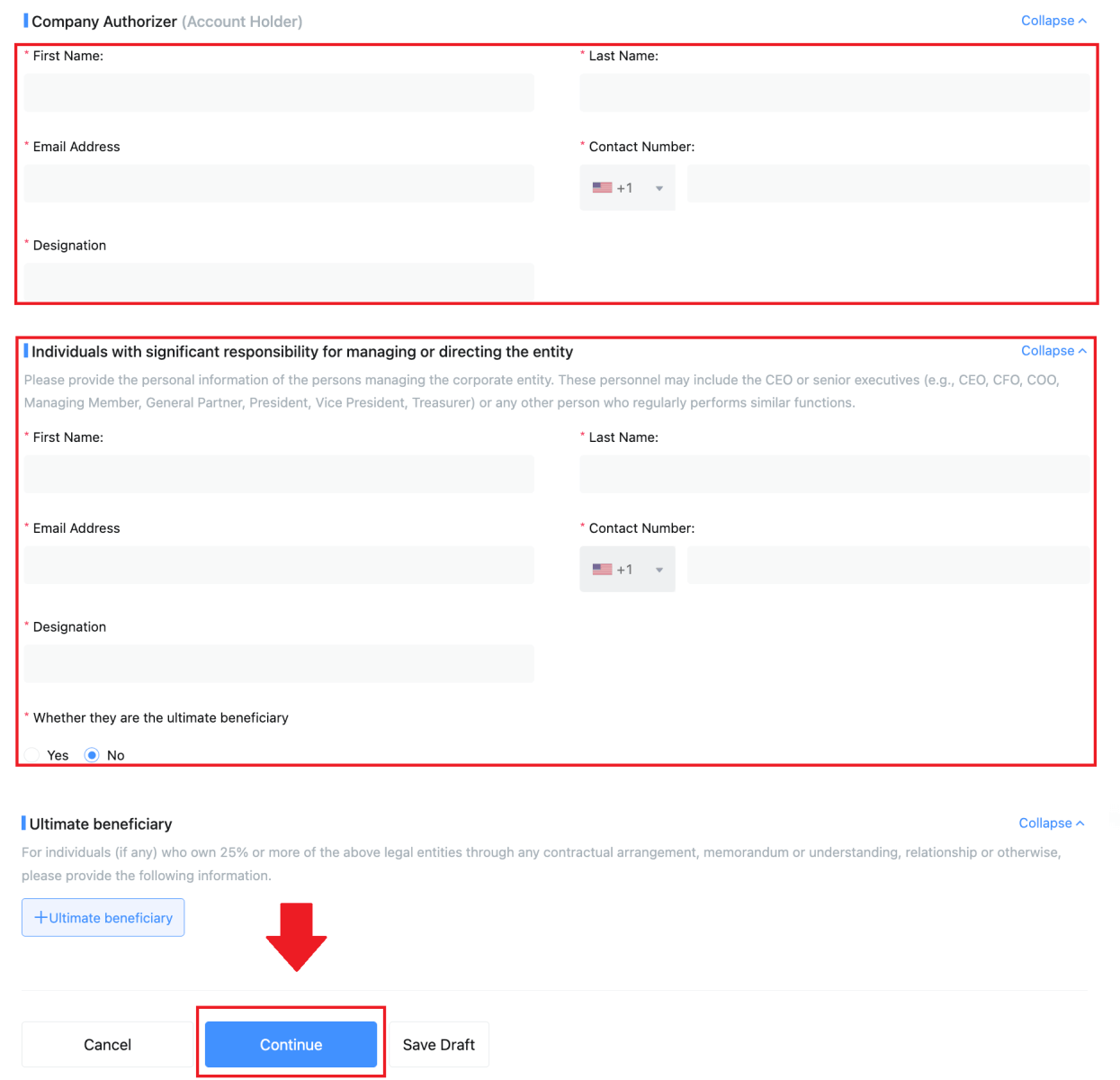

4. Navigate to the "Member Information" page, where you are required to input essential details concerning the company authorizer, individuals holding significant roles in managing or directing the entity, and information about the ultimate beneficiary. Once you’ve filled in the required information, proceed by clicking the [Continue] button.

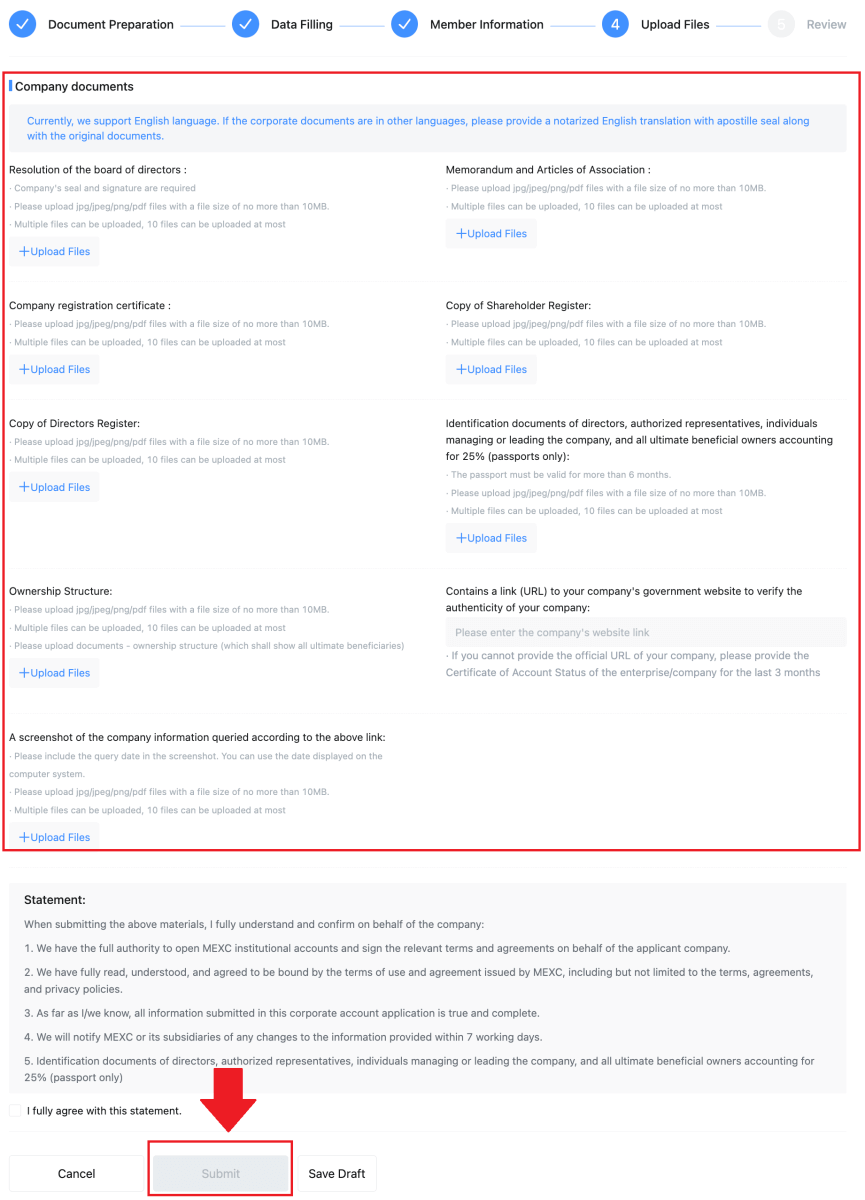

5. Proceed to the "Upload Files" page, where you can submit the documents prepared earlier for the institutional verification process. Upload the necessary files and carefully review the statement. After confirming your agreement by checking the "I fully agree with this statement" box, click on [Submit] to complete the process.

5. Proceed to the "Upload Files" page, where you can submit the documents prepared earlier for the institutional verification process. Upload the necessary files and carefully review the statement. After confirming your agreement by checking the "I fully agree with this statement" box, click on [Submit] to complete the process.

6. After that, your application is successfully submitted. Please wait patiently for us to review.

Deposit

What is a tag or meme, and why do I need to enter it when depositing crypto?

A tag or memo is a unique identifier assigned to each account for identifying a deposit and crediting the appropriate account. When depositing certain crypto, such as BNB, XEM, XLM, XRP, KAVA, ATOM, BAND, EOS, etc., you need to enter the respective tag or memo for it to be successfully credited.How to check my transaction history?

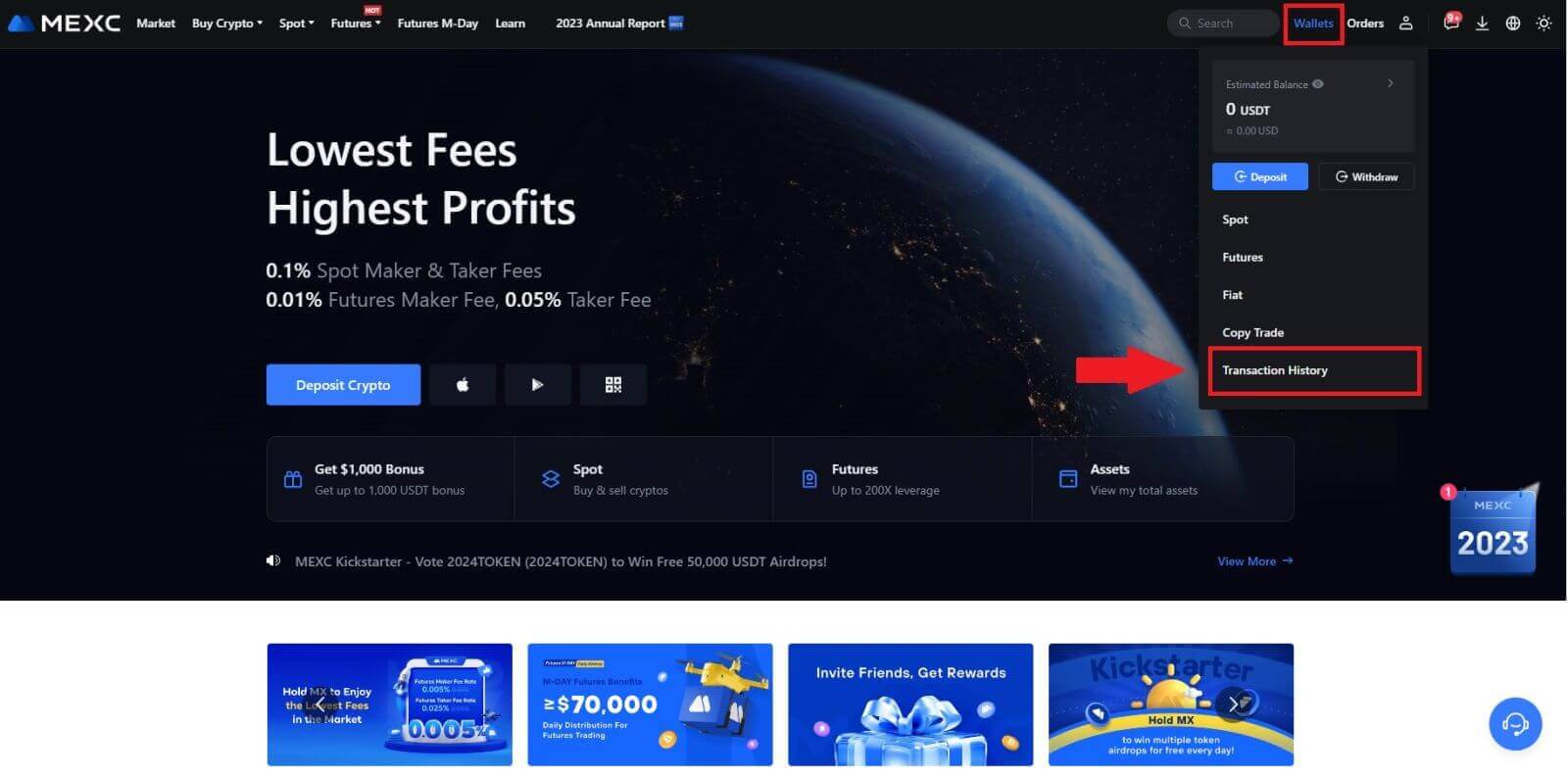

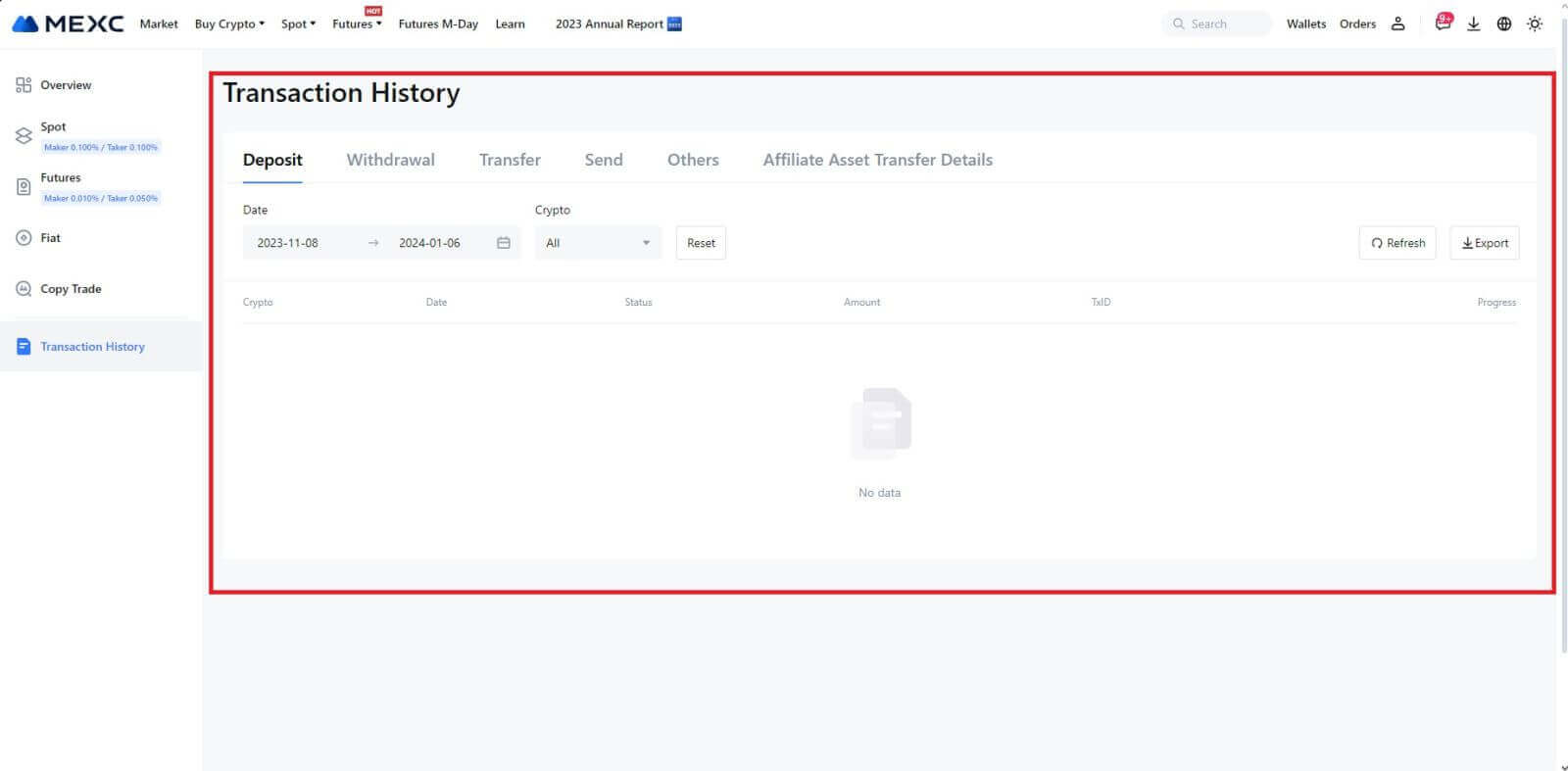

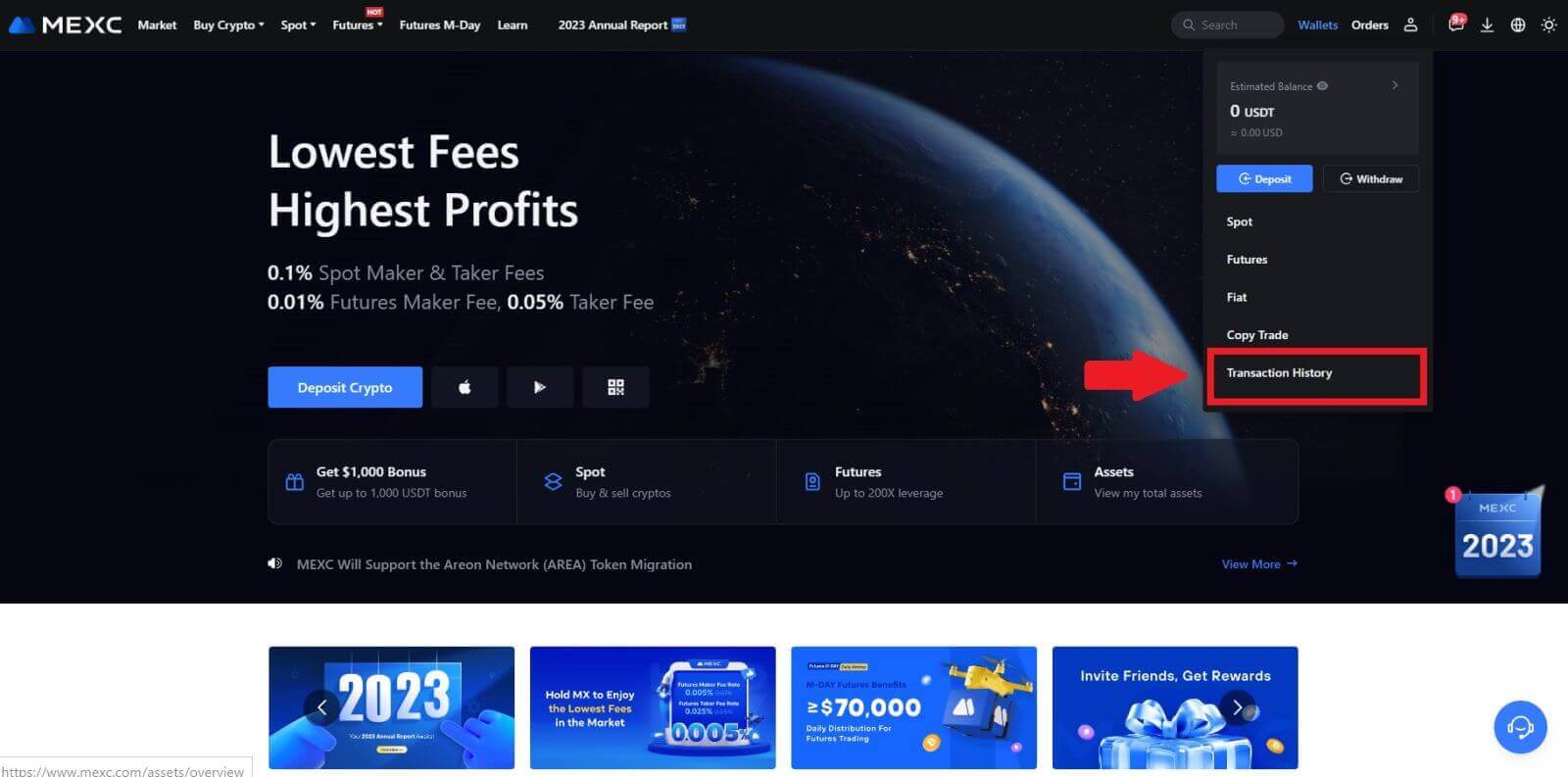

1. Log in to your MEXC account, click on [Wallets], and select [Transaction History].

2. You can check the status of your deposit or withdrawal from here.

Reasons for Uncredited Deposits

1. Insufficient number of block confirmations for a normal deposit

Under normal circumstances, each crypto requires a certain number of block confirmations before the transfer amount can be deposited into your MEXC account. To check the required number of block confirmations, please go to the deposit page of the corresponding crypto.

Please ensure that the cryptocurrency you intend to deposit on the MEXC platform matches the supported cryptocurrencies. Verify the full name of the crypto or its contract address to prevent any discrepancies. If inconsistencies are detected, the deposit may not be credited to your account. In such cases, submit a Wrong Deposit Recovery Application for assistance from the technical team in processing the return.

3. Depositing through an unsupported smart contract methodAt present, some cryptocurrencies cannot be deposited on the MEXC platform using the smart contract method. Deposits made through smart contracts will not reflect in your MEXC account. As certain smart contract transfers necessitate manual processing, please promptly reach out to online customer service to submit your request for assistance.

4. Depositing to an incorrect crypto address or selecting the wrong deposit network

Ensure that you have accurately entered the deposit address and selected the correct deposit network before initiating the deposit. Failure to do so may result in the assets not being credited. In such a scenario, kindly submit a [Wrong Deposit Recovery Application] for the technical team to facilitate the return processing.

Trading

What is a stop-limit order?

A stop-limit order is a specific type of limit order used in trading financial assets. It involves setting both a stop price and a limit price. Once the stop price is reached, the order is activated, and a limit order is placed on the market. Subsequently, when the market reaches the specified limit price, the order is executed.

Here’s how it works:

- Stop Price: This is the price at which the stop-limit order is triggered. When the asset’s price hits this stop price, the order becomes active, and the limit order is added to the order book.

- Limit Price: The limit price is the designated price or a potentially better one at which the stop-limit order is intended to be executed.

It’s advisable to set the stop price slightly higher than the limit price for sell orders. This price difference provides a safety margin between the activation of the order and its fulfillment. Conversely, for buy orders, setting the stop price slightly lower than the limit price helps minimize the risk of the order not being executed.

It’s important to note that once the market price reaches the limit price, the order is executed as a limit order. Setting the stop and limit prices appropriately is crucial; if the stop-loss limit is too high or the take-profit limit is too low, the order may not be filled because the market price may not reach the specified limit.

How to create a stop-limit order

How does a stop-limit order work?

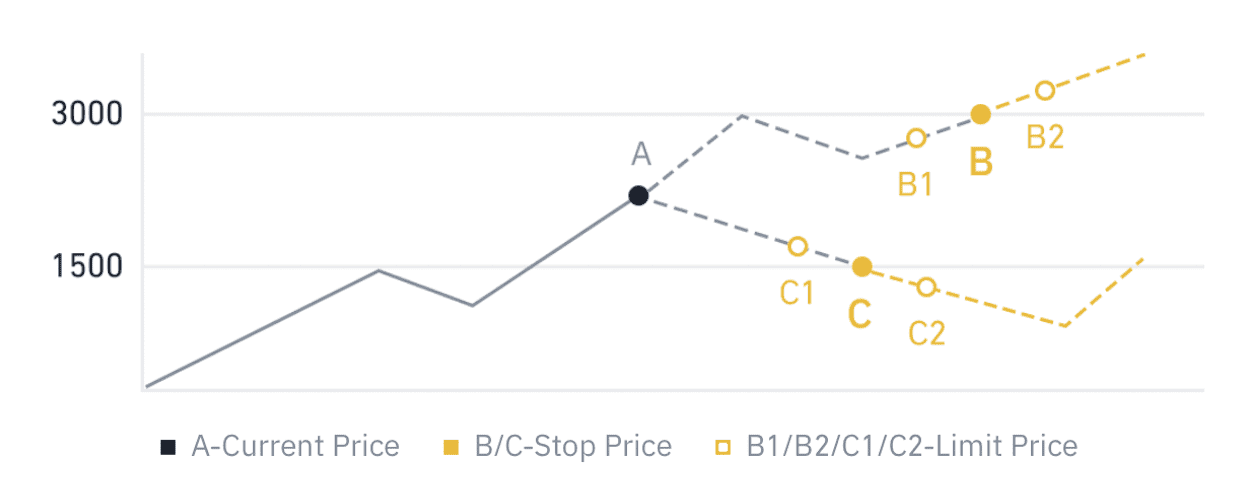

The current price is 2,400 (A). You can set the stop price above the current price, such as 3,000 (B), or below the current price, such as 1,500 (C). Once the price goes up to 3,000 (B) or drops to 1,500 (C), the stop-limit order will be triggered, and the limit order will be automatically placed on the order book.

Note

Limit price can be set above or below the stop price for both buy and sell orders. For example, stop price B can be placed along with a lower limit price B1 or a higher limit price B2.

A limit order is invalid before the stop price is triggered, including when the limit price is reached ahead of the stop price.

When the stop price is reached, it only indicates that a limit order is activated and will be submitted to the order book, rather than the limit order being filled immediately. The limit order will be executed according to its own rules.

How to place a stop-limit order on MEXC?

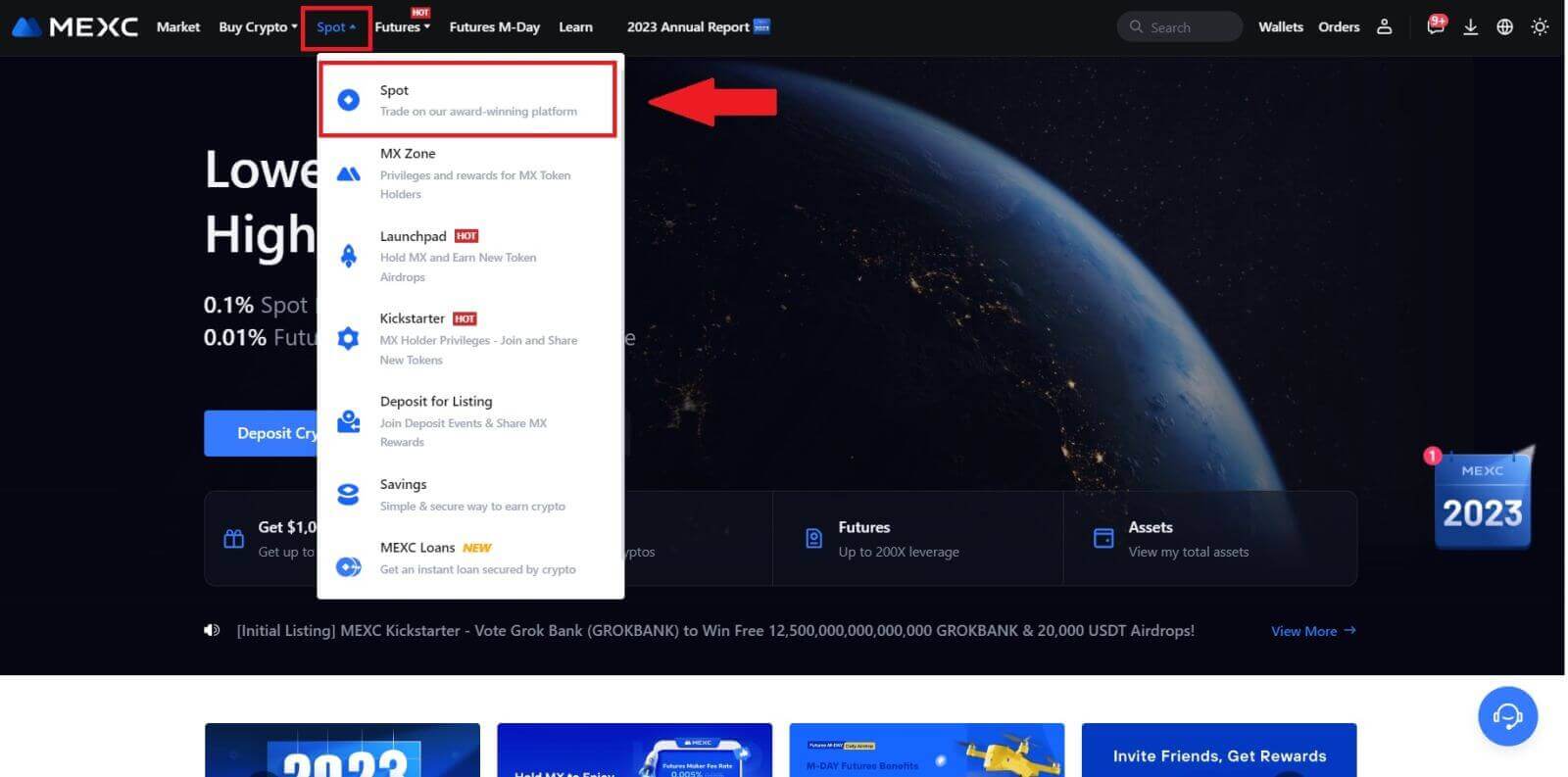

1. Log in to your MEXC account, click and select [Spot].

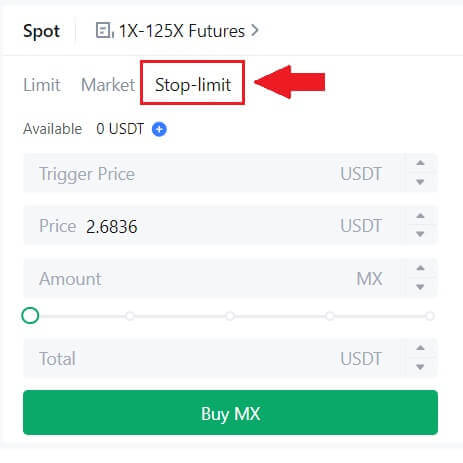

2. Select [Stop-limit], here we take MX as an example.

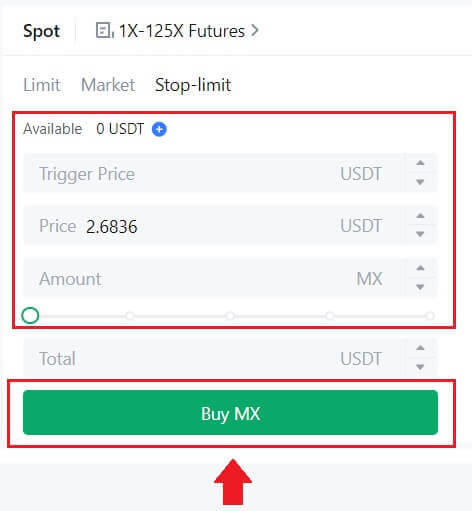

3. Enter the trigger price, limit price, and the amount of crypto you wish to purchase. Click [Buy MX] to confirm the details of the transaction.

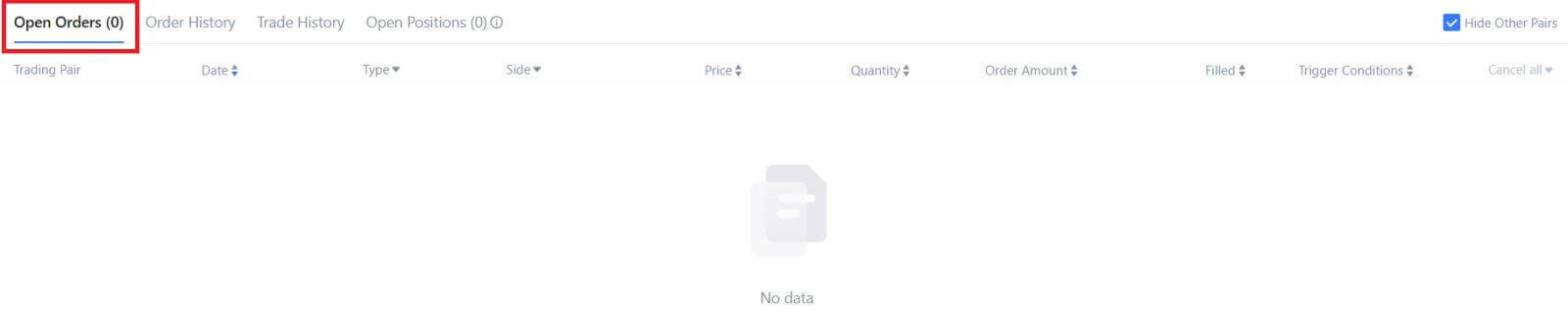

How to view my stop-limit orders?

Once you submit the orders, you can scroll down to the bottom, view and edit your stop-limit orders under [Open Orders].

To view executed or canceled orders, go to the [Order History] tab.

What is Limit Order

A limit order is an instruction to buy or sell an asset at a specified limit price, which is not executed immediately like a market order. Instead, the limit order is activated only if the market price reaches the designated limit price or surpasses it favorably. This allows traders to aim for specific buying or selling prices different from the prevailing market rate.

For instance:

-

If you set a buy limit order for 1 BTC at $60,000 while the current market price is $50,000, your order will be promptly filled at the prevailing market rate of $50,000. This is because it represents a more favorable price than your specified limit of $60,000.

-

Similarly, if you place a sell limit order for 1 BTC at $40,000 when the current market price is $50,000, your order will be immediately executed at $50,000, as it is a more advantageous price compared to your designated limit of $40,000.

In summary, limit orders provide a strategic way for traders to control the price at which they buy or sell an asset, ensuring execution at the specified limit or a better price in the market.

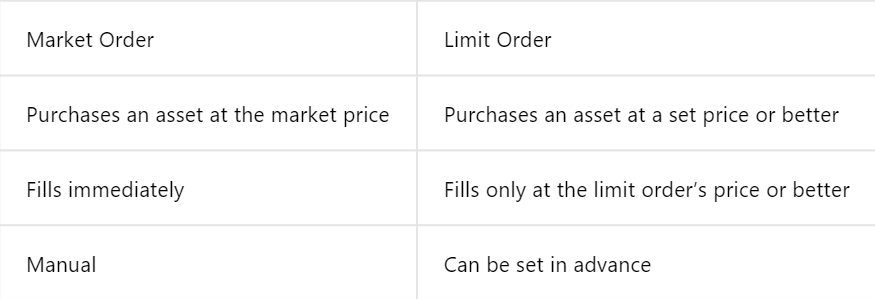

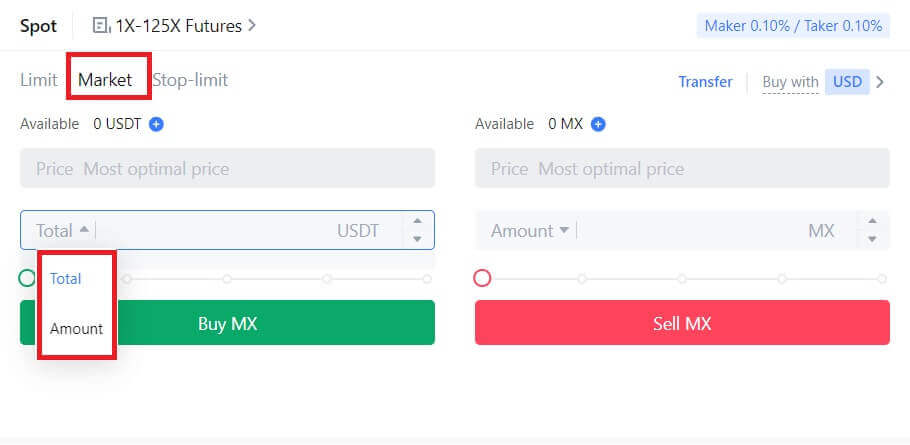

What is Market Order

A market order is a type of trading order that is executed promptly at the current market price. When you place a market order, it is fulfilled as swiftly as possible. This order type can be utilized for both buying and selling financial assets.

When placing a market order, you have the option to specify either the quantity of the asset you want to buy or sell, denoted as [Amount], or the total amount of funds you wish to spend or receive from the transaction, denoted as [Total].

For instance, if you intend to purchase a specific quantity of MX, you can directly enter the amount. Conversely, if you aim to acquire a certain amount of MX with a specified sum of funds, like 10,000 USDT, you can use the [Total] option to place the buy order. This flexibility allows traders to execute transactions based on either a predetermined quantity or a desired monetary value.

What is One-Cancels-the-Other (OCO) Order

A limit order and a TP/SL order are combined into a single OCO order for placement, known as an OCO (One-Cancels-the-Other) order. The other order is automatically canceled if the limit order is performed or partially executed, or if the TP/SL order is activated. When one order is manually canceled, the other order is also canceled at the same time.

OCO orders can help get better execution prices when buying/selling is assured. This trading approach can be used by investors who want to set a limit order and a TP/SL order at the same time during spot trading.

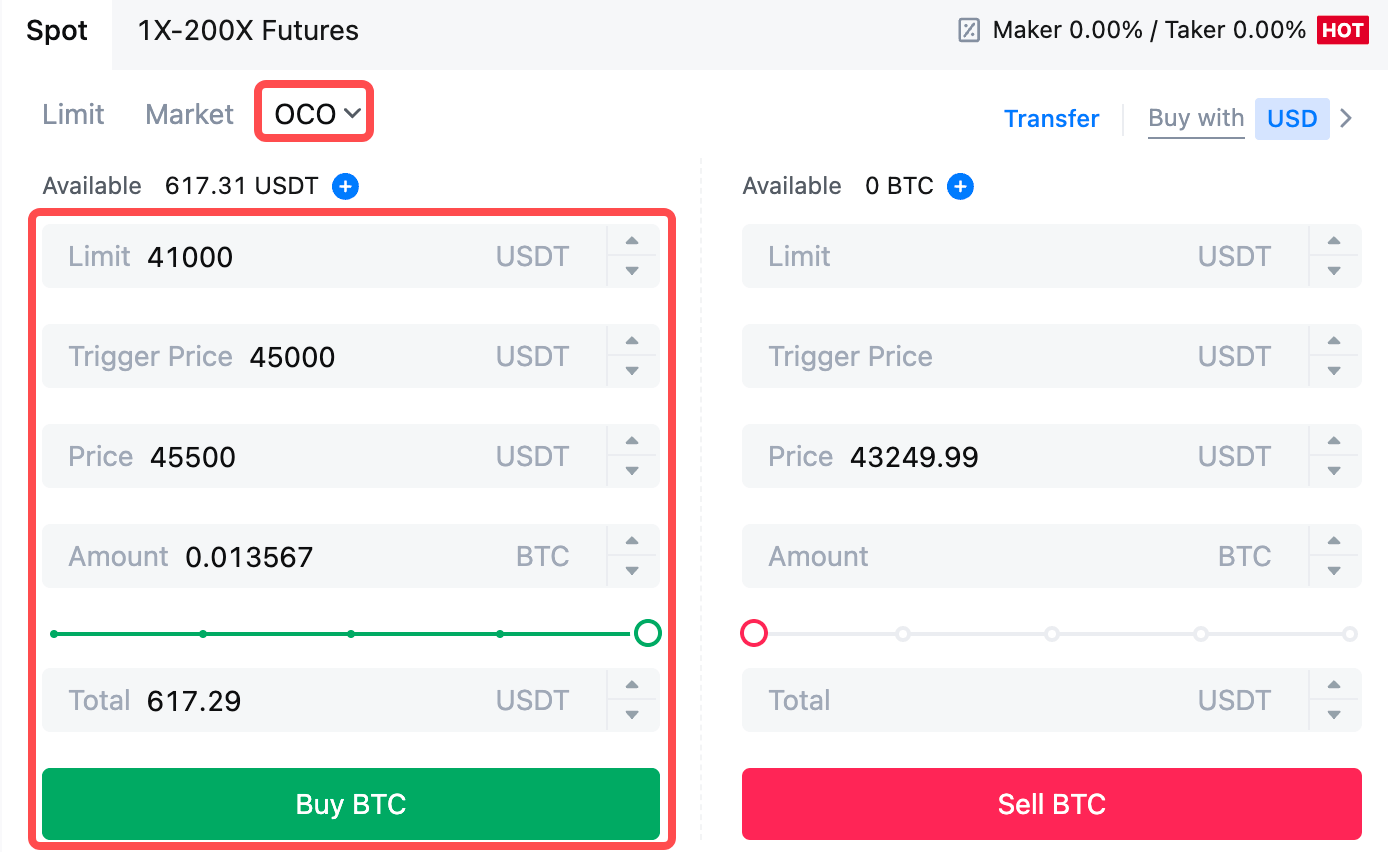

OCO orders are currently only supported for a few tokens, notably Bitcoin. We’ll use Bitcoin as an illustration:

Let’s say you wish to purchase Bitcoin when its price drops to $41,000 from its current $43,400. But, if the price of Bitcoin keeps rising and you think it will keep rising even after crossing $45,000, you would prefer to be able to purchase when it hits $45,500.

Under the "Spot" section on the BTC trading website, click [ᐯ] next to "Stop-limit," then choose [OCO]. Put 41,000 in the "Limit" field, 45,000 in the "Trigger Price" field, and 45,500 in the "Price" field in the left section. Then, to place the order, enter the purchase price in the "Amount" section and choose [Buy BTC].

How to View my Spot Trading Activity

You can view your spot trading activities from the Orders and Positions panel at the bottom of the trading interface. Simply switch between the tabs to check your open order status and previously executed orders.

1. Open orders

Under the [Open Orders] tab, you can view details of your open orders, including:- Trading pair.

- Order Date.

- Order Type.

- Side.

- Order price.

- Order Quantity.

- Order amount.

- Filled %.

- Trigger conditions.

To display current open orders only, check the [Hide Other Pairs] box.

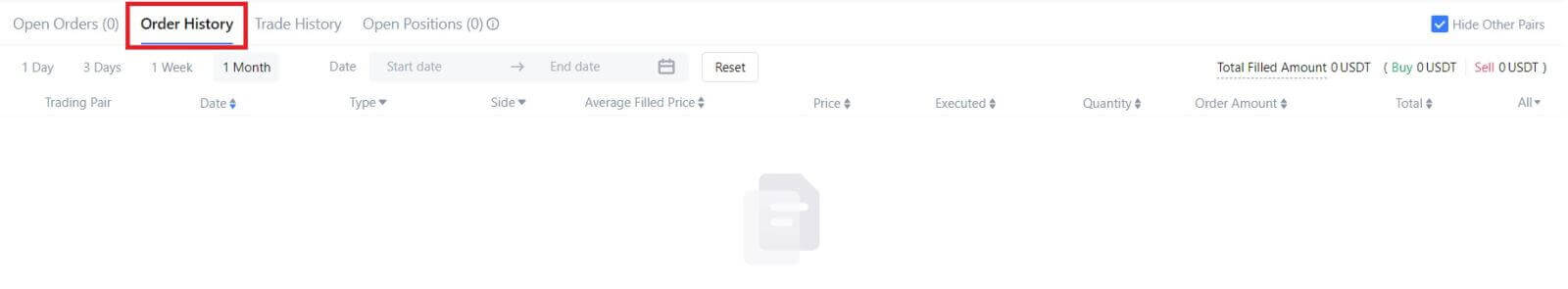

2. Order history

Order history displays a record of your filled and unfilled orders over a certain period. You can view order details, including:- Trading Pair.

- Order Date.

- Order Type.

- Side.

- Average Filled Price.

- Order Price.

- Executed.

- Order Quantity.

- Order Amount.

- Total amount.

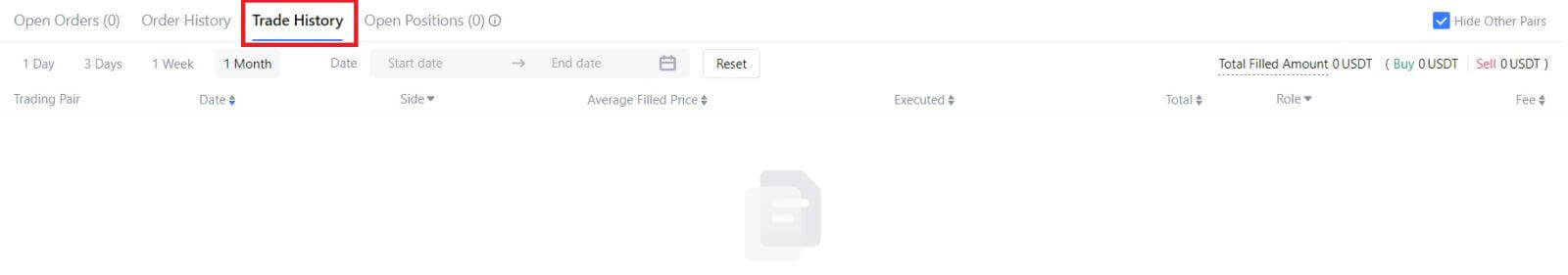

3. Trade history

Trade history shows a record of your filled orders over a given period. You can also check the transaction fees and your role (market maker or taker).To view trade history, use the filters to customize the dates.

Withdrawal

Why hasn’t my withdrawal arrived?

Transferring funds involves the following steps:

- Withdrawal transaction initiated by MEXC.

- Confirmation of the blockchain network.

- Depositing on the corresponding platform.

Normally, a TxID (transaction ID) will be generated within 30–60 minutes, indicating that our platform has successfully completed the withdrawal operation and that the transactions are pending on the blockchain.

However, it might still take some time for a particular transaction to be confirmed by the blockchain and, later, by the corresponding platform.

Due to possible network congestion, there might be a significant delay in processing your transaction. You may use the transaction ID (TxID) to look up the status of the transfer with a blockchain explorer.

- If the blockchain explorer shows that the transaction is unconfirmed, please wait for the process to be completed.

- If the blockchain explorer shows that the transaction is already confirmed, it means that your funds have been sent out successfully from MEXC, and we are unable to provide any further assistance on this matter. You will need to contact the owner or support team of the target address and seek further assistance.

Important Guidelines for Cryptocurrency Withdrawals on MEXC Platform

- For crypto that support multiple chains such as USDT, please make sure to choose the corresponding network when making withdrawal requests.

- If the withdrawal crypto requires a MEMO, please make sure to copy the correct MEMO from the receiving platform and enter it accurately. Otherwise, the assets may be lost after the withdrawal.

- After entering the address, if the page indicates that the address is invalid, please check the address or contact our online customer service for further assistance.

- Withdrawal fees vary for each crypto and can be viewed after selecting the crypto on the withdrawal page.

- You can see the minimum withdrawal amount and withdrawal fees for the corresponding crypto on the withdrawal page.

How do I check the transaction status on the blockchain?

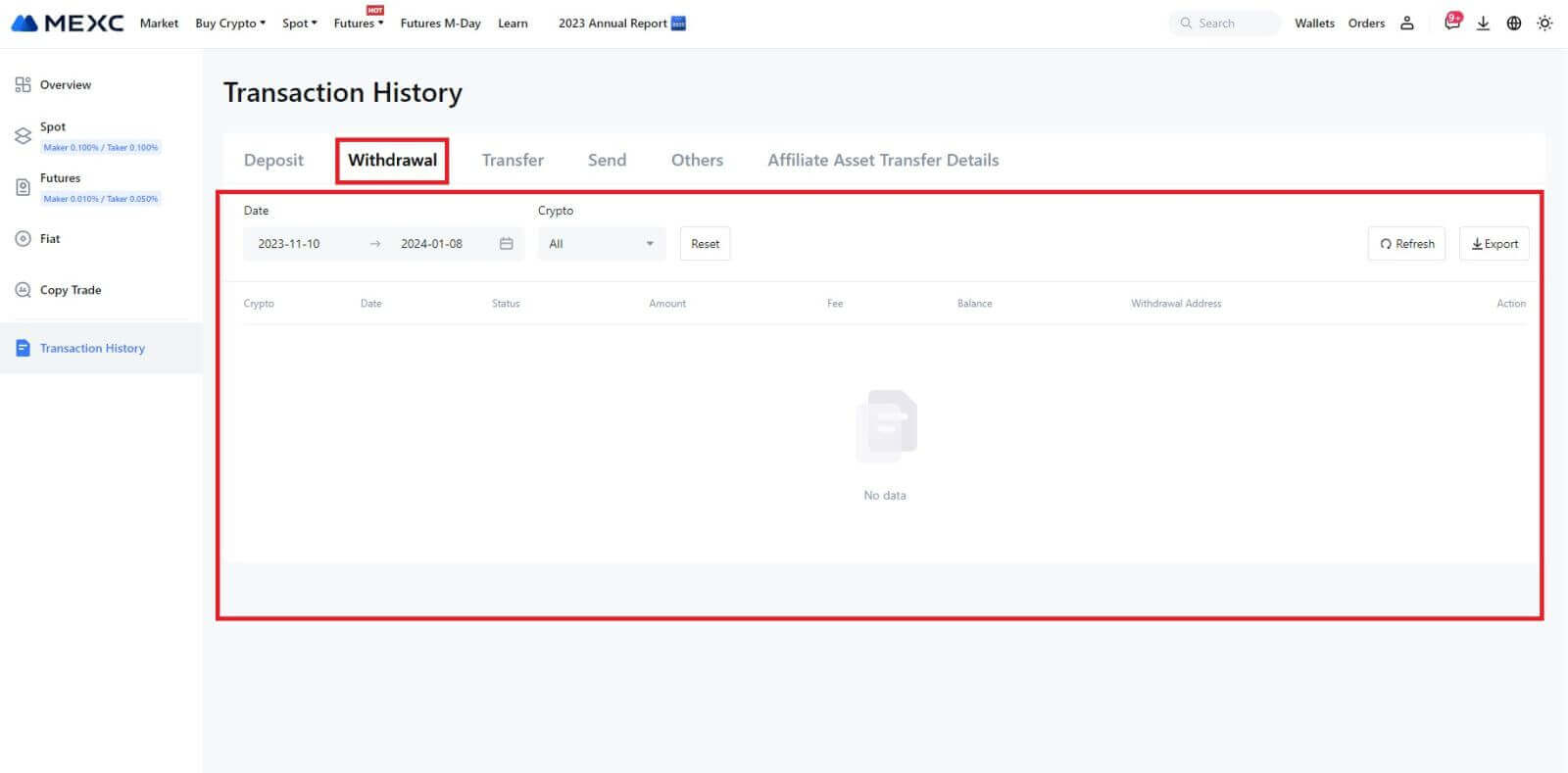

1. Log in to your MEXC, click on [Wallets], and select [Transaction History].

2. Click on [Withdrawal], and here you can view your transaction status.