How to Trade Crypto in MEXC

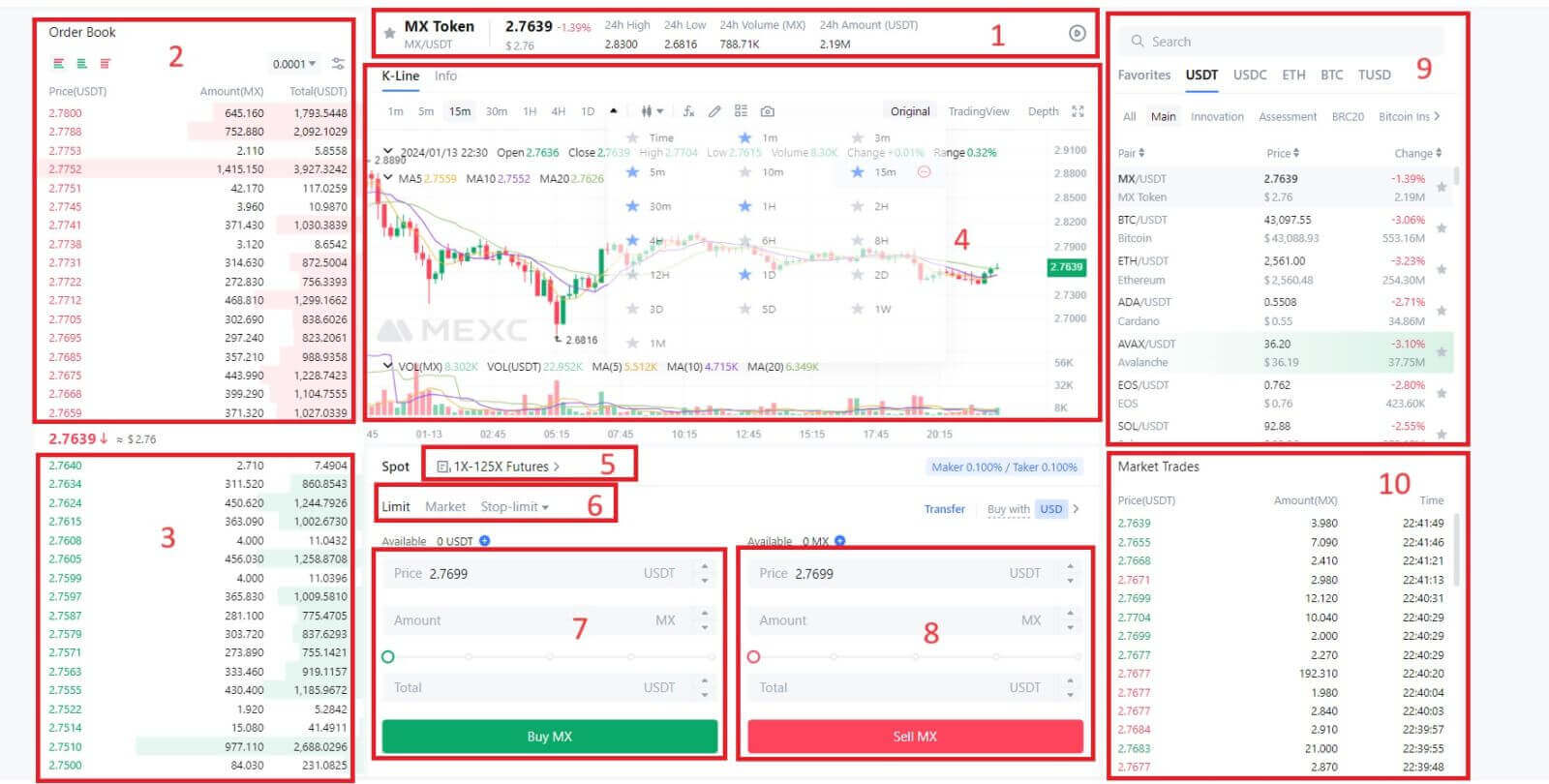

How to Trade Spot on MEXC (Web)

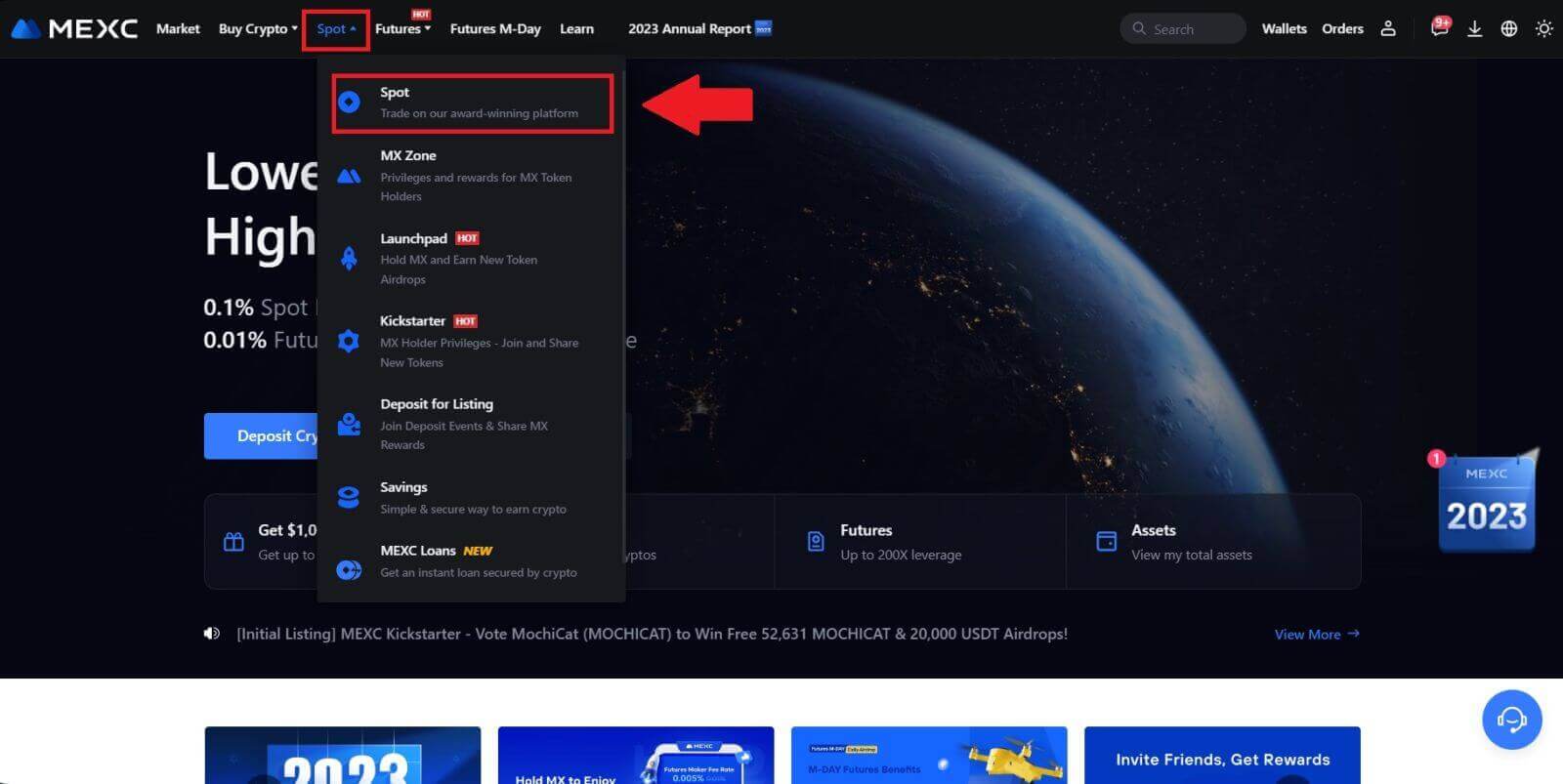

Step 1: Login to your MEXC account, and select [Spot].

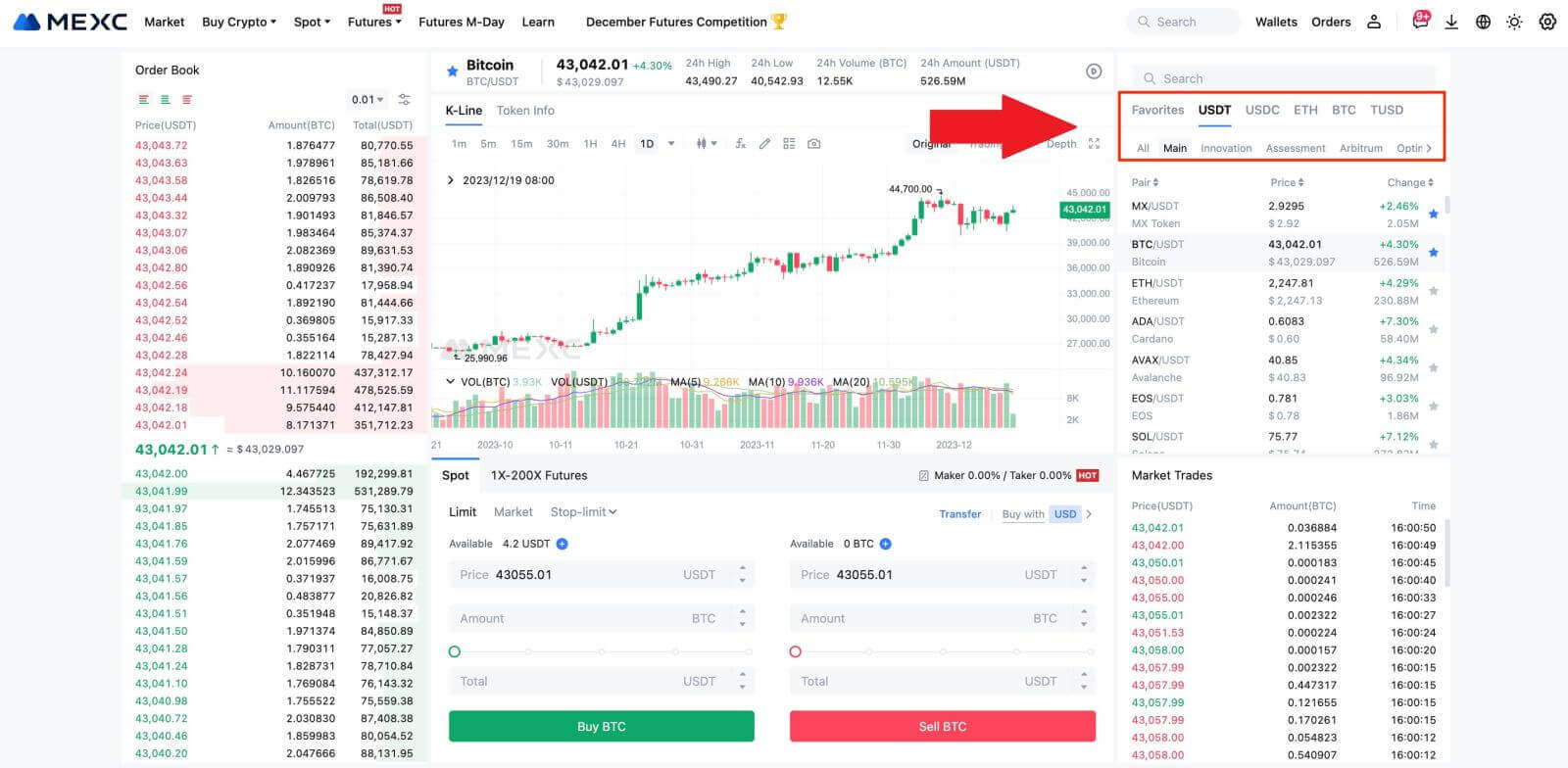

- Market PriceTrading volume of trading pair in 24 hours.

- Asks (Sell orders) book.

- Bids (Buy orders) book.

- Candlestick chart and Technical Indicators.

- Trading Type: Spot / Margin / Futures / OTC.

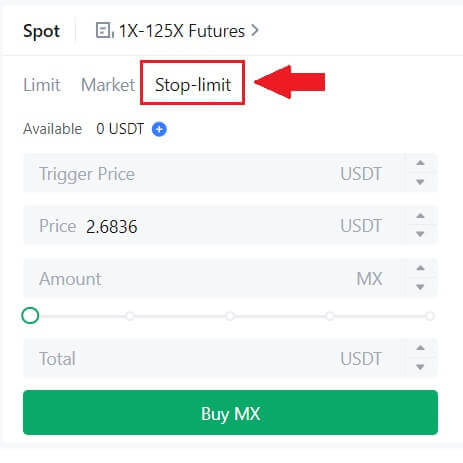

- Type of order: Limit / Market / Stop-limit.

- Buy Cryptocurrency.

- Sell Cryptocurrency.

- Market and Trading pairs.

- Market latest completed transaction.

- Your Limit Order / Stop-limit Order / Order History.

Step 3: Transfer Funds to Spot Account

In order to initiate spot trading, it is essential to have cryptocurrency in your spot account. You can acquire cryptocurrency through various methods.

One option is to purchase cryptocurrency through the P2P Market. Click on "Buy Crypto" in the top menu bar to access the OTC trading interface and transfer funds from your fiat account to your spot account.

Alternatively, you can deposit cryptocurrency directly into your spot account.

Step 4: Buy Crypto

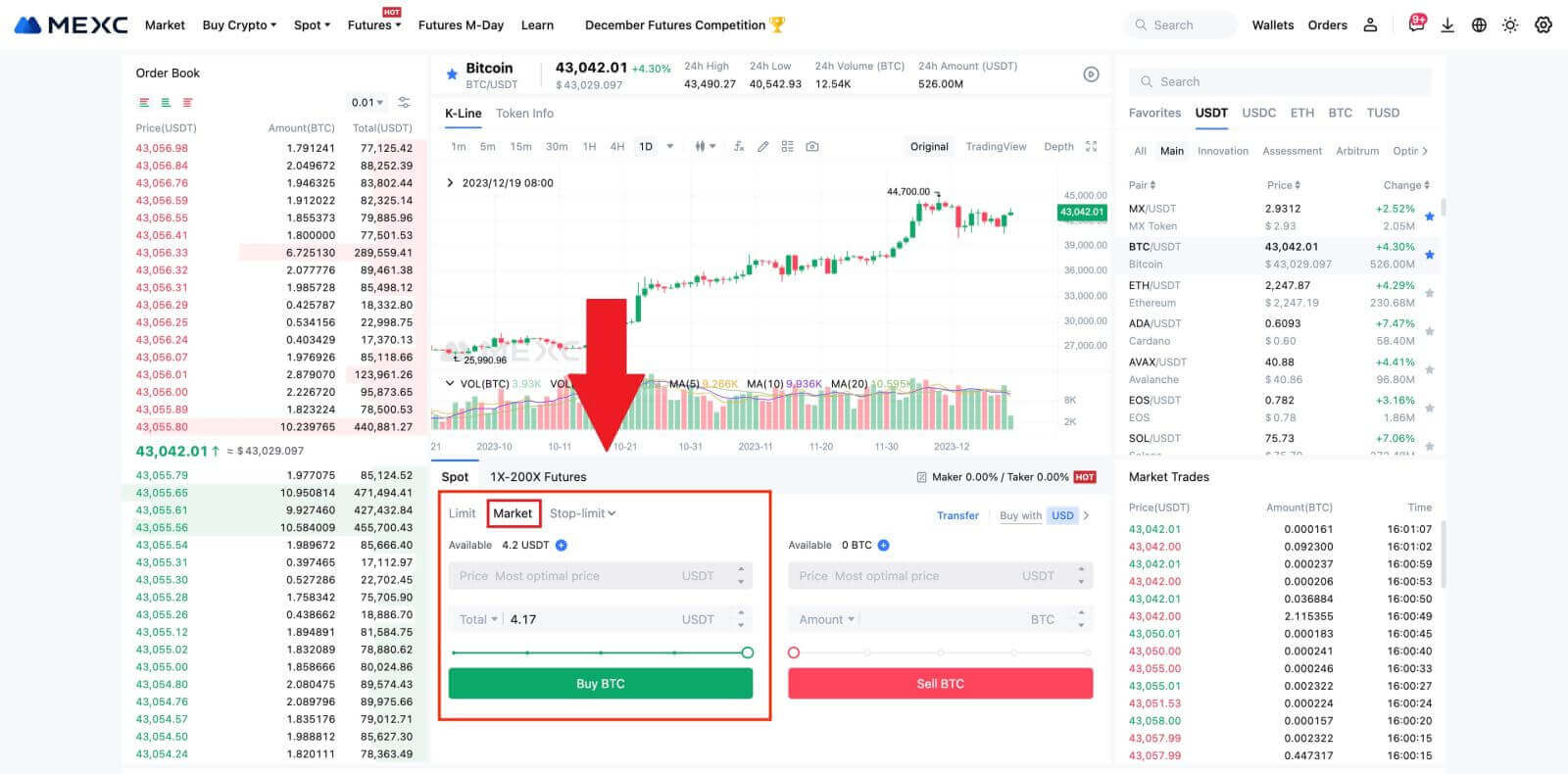

The default order type is a limit order, which allows you to specify a particular price for buying or selling crypto. However, if you wish to execute your trade promptly at the current market price, you can switch to a [Market] Order. This enables you to trade instantly at the prevailing market rate.

For instance, if the current market price of BTC/USDT is $61,000, but you desire to purchase 0.1 BTC at a specific price, say $60,000, you can place a [Limit] order.

Once the market price reaches your specified amount of $60,000, your order will be executed, and you will find 0.1 BTC (excluding commission) credited to your spot account.

To promptly sell your BTC, consider switching to a [Market] order. Enter the selling quantity as 0.1 to complete the transaction instantly.

For example, if the current market price of BTC is $63,000 USDT, executing a [Market] Order will result in 6,300 USDT (excluding commission) being credited to your Spot account immediately.

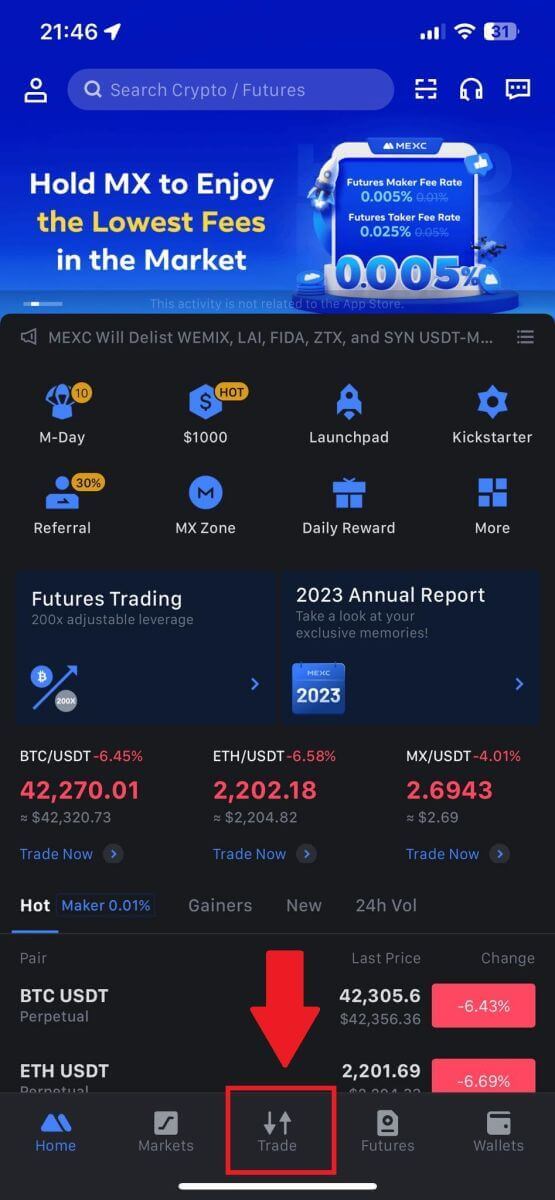

How to Trade Spot on MEXC (App)

Heres how to start trading Spot on MEXCs App:1. On your MEXC App, tap [Trade] on the bottom to head to the spot trading interface.

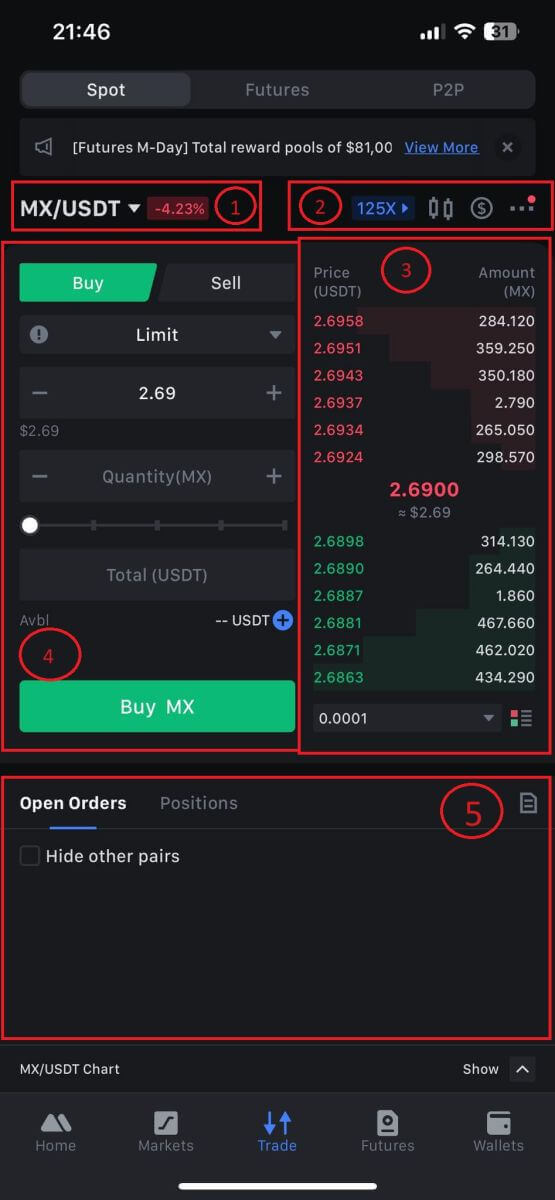

2. Here is the trading page interface.

1. Market and Trading pairs.

2. Real-time market candlestick chart, supported trading pairs of the cryptocurrency, “Buy Crypto” section.

3. Sell/Buy order book.

4. Buy/Sell Cryptocurrency.

5. Open orders.

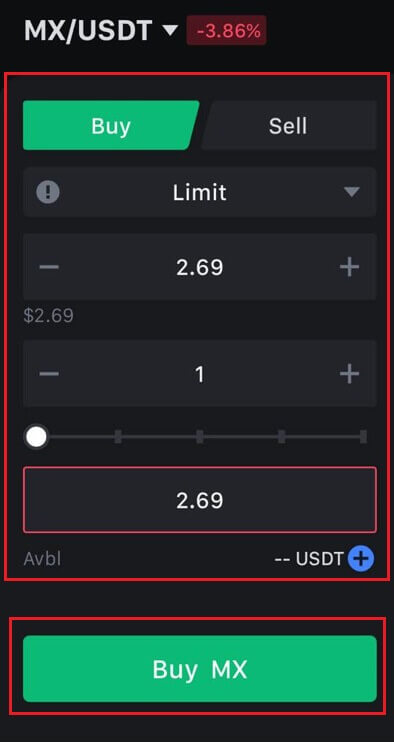

3. As an example, we will make a "Limit order" trade to buy MX.

Enter the order placing section of the trading interface, refer to the price in the buy/sell order section, and enter the appropriate MX buying price and the quantity or trade amount.

Click [Buy MX] to complete the order. (Same for sell order)

How To Buy Bitcoin in under One Minute on MEXC

Buying Bitcoin on MEXC Website

1. Log in to your MEXC, click and select [Spot].

2. In the trading zone, pick your trading pair. MEXC currently offers support for popular trading pairs like BTC/USDT, BTC/USDC, BTC/TUSD, and more.

3. Consider making a purchase with the BTC/USDT trading pair. You have three order types to choose from: Limit , Market , Stop-limit, each with distinct characteristics.

- Limit Price Purchase:

Specify your desired buying price and quantity, then click [Buy BTC]. Keep in mind that the minimum order amount is 5 USDT. If your set buying price significantly differs from the market price, the order may not be filled immediately and will be visible in the "Open Orders" section below.

- Market Price Purchase:

- Stop-limit Order:

With stop-limit orders, you can pre-set trigger prices, buying amounts, and quantities. When the market price reaches the trigger price, the system will automatically place a limit order at the specified price.

Let’s consider the BTC/USDT pair. Suppose the current market price of BTC is 27,250 USDT, and based on technical analysis, you anticipate a breakthrough at 28,000 USDT initiating an upward trend. In this case, you can use a stop-limit order with a trigger price set at 28,000 USDT and a buying price set at 28,100 USDT. Once BTC reaches 28,000 USDT, the system will promptly place a limit order to buy at 28,100 USDT. The order may be filled at 28,100 USDT or a lower price. Note that 28,100 USDT is a limit price, and rapid market fluctuations might affect order execution.

Buying Bitcoin on MEXC App

1. Log in to the MEXC App and tap on [Trade].

2. Choose the order type and trading pair. Select from the three available order types: Limit , Market , and stop-limit. Alternatively, you can tap on [BTC/USDT] to switch to a different trading pair.

3. Consider placing a market order with the BTC/USDT trading pair as an example. Simply tap on [Buy BTC].

Frequently Asked Questions (FAQ)

What is Limit Order

A limit order is an instruction to buy or sell an asset at a specified limit price, which is not executed immediately like a market order. Instead, the limit order is activated only if the market price reaches the designated limit price or surpasses it favorably. This allows traders to aim for specific buying or selling prices different from the prevailing market rate.

For instance:

-

If you set a buy limit order for 1 BTC at $60,000 while the current market price is $50,000, your order will be promptly filled at the prevailing market rate of $50,000. This is because it represents a more favorable price than your specified limit of $60,000.

-

Similarly, if you place a sell limit order for 1 BTC at $40,000 when the current market price is $50,000, your order will be immediately executed at $50,000, as it is a more advantageous price compared to your designated limit of $40,000.

In summary, limit orders provide a strategic way for traders to control the price at which they buy or sell an asset, ensuring execution at the specified limit or a better price in the market.

What is Market Order

A market order is a type of trading order that is executed promptly at the current market price. When you place a market order, it is fulfilled as swiftly as possible. This order type can be utilized for both buying and selling financial assets.

When placing a market order, you have the option to specify either the quantity of the asset you want to buy or sell, denoted as [Amount], or the total amount of funds you wish to spend or receive from the transaction, denoted as [Total].

For instance, if you intend to purchase a specific quantity of MX, you can directly enter the amount. Conversely, if you aim to acquire a certain amount of MX with a specified sum of funds, like 10,000 USDT, you can use the [Total] option to place the buy order. This flexibility allows traders to execute transactions based on either a predetermined quantity or a desired monetary value.

What is the Stop-Limit Function and How to use it

A stop-limit order is a specific type of limit order used in trading financial assets. It involves setting both a stop price and a limit price. Once the stop price is reached, the order is activated, and a limit order is placed on the market. Subsequently, when the market reaches the specified limit price, the order is executed.

Here’s how it works:

- Stop Price: This is the price at which the stop-limit order is triggered. When the asset’s price hits this stop price, the order becomes active, and the limit order is added to the order book.

- Limit Price: The limit price is the designated price or a potentially better one at which the stop-limit order is intended to be executed.

It’s advisable to set the stop price slightly higher than the limit price for sell orders. This price difference provides a safety margin between the activation of the order and its fulfillment. Conversely, for buy orders, setting the stop price slightly lower than the limit price helps minimize the risk of the order not being executed.

It’s important to note that once the market price reaches the limit price, the order is executed as a limit order. Setting the stop and limit prices appropriately is crucial; if the stop-loss limit is too high or the take-profit limit is too low, the order may not be filled because the market price may not reach the specified limit.

The current price is 2,400 (A). You can set the stop price above the current price, such as 3,000 (B), or below the current price, such as 1,500 (C). Once the price goes up to 3,000 (B) or drops to 1,500 (C), the stop-limit order will be triggered, and the limit order will be automatically placed on the order book.

Note

Limit price can be set above or below the stop price for both buy and sell orders. For example, stop price B can be placed along with a lower limit price B1 or a higher limit price B2.

A limit order is invalid before the stop price is triggered, including when the limit price is reached ahead of the stop price.

When the stop price is reached, it only indicates that a limit order is activated and will be submitted to the order book, rather than the limit order being filled immediately. The limit order will be executed according to its own rules.

What is One-Cancels-the-Other (OCO) Order

A limit order and a TP/SL order are combined into a single OCO order for placement, known as an OCO (One-Cancels-the-Other) order. The other order is automatically canceled if the limit order is performed or partially executed, or if the TP/SL order is activated. When one order is manually canceled, the other order is also canceled at the same time.

OCO orders can help get better execution prices when buying/selling is assured. This trading approach can be used by investors who want to set a limit order and a TP/SL order at the same time during spot trading.

OCO orders are currently only supported for a few tokens, notably Bitcoin. We’ll use Bitcoin as an illustration:

Let’s say you wish to purchase Bitcoin when its price drops to $41,000 from its current $43,400. But, if the price of Bitcoin keeps rising and you think it will keep rising even after crossing $45,000, you would prefer to be able to purchase when it hits $45,500.

Under the "Spot" section on the BTC trading website, click [ᐯ] next to "Stop-limit," then choose [OCO]. Put 41,000 in the "Limit" field, 45,000 in the "Trigger Price" field, and 45,500 in the "Price" field in the left section. Then, to place the order, enter the purchase price in the "Amount" section and choose [Buy BTC].

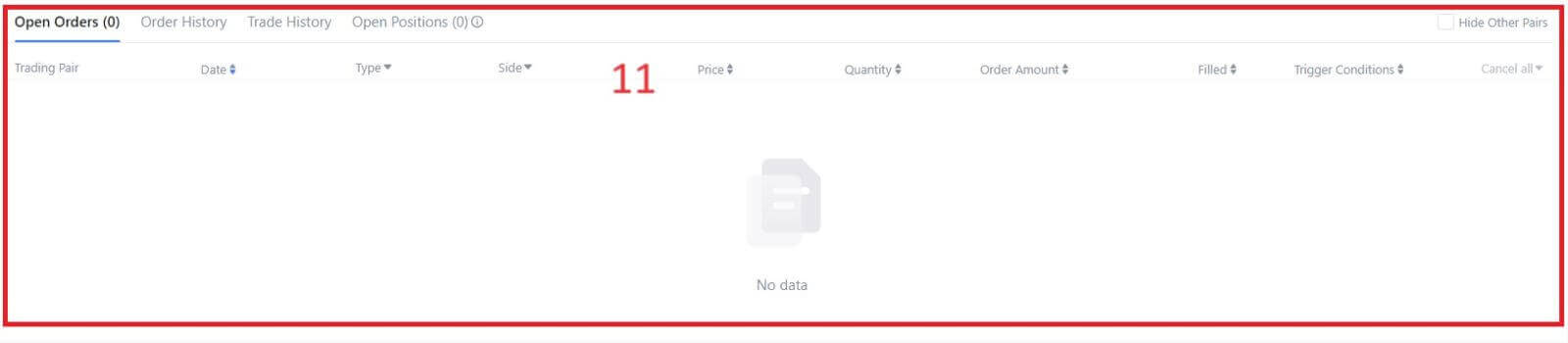

How to View my Spot Trading Activity

You can view your spot trading activities from the Orders and Positions panel at the bottom of the trading interface. Simply switch between the tabs to check your open order status and previously executed orders.

1. Open orders

Under the [Open Orders] tab, you can view details of your open orders, including:

-

Trading pair.

-

Order Date.

-

Order Type.

-

Side.

-

Order price.

-

Order Quantity.

-

Order amount.

-

Filled %.

-

Trigger conditions.

To display current open orders only, check the [Hide Other Pairs] box.

2. Order history

Order history displays a record of your filled and unfilled orders over a certain period. You can view order details, including:

-

Trading Pair.

-

Order Date.

-

Order Type.

-

Side.

-

Average Filled Price.

-

Order Price.

-

Executed.

-

Order Quantity.

-

Order Amount.

-

Total amount.

3. Trade history

Trade history shows a record of your filled orders over a given period. You can also check the transaction fees and your role (market maker or taker).

To view trade history, use the filters to customize the dates.